- Santiment shared a tweet yesterday regarding the percentage of BTC stored on exchanges.

- The recent FTX drama has pushed investors towards self-custody.

- BTC’s price is currently in a consolidation channel.

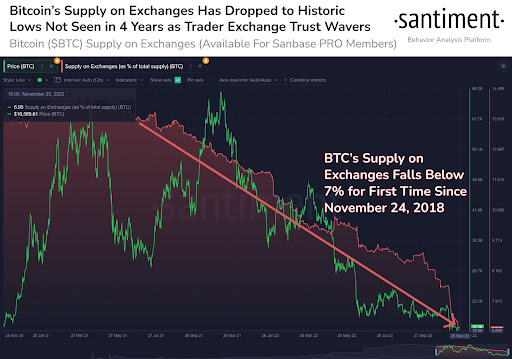

Santiment, the blockchain analysis firm, tweeted a chart yesterday that shows that the percentage of Bitcoin’s supply on exchanges has dropped to single digits. According to the tweet, “Just 6.95% of Bitcoin is sitting on exchanges.”

The tweet added that there was already a gradual shift in BTC moving into custody that had started back in March 2020. However, the recent FTX drama has now accelerated the trend.

As can be seen on the chart shared by Santiment, the supply of BTC on exchange platforms has dropped for the first time since November 24, 2018.

Meanwhile, BTC is changing hands at $16,539.62 at press time after the market leader’s price dropped 0.36% over the last 24 hours. BTC’s dominance in the market has also dropped over the last 24 hours, according to CoinMarketCap. Currently, BTC’s dominance is approximately 37.80%, which is 0.07% lower than yesterday.

On the 4-hour chart for BTC, the 9 EMA crossed bullishly above the 20 EMA line to trigger a bullish sequence that saw BTC’s price rise from a low of $16,160.20 to a high of $16,812.63. Since then, however, the price of BTC has fallen into a consolidation channel between $16,402.95 and $16,626.81.

The 4-hour 9 EMA line is still positioned above the 4-hour 20 EMA line, which is a bullish flag. Despite this, it seems that BTC’s price will be unable to break above the next resistance level at $16,598.83 given the over-powering sell volume that has entered BTC’s chart today.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.