- XRP community member referenced Brad Garlinghouse’s statements in an interview to shed light on FTX’s debt to Ripple.

- Garlinghouse, in the interview, confirmed that Ripple leased $10 million worth of XRP tokens to FTX before its collapse.

- Community members noted that Ripple’s Singapore subsidiary wants to recover the assets.

In a recent post on X, an XRP community member referenced a January interview where Ripple CEO Brad Garlinghouse disclosed a $10 million lease exposure to the bankrupt crypto exchange FTX. The post from the user follows growing speculations in the community around Ripple’s claims to FTX assets.

In the said interview with CNBC, Garlinghouse confirmed that the San Francisco-based company was exposed to FTX, which collapsed last year. Under its leasing business, Garlinghouse said around $10 million worth of XRP was given to the bankrupt crypto exchange.

According to the CEO, the $10 million worth of XRP represents around 1% of Ripple’s liquid assets and is why the company wasn’t affected by the collapse. “I am hopeful that through the bankruptcy process, we get all of it back. But it is not too consequential to business,” he said.

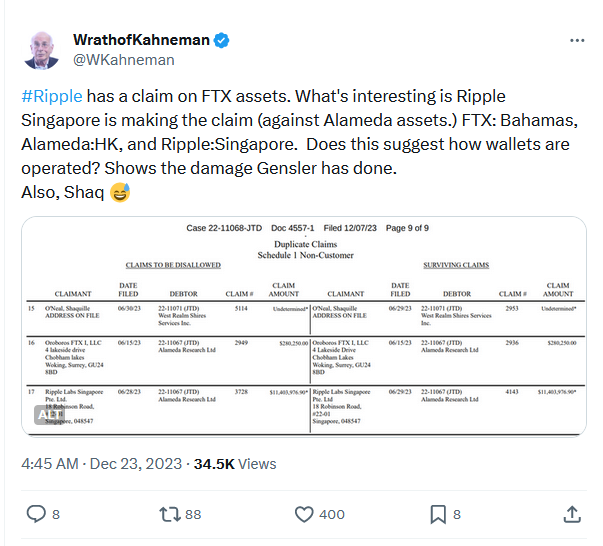

Discussions about Ripple’s exposure to FTX sprung up after XRP community members noted that the firm’s Singapore subsidiary has a claim to FTX assets. In an X post, XRP enthusiast “WrathofKahneman” posted a snapshot that showed the claim amount is worth $11.4 million.

Meanwhile, on December 17, FTX debtors unveiled a new proposal to end all customer claims against the crypto exchange. While the proposal factored in deals with debtor groups, a plan to pay customers the worth of their assets as of when the crypto exchange collapsed raised criticism.

Furthermore, the proposal also left out details on whether the crypto exchange will restart and how it will do so, as previously hinted. In earlier reports, the new management of the crypto exchange disclosed they were weighing restart proposals from three bidders.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.