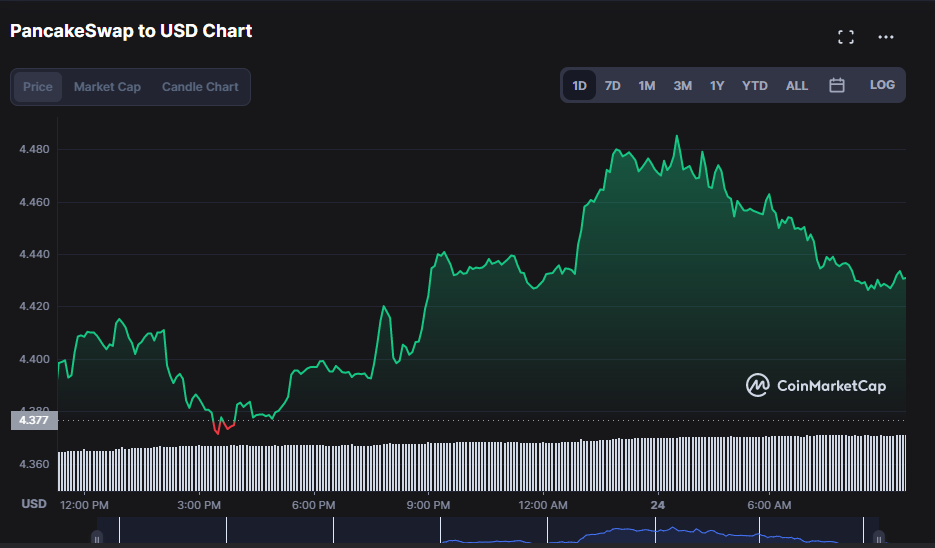

- On the previous day, PancakeSwap recovers 0.43% of its lost value.

- Bulls are trying to maintain the upward trend shown by the CAKE price analysis.

- CAKE encounters resistance at $4.49 and support at $4.37.

The 24-hour price chart’s price analysis of PancakeSwap (CAKE) indicates that the value of the digital asset has increased. Since finding support at $4.37, the bulls have got the better hand, and the price of CAKE has been rising to its present peak.

At the time of publication, CAKE was worth $4.42 and was trading up 0.60% against the US dollar. The one-day trading volume has surged by 45.23% to $25,389,807, and the market capitalization has climbed by 4.08% to $666,969,055. These are some of the causes that have helped drive up prices.

The technical indicators on the daily price charts suggest that the positive trend in CAKE analysis may continue because they are all pointing north.

The Moving Average Convergence Divergence (MACD), which has a reading of -0.001, is pointing up and above the signal line. The histogram, which is in the positive region and indicates that the uptrend may continue, is supporting this bullish momentum.

If the current trend persists, the Chaikin Money Flow (CMF), which has a reading of -0.01, may rise upward.

The upper and lower Bollinger Bands are in a linear movement and touching at 4.458 and 4.321, respectively. According to this trend, the market is stable and the price of the action might go anyway.

With the 5-day MA touching 4.439 and the 20-day MA touching 4.390, the shorter-term MA is crossing above the longer-term MA, indicating a bullish crossover. According to this pattern, there are unquestionably more bulls than bears in the current market, and the pattern may continue.

Since the Relative Strength Index (RSI) stands at 49.01, it is neither overbought nor oversold. This indicates a stable market as well as the possibility that the current trend will continue in the foreseeable future.

In general, the bears appear exhausted as the bulls have taken over the market; nevertheless, if the bulls do not hold the resistance level, the positive momentum may be fleeting.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.