- BONK surges 30%, hitting an all-time high of $0.00005377, up 213.89% from its monthly low.

- BONK overtakes WIF with a $4B market cap, making it the largest meme coin on Solana.

- Recent Coinbase listing boosts both BONK and WIF, with BONK leading in trading volume.

As the crypto bull run continues, meme coins are leading the charge with spectacular gains and soaring market valuations. Although the meme coin fever has cooled off somewhat compared to earlier in the week, Solana’s meme coin BONK capitalized on this relative calm and hit an all-time high.

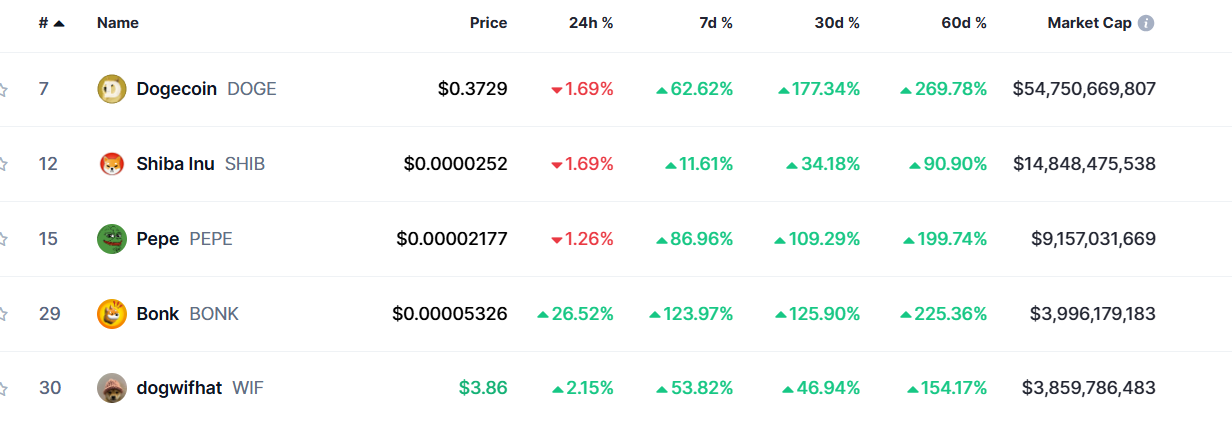

In the last 24 hours, BONK surged by over 30%, reaching a price point of $0.00005377, its highest ever. In contrast, meme coins like FLOKI saw only a 6% gain during the same period, while others like Dogecoin and Shiba Inu experienced a 3% loss.

Notably, just two weeks ago, BONK was trading at $0.00001713. With its value now hitting $0.00005377, it represents an impressive 213% increase from its monthly low.

BONK Overtakes WIF

This remarkable performance has allowed BONK to reclaim market share from Dogwifhat (WIF), the Solana meme coin that made headlines in the first quarter of the year with explosive gains. Then, WIF briefly became the third-largest meme coin by market cap, ahead of PEPE.

Currently, BONK boasts a market cap of approximately $4 billion, while WIF’s market cap stands at $3.86 billion. WIF has yet to experience a significant price pump like BONK. As of now, WIF is trading at $3.87, up 2.15% in the last 24 hours and 53% over the past week.

A major factor contributing to WIF’s price surge is that it was recently listed on Coinbase, the largest U.S.-based crypto exchange. Yet, the frenzy around BONK has far surpassed that of WIF.

At one point last week, BONK recorded higher 24-hour trading volume than Ethereum, the largest altcoin by market cap.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.