- Bolivia is negotiating a $9 billion financing package with the World Bank and CAF.

- The new administration plans to cut spending by 30% and integrate stablecoins into banks.

- Crypto adoption has surged 530% as citizens seek alternatives to the weakening local currency.

Bolivia is moving into a new economic phase as the government is seeking over $9 billion in multilateral financing to stabilize its currency and restart growth. This capital injection coincides with a radical policy shift: integrating stablecoins directly into the regulated banking sector.

According to Reuters data, the plan marks the first major policy shift under President Rodrigo Paz, who took office earlier this month. The administration aims to reverse years of inflation and shrinking reserves caused by state-driven intervention.

The $9 Billion Rescue Plan: World Bank and CAF Lead Support

Economy Minister Jose Gabriel Espinoza confirmed that the proposed package exceeds earlier projections. He expects about one-third of the funds within three months.

The World Bank and CAF lead the lender group and will support infrastructure, renewable energy, and financial inclusion. Additionally, the plan expands access to credit for private businesses, which officials see as essential for long-term recovery.

The government also introduced tax reforms to support the shift. Authorities removed the wealth tax and lifted charges on financial transactions. Hence, policymakers want to encourage investment after years of strained relations with global capital.

Congress still needs to review the reforms, and the administration expects debate over elements of the 2026 budget. The draft budget targets a 30% reduction in public spending, reflecting a more austere approach.

Financial markets reacted quickly. Dollar-denominated bonds traded near their strongest levels since 2022. Consequently, investors now expect a more predictable policy direction after months of uncertainty.

Integrating Crypto: Banks to Offer Stablecoin Services

Another major shift is underway in the financial system. The government plans to integrate cryptocurrencies, beginning with stablecoins, into regulated banking services.

Banks will soon support savings products, cards, and loans tied to digital assets. Officials believe the move could improve everyday access to finance and reduce reliance on a weakening local currency.

Related: Bolivia’s Auto Dealers Turn to Tether (USDT) as Dollar Reserves Hit Crisis Point

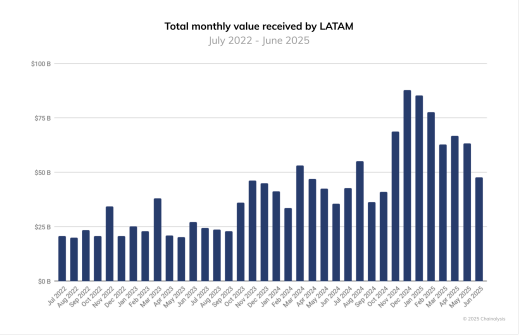

Chainalysis data shows why the policy matters. Bolivia processed nearly $15 billion in crypto and stablecoin volume from mid-2024 to mid-2025. Moreover, the Central Bank tracked a surge in supervised digital asset transactions.

Activity grew more than 530% within one year. May 2025 marked the strongest month with $68 million processed. Most transfers involved individuals, and platforms such as Binance played a major role.

Related: Dollar-strapped Bolivia turns to crypto to pay for fuel, shifts global trade norms

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.