- A recent analysis of the price of Bitcoin shows that the market is optimistic.

- Technical indicators suggest that a bullish trend in the BTC market is imminent.

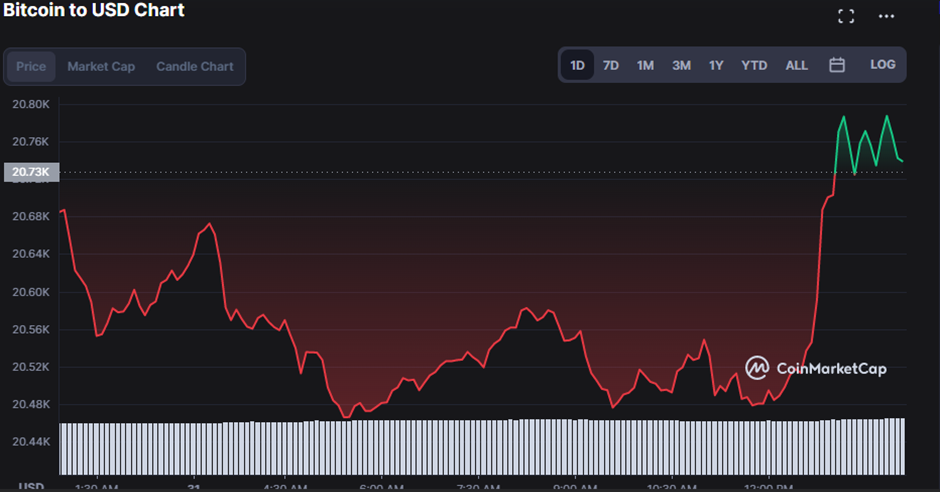

- Bitcoin (BTC) currently values at $20,646.34 a 0.36% downturn.

A significant price decline has occurred in Bitcoin (BTC), with the currency losing more than 0.03% of its value. From an all-day high of $20,795.32, BTC is currently trading at $20,657.90

On the previous day, Bitcoin encountered resistance at $20,795.32 and found support at $20,461.72. While the market capitalization has climbed by 0.29% to $397,590,766,427, the trading volume has decreased by 4.70% to $34,417,633,675.

Despite being bearish, technical indicators on the BTC price chart indicate that a bullish run is almost certain to occur in the near future.

An increase in market activity and a likelihood of a breakout are indicated by the Bollinger Bands’ divergence. At 20792.16 and 20432.60, respectively, the top and bottom bands touch. The market’s movement in the direction of the upper band supports this notion because it suggests a positive trend.

The signal line has a reading of -23.54, while the MACD blue line is positive and rises above it with a reading of 3.43. This bullish momentum is supported by the histogram, which is also in the positive range.

In recent hours, the Stoch RSI crossed into the overbought zone as the market for digital currencies was bearish. The present positive trend is supported by the fact that it is currently going south with a value of 90.55 moving out of the oversold range.

On the 1-hour price chart, there is a bullish golden cross formed by the 5-day Moving Average crossing over the 20-day Moving Average. The 20-day MA is approaching 20612.19, and the 5-day MA is touching 20724.01. The market is above both moving averages, indicating that bulls are outnumbering bears.

The Bull Bear Power is going upward with a value of 145.42. When the BBP value is more than 0, the market is in a bullish trend.

The BTC market has been taken over by the bears, however, technical indicators show that bulls are still fighting to maintain the market’s upward trajectory.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.