- FTX Token (FTT) has fallen by 5.64% amid its bankruptcy crisis.

- CRO bulls demolish bear dominance as prices rise by 2.53%.

- As bears tire, Huobi Token indicators predict another bull run.

Following the FTX debacle, the crypto community’s trust in centralized exchanges has begun to plummet. Price drops imply that crypto whales and sharks have ditched a large portion of their CEX tokens in the last ten days.

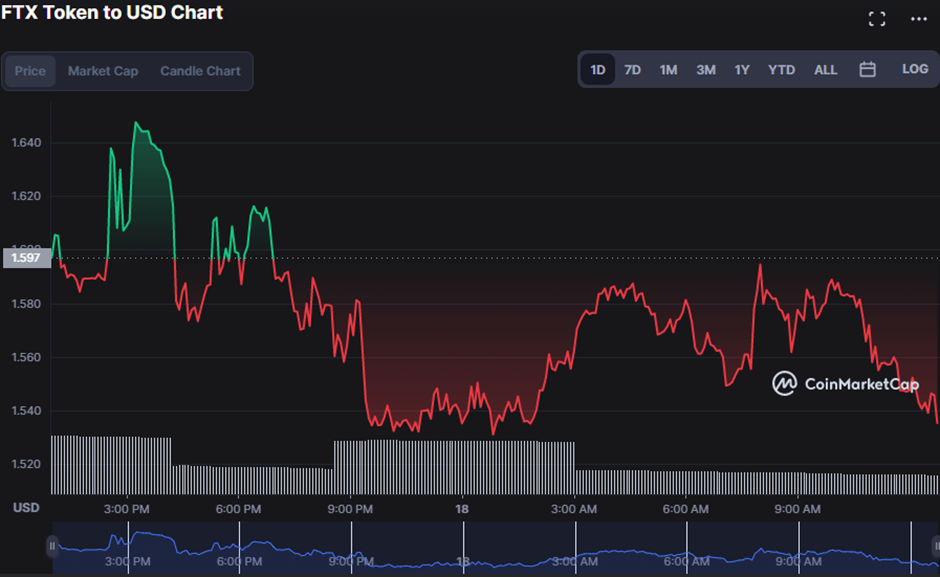

Amid this crisis, FTX Token (FTT) has dropped 5.64% in the last 24 hours to $1.54 as of press time after hitting resistance at $1.65.

With a reading of -0.007, the Moving Average Convergence Divergence (MACD) makes a bearish crossover and moves below the signal line. This move into negative territory tends to suggest that the bear influence in the FTT market will continue.

As the Stoch RSI fluctuated south with a reading of 39.22, the negative momentum on the FTT market is expected to continue since it approaches the oversold region.

Converging Keltner Channels on the 30 min price chart implies lower market volatility, with the upper band touching 1.607 and the lower band touching 1.512. The market’s oscillation below its signal line and trending to the lower band indicates that the current negative trend will persist.

