- Bitcoin’s price surge in 2023 has outpaced that of Gold.

- BTC’s 20%-plus volatility has been compared to Gold’s 18%.

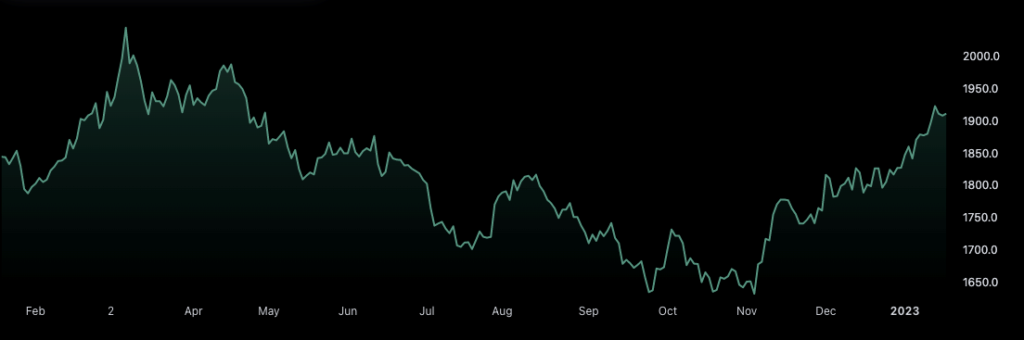

- Gold’s price is confined between 1900.00 support and 1928.60 resistance.

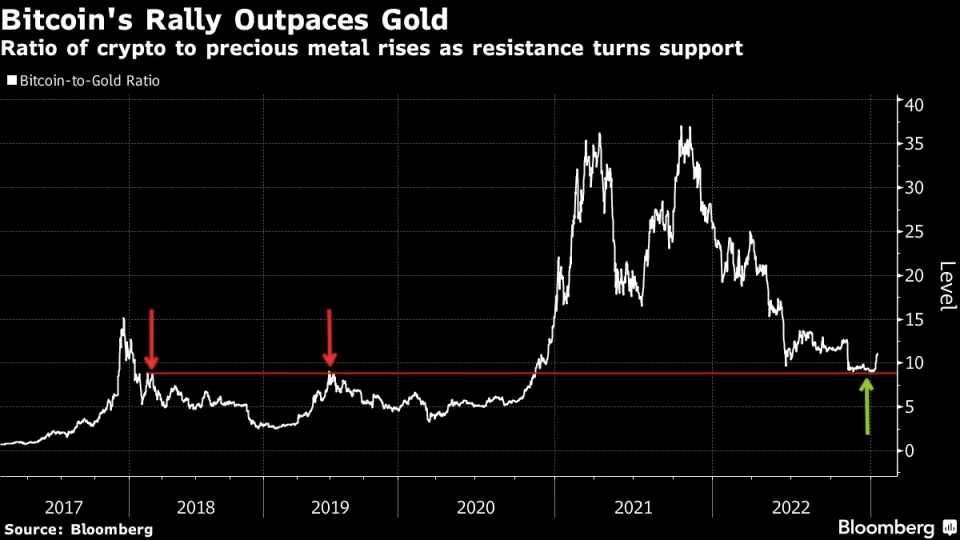

Bitcoin’s significant price surge at the start of the year has outpaced the gains associated with gold. Reportedly, the recent 20%-plus volatility in Bitcoin and the top 100 tokens has provided a little measure of relief from the digital asset destruction of the previous year.

Subsequently, gold prices ascend above $1,900 an ounce, marking a notable 18% increase since early November, as inflation levels diminish and market speculation reflects a moderate monetary posture from the US Federal Reserve.

Due to Bitcoin’s massive increase in the recent past, analysts believe that the barrier has transformed into a sturdy support zone. Additionally, as Bloomberg reports, much of that has been spurned by the supposition that struggling interest-rate hikes are coming to an end as inflation cools.

According to experts, the significant lows seen in US yields suggest investors are becoming more confident. This is allegedly due to the hopes of less pressure from the Federal Reserve and a ramping up of foreign and domestic government stimulus programs.

It is important to note that gold’s price is moving within a sideways track that appears on the charts, confined between $1900.00 support and $1928.60 resistance according to Trading View data. Proponents suggest that the price needs to surpass one of these levels to detect its next destination targets clearly.

On the other hand, Bitcoin was changing hands at $20,787.82 at press time revealing a 1.99% drop in the last 24 hours. With a 24-hour trading volume of $29,762,105,380, the BTC/USD pair has a live market cap of about $400 billion.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.