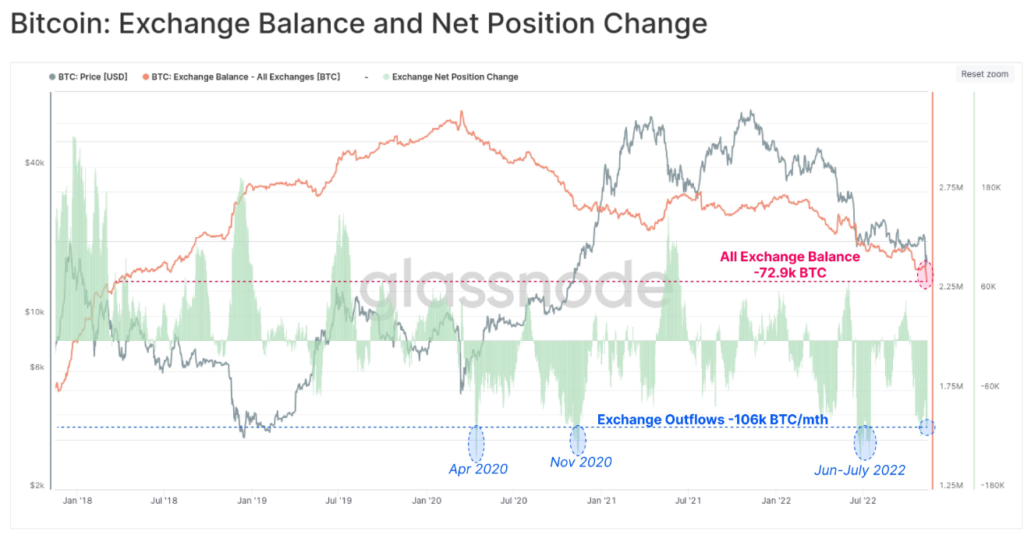

- Glassnode tweeted the withdrawal of BTC coins at a historic rate of 106 BTC/month.

- The rate was similar to the pattern of withdrawals in April and November 2020 and June and July 2022.

- The bulk withdrawals resulted from the bankruptcy filing and SBF’s resignation.

The leading onchain and financial metrics platform Glassnode tweeted that the BTC investors have been withdrawing coins at a historic rate of 106 BTC per month, after the fall of FTX.

The platform added the current tendency of the investors could be comparable with the previous trends in April and November 2020, and June and July 2022:

Following the Twitter post by FTX on the bankruptcy of FTX and other 129 companies, the FTX CEO Sam Bankman-Fried resigned from his position, giving way to John Ray.

Immediately after his resignation, SBF tweeted his apologies mentioning that there could be ways to find recovery from the present situation. He added that the company’s decision to file bankruptcy could “bring some amount of transparency, trust, and governance.”

Consequently, investors in fear of losing their holdings started to withdraw them; but the platform halted transactions. However, when the customers were able to carry on their transactions, more than $1 billion customer funds vanished all of a sudden, cited Reuters.

Recently, more than $600 million in coins were transacted from FTX international and FTX US, according to the findings of Reuters. In addition, the blockchain analytic company Elliptic, cited that over $473 million worth of crypto assets were transacted on a suspicious scale.

Alan Wong, the Operations Manager of Hong Kong Digital Asset commented that “things will continue to simmer after the FTX crash”:

“With a gap of $8 billion between liabilities and assets, when FTX is insolvent, it will trigger a domino effect, which will lead to a series of investors related to FTX going bankrupt or being forced to sell assets”.

Notably, it could be analyzed from the journey of the company that the current flow of the coin resembles a similar pattern that was seen in 2020 and earlier in 2022.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.