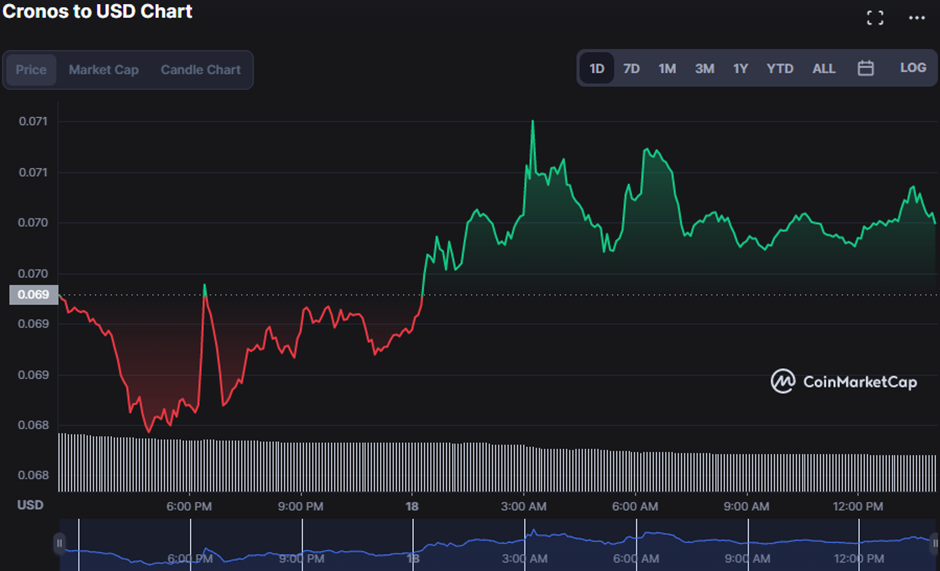

Crypto.com CEO Kris Marszalek’s reassurance to customers via Twitter, YouTube, and the airwaves that their deposits are safe and the company is on solid ground appears to be bearing fruit as CRO bulls seize the market, pushing prices to $0.07042, a 2.53% uptick.

The CRO market is trending stable, with the Bollinger bands moving linearly and touching 0.0714 and 0.0680, respectively. This BB action suggests that the current trend will continue, with market price movement toward the upper band supporting this bullish momentum.

The RSI reading of 49.71 lends support to this stable market trend and the continuation of the current trend because it indicates equal buying and selling pressure.

With a reading of -3.4408, the Know Sure Thing indicator also makes an overly optimistic crossover, moving above its signal line and towards the positive region.

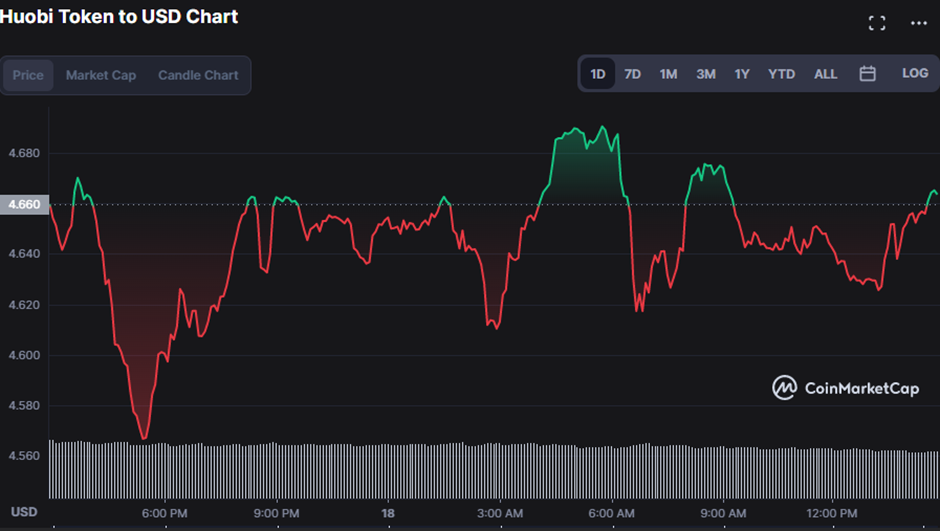

In the last 24 hours, Huobi Token (HT) bulls have outperformed bears several times. After finding support at $4.56, they were able to raise prices by 0.39% to $4.67.

Per the Williams Alligator, the three lines are shifting upstream, indicating a positive trend. Because the green line is above the red line and the red line is above the blue line, the current trend in the Huobi market will persist unless bears invalidate it. The green line (lips) is 4.6551, the red line (teeth) is 4.6532, and the blue line (jaw) is 4.6517.

As Bull Bear Power (BBP) crosses above the “0” level with a reading of 0.0102, bullish momentum is predicted to continue, but its pointing south causes investors concern.

With a reading of 77.99 and pointing south, the Stoch RSI predicts that the bullish trend in the HT market will continue as the indicator maintains consistency with its trajectory away from the overbought region.

Bulls in FTT must pull up their socks to invalidate the current trend, while bulls in CRO and HT must fight to avoid a bear grip.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.