- FXRP/USDC becomes the first XRP-linked spot pair on Hyperliquid.

- Traders can hedge XRP perpetuals using spot FXRP on one platform.

- FXRP moves across chains while staying linked to the XRP Ledger.

Flare has launched the first XRP spot market on Hyperliquid, marking a new step in bringing the cryptocurrency into decentralized finance trading, the company said.

The listing uses FXRP, a token issued on the Flare network that represents XRP and allows it to move across blockchains while remaining linked to the XRP Ledger. Trading has begun with an FXRP/USDC pair, giving traders direct spot exposure to XRP on Hyperliquid for the first time.

Flare co-founder Hugo Philion said, “Traders on Hyperliquid can now create a delta neutral XRP position between the spot FXRP market and futures, on a single decentralised platform, whilst earning the funding rate.”

How the listing works

The FXRP listing is enabled through Flare’s FAssets system and cross-chain infrastructure provided by LayerZero. This setup allows FXRP to move between different blockchains, trade on Hyperliquid’s on-chain orderbook, and be transferred back to the XRP Ledger through a single process.

Initially, FXRP is paired with USDC, with additional stablecoin pairs expected later.

Why the launch matters

The listing gives XRP and Flare users access to spot trading on Hyperliquid while keeping assets under on-chain custody. At the same time, existing Hyperliquid users can gain exposure to XRP-linked assets without first setting up accounts on Flare or the XRP Ledger.

Flare estimates around $250 million is currently tied up in XRP perpetual trades, with few ways to hedge using spot markets. With FXRP on Hyperliquid, traders get more options. FXRP can also be moved back to the XRP Ledger through Flare at any time.

First XRP exposure on Hyperliquid

This launch introduces XRP exposure to one of the larger on-chain trading venues currently operating. Hyperliquid uses an orderbook-based model rather than automated market makers, a structure typically associated with tighter spreads and deeper liquidity during high-volume trading.

Signs of growing activity

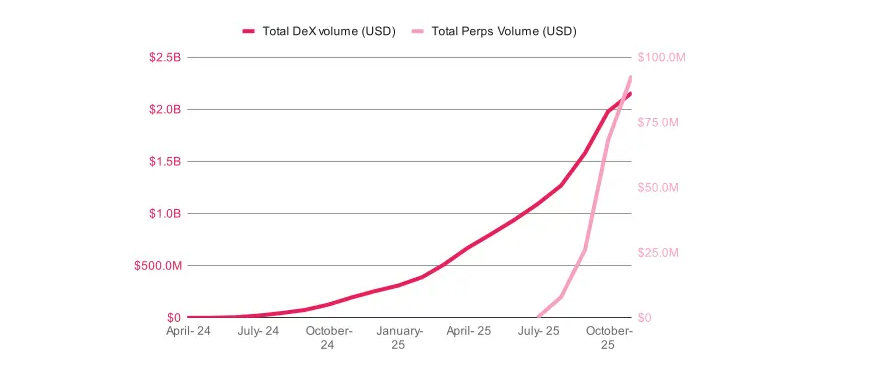

Flare pointed to on-chain data as evidence that the strategy is already in motion. The network has recorded more than $2 billion in cumulative decentralized exchange volume, averaging around $210 million per month, along with over $100 million in cumulative perpetuals trading and roughly $1.5 million in open interest.

FXRP, along with FLR and USD₮0, is among the most actively traded assets in the ecosystem.

Related Articles: WisdomTree Withdraws XRP ETF Filing From US SEC

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.