- BONK is currently consolidating near a key support level at $0.00001801, indicating potential for upward movement.

- A breakout above the descending trendline could target resistance levels of $0.0000627 and $0.0001592, offering significant gains.

- Increased trading volume and open interest in BONK derivatives suggest heightened trader activity and growing market interest.

BONK is showing signs of a potential breakout, according to crypto analyst Sheldon The Sniper. He suggests that the meme coin is currently in an accumulation zone, trading below a key weekly trendline. If BONK breaks above this trendline, it could see significant gains, with potential targets of $0.0000627 and $0.0001592.

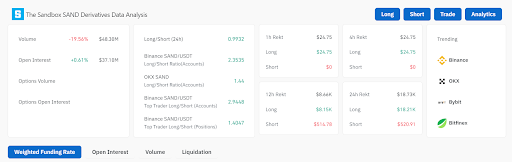

This bullish outlook is supported by increasing activity in the BONK derivatives market, with trading volume and open interest both on the rise. However, long/short ratios across different exchanges paint a mixed picture of trader sentiment.

The BONK/USDT daily chart reveals a bearish trend, marked by a descending trendline since June. BONK is consolidating near a notable support zone at $0.00001801 and a breakout above the trendline represents potential gains between 36.34% and 92.34%.

Current Market Conditions

BONK is valued at $0.000018, with a 24-hour trading volume of $114,534,355. It has increased by 4.47% over the past 24 hours, boasting a market cap of $1,290,132,673. The circulating supply stands at 70,640,730,768,154 BONK coins.

Read also: WIF Price Dips, BONK, PEPE, and SHIB Gain Attention

This price movement suggests ongoing interest and activity in the market. And, the BONK derivatives market shows increased activity, as trading volume rose by 11.55% to $25.51 million. This rise indicates a growing interest among traders.

Open interest in the BONK derivatives market has also increased by 3.65%, reaching $6.42 million. This rise suggests that more contracts are outstanding, pointing to heightened trading activity.

The long/short ratio is 0.9421 on Binance, signaling a slight preference for short positions. But OKX reflects a more bullish stance with a long/short ratio of 1.73. This disparity highlights differing market sentiments across exchanges.

Liquidation data reveals a total of $54.63K liquidated over the past 24 hours. This includes $29.85K from longs and $24.78K from shorts. These figures indicate ongoing volatility as traders balance potential gains and losses. This activity underscores the need for caution in a fluctuating market environment.

Experts also analyzed the price forecast for BONK throughout 2024. They predict a maximum trading value of around $0.000026 by December 2024. However, they also note the price could drop to a minimum of $0.000026. The average cost in December 2024 is expected to be around $0.000026.

Trading Strategy Insights

AmiCatCrypto, a swing trader, has expressed a bullish outlook on BONK, indicating a potential long position. While he usually waits for a breakout, he notes a clear shift in market momentum.

So, he suggests entering a long position now rather than waiting for a breakout and a test. This urgency reflects a belief in the current market dynamics, emphasizing that waiting could lead to missed opportunities.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.