- BNB price today trades near $1,294, consolidating below $1,320 resistance after rebounding from $1,050 lows.

- On-chain data shows $96M inflows, pointing to renewed accumulation despite lingering Binance controversy.

- Key levels: $1,350 and $1,380 upside targets, with $1,231 and $1,207 as critical support pivots.

BNB price today is trading around $1,294, holding gains after last week’s sharp rebound from the $1,050 low. The recovery from the 200-day EMA has pushed price back into a key resistance zone between $1,300 and $1,320, a level that will decide whether the rally extends toward higher highs or stalls under supply pressure.

BNB Price Retests Symmetrical Triangle Resistance

The 4-hour chart shows BNB breaking out from a symmetrical triangle formation, with strong buying momentum emerging near $1,150. The 20-day EMA at $1,231 and the 50-day EMA at $1,207 are now acting as immediate support, while the 100-day EMA near $1,154 reinforces the broader bullish structure.

Price is testing resistance at $1,320, marked by the upper triangle boundary and previous consolidation highs. A clear breakout above this zone could open the door to $1,350 and $1,380, while rejection may bring a pullback toward $1,231 or $1,207.

The Parabolic SAR has flipped below price, signaling a short-term bullish phase, and RSI remains neutral, leaving room for continued upside if momentum strengthens.

On-Chain Flows Show Renewed Buying Interest

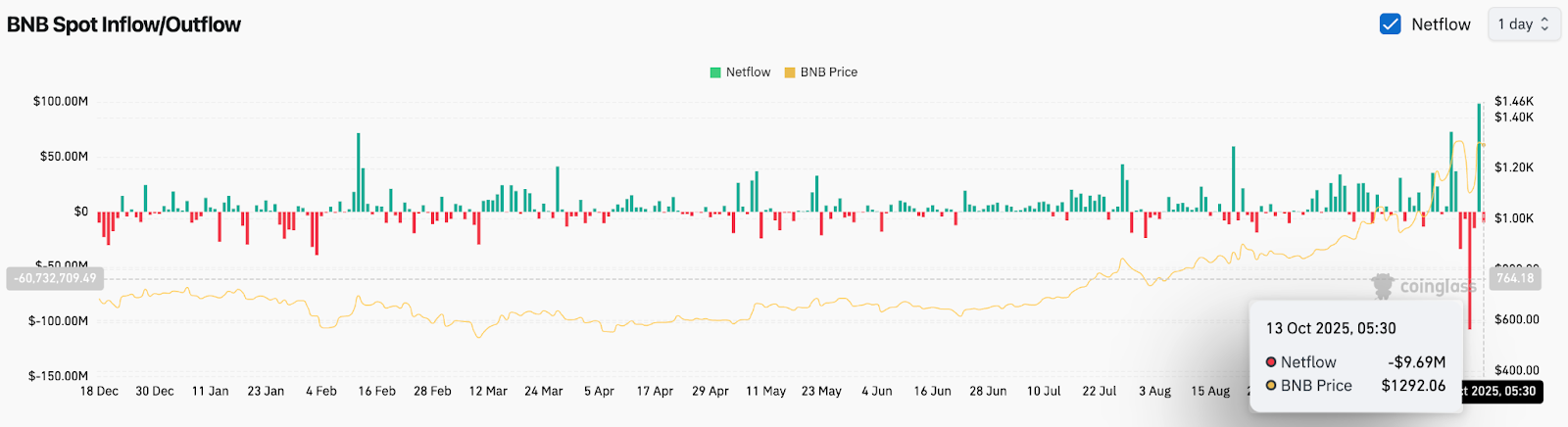

On-chain data from Coinglass reveals $96 million in net inflows yesterday, followed by a smaller $9.69 million outflow today, indicating a transition from panic selling to accumulation. These figures reflect renewed investor confidence after one of the most volatile weeks for the Binance ecosystem.

The shift in flow direction is significant. Heavy inflows often suggest smart-money repositioning after capitulation events. Analysts say consistent daily inflows above $25 million could sustain the rebound, while mixed flows may lead to continued range-bound action between $1,200 and $1,320.

Binance Controversy Adds Volatility To Sentiment

Market chatter intensified after Hyperliquid Daily questioned Binance’s role in last week’s massive liquidation event, noting that token prices, including BNB rebounded “as if untouched.” The post implied manipulation, pointing to the rapid price recovery despite widespread losses across trader portfolios.

Although no formal comment has been issued by Binance, the discussion injected short-term uncertainty into market sentiment. Still, BNB remains the third-largest cryptocurrency, up over 16% in the last 24 hours, underscoring resilience despite scrutiny.

Technical Outlook For BNB Price

BNB’s technical picture remains constructive as long as price holds above the $1,231 pivot zone.

- Upside levels: $1,350, $1,380, and $1,420 if bullish momentum persists.

- Downside levels: $1,231, $1,207, and $1,150 if rejection occurs.

- Trend anchors: 100-day EMA at $1,154 and 200-day EMA at $1,074 continue to define long-term support.

Outlook: Will BNB Go Up?

BNB’s near-term trajectory depends on whether buyers can defend $1,231 while maintaining inflow momentum. The recent $96 million inflow suggests fresh accumulation from institutional participants, hinting at renewed confidence after the flash crash.

If price can sustain above $1,300 with rising spot volumes, analysts expect a move toward $1,350–$1,380 in the coming sessions. Failure to defend $1,231 could shift focus back toward $1,150.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.