- Whale Alert observed that 3,900 BTC was transferred from an unknown wallet to another anonymous wallet.

- BTC is priced at $30,145.01, after witnessing a 1.66% fall in seven days.

- The cryptocurrency’s current uptrend level could trigger an oversold event soon as traders seek profits.

Whale Alert notified the crypto community that 3,900 BTC, valued at approximately $117,580,367, was transferred from an unknown wallet to another anonymous wallet. Although the reason behind this transfer was not mentioned, there could still be a possibility that BTC’s price may be affected by the whale’s transfer.

Based on CoinMarketCap, BTC is priced at $30,145.01, after witnessing a 1.66% fall in seven days, at the reported time. Moreover, BTC’s market cap fell by 0.44% to $585,571,151,277 in one day. However, BTC’s demand continues to prevail in the crypto community as the trading volume increased by 25.85% to $9,330,370,578. Currently, BTC is residing in the red zone after facing a slight tumble over the week.

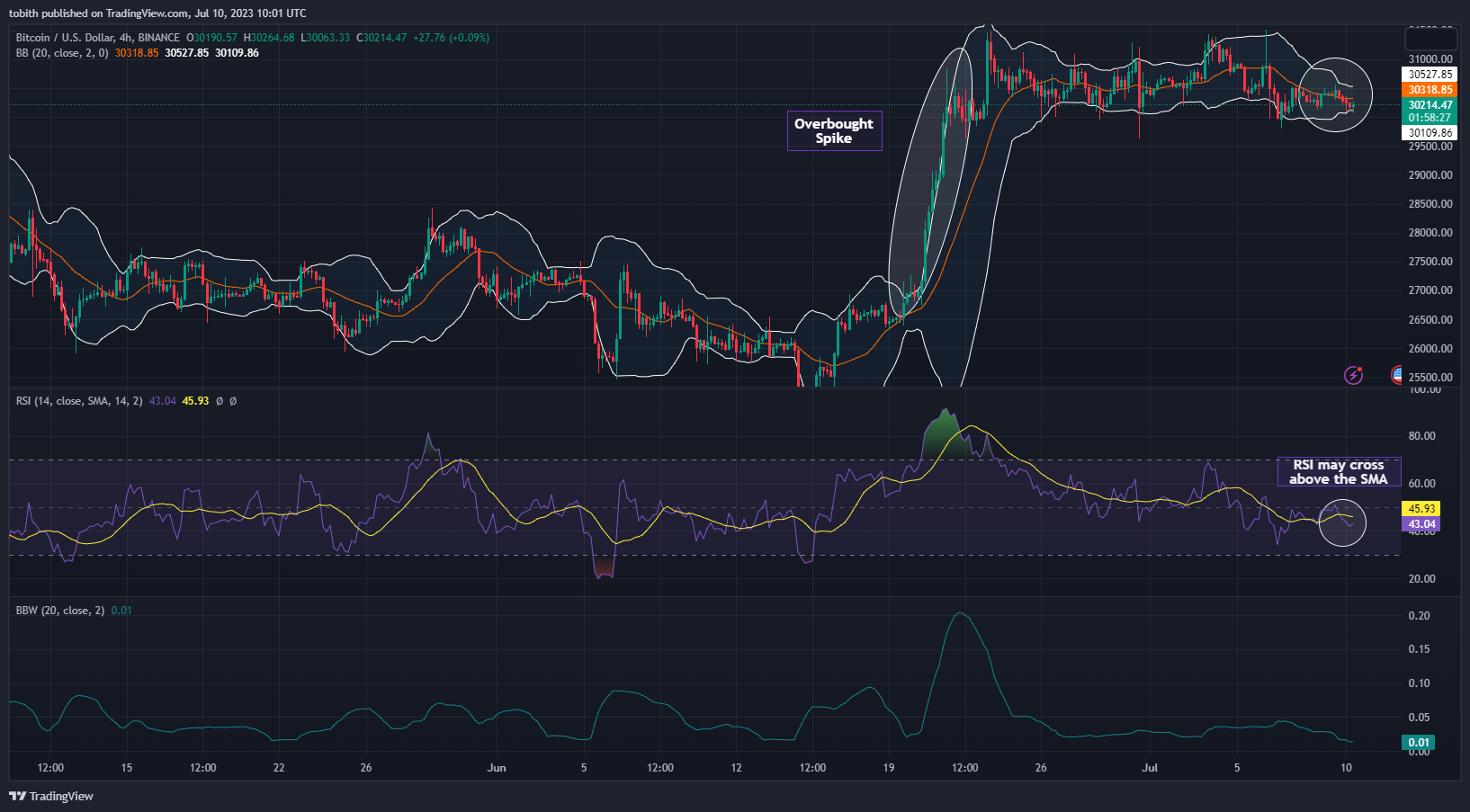

Looking at the charts, BTC is currently trading in the lower half of the Bollinger Bands. Moreover, the newly-formed candlesticks’ wicks have touched the lower band, indicating that BTC may reach the oversold region soon. Looking at the Bollinger Band Width (BBW) indicator, the BBW is moving horizontally which could be a sign that the gap between the upper and the lower band of the Bollinger Band indicator may reduce. When the gap between the upper and the lower band contracts, traders expect the market volatility to reduce.

The RSI is currently valued at 43.65, which is considered a weak region by most traders as it is valued between 50 and 30. Although the indicator shows signs of a bullish crossover, the RSI could again fall below the SMA. Moreover, there could be a possibility that traders may seek to profit from the recent surge by selling which could trigger BTC to reach the oversold region.

Once BTC reaches the oversold region, traders could once again start purchasing BTC in the hopes of witnessing a bull run in the future market. Currently, traders need to wait for confirmation regarding the next bull run in the future as the current indicators show that BTC might move to the oversold region soon.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.