- Technical indicators suggest that bullish supremacy will continue.

- The support and resistance levels for FIL are $4.28 and $4.50, respectively.

- The value of FIL has increased significantly in the past few hours, by 1.96%.

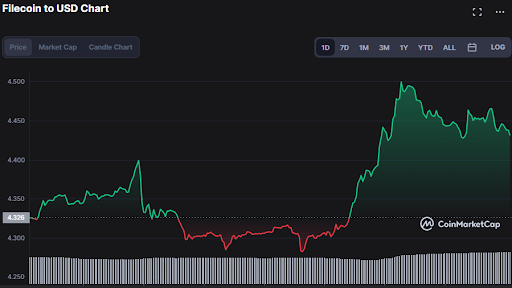

In the previous hours, Filecoin’s (FIL) price was under extreme bear pressure and plunged to a low of $4.28. However, the bulls jumped in and saved it, driving prices up to $4.43, a 1.96% advance.

This bullish control has increased capitalization and 24 hour trading volume by 2.05% to $1,449,074,487 and 23.52% to $95,219,037, respectively.

FIL/USD 24-hour price chart (source:CoinMarketCap)As the upper band reaches 4.4711 and the lower band reaches 4.2435, the bullish momentum is expected to continue because the Bollinger Bands are swelling and pointing up. The price progression towards the top band supports this upward tendency.

The blue MACD line crosses over the signal line and enters positive territory, reading 0.0265. This suggests a bullish predominance. The fact that the histogram trend is positive at 0.0126 lends credence to this assertion.

With the stochastic RSI at 57.92, the market appears to be stable, giving investors enough time to exercise additional positive control.

FIL/USD 2-hour price chart ((source: radingView)According to the upward-pointing Keltner Channel bands, the bullish trend is expected to continue while the top band reaches 4.4872 and the lower band reaches 4.2586. Additional support for this comes from the price trend toward the top band.

On the basis of the 2-hour price chart’s True Strength Indicator, which is at 13.5171 and is rising above the signal line while trending upward, it is expected that this bullish momentum will persist. This is due to the TSI’s crossing of the signal line from below, which suggests a long position.

FIL/USD 2-hour price chart (source: TradingView)In a nutshell, the bulls must keep up the fight and outweigh the bears in order to preserve their current trend in the FIL market.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.