- Research analyst Tom Wan recently highlighted that BRC-20 tokens account for 45% of the total Ordinal trading volume.

- The analyst’s post comes after trading volume for Ordinals surpassed that of Solana-based NFTs.

- In related news, both BTC and ETH printed gains in the past 24 hours.

In a recent tweet, a research analyst by the name of Tom Wan shared some insights relating to BRC-20 tokens and BTC Ordinals. According to the post, 45% of the ordinal trading volume is attributed to BRC-20 tokens, while Ordinals (ORDI) account for 22.1%.

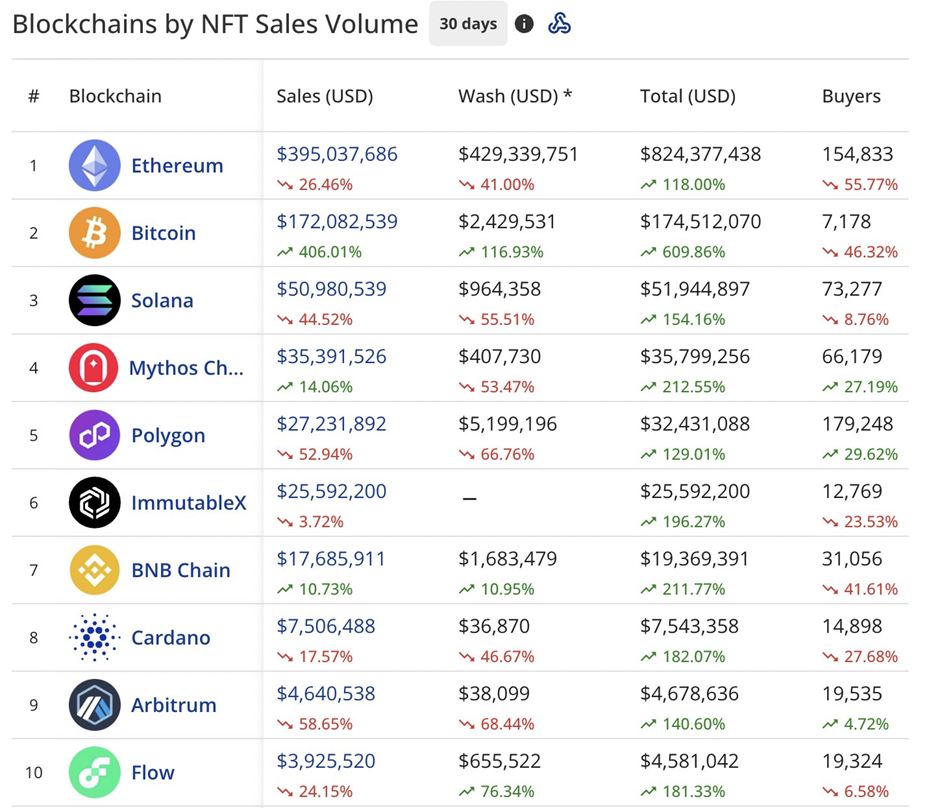

As a result, the analyst raised a thought-provoking question about whether all Ordinals should be considered as NFT volume or if it should be limited to the Image Inscribed Ordinals. This follows the news of the trading volume for Bitcoin (BTC) Ordinals surpassing that of Solana-based NFTS — ranking their trading volume second under Ethereum-hosted NFTs.

Over the past 30 days, the total trading volume for BTC Ordinals reached $172,082,539, which is a 406.01% increase. During this time, the trading volume for ETH NFTs dropped by 26.46% to $395,037,686.

At press time, CoinMarketCap indicated that both BTC and Ethereum (ETH) experienced price increases over the past 24 hours. BTC was changing hands at $26,418.97 after it printed a 24-hour gain of 0.52%. Meanwhile, ETH’s price stood at $1,809.58 after it climbed 1.39% in the last day.

The market leader was able to reach a daily high of $26,591.52, but has since retraced. Its 24-hour low stood at $26,121.83. Similar to BTC, ETH has also dropped from its daily high at $1,815.99, with its 24-hour low sitting at $1,777.93.

Both of the cryptos experienced drops in their daily trading volume. At press time, ETH’s trading volume stood at $5,414,599,653, a 22.47% decrease. BTC’s trading volume had dropped 20.71% and stood at $12,676,643,115.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.