- Cheeky Crypto argues that BTC has support levels at $50,798 and $51,219.

- The analyst anticipates a Bitcoin rebound, targeting prices in the $55k range.

- However, he lacked confidence in HBAR’s ability to sustain its bullish trajectory.

In a recent market analysis on the Cheeky Crypto YouTube channel, an analyst discussed the potential for Bitcoin to surpass the $55,000 threshold. He examined BTC’s candlestick patterns in the four-hour timeframe.

Following the examination, the analyst highlighted that Bitcoin now has a support level of around $51,219, considering BTC’s 50-day simple moving average. At the same time, he proposed that if the $51,219 support fails to endure, the focus could shift to the 50-day exponential moving average (50EMA). This 50EMA provides an additional support level for BTC at $50,798.

Besides, he identified the presence of a midlevel trend line, previously a resistance area that has now transformed into support. With these factors in play, the analyst anticipates a Bitcoin rebound. Specifically, the Cheeky Crypto presenter set his sights toward the $54,755 regions and beyond for BTC. Notably, Bitcoin currently hovers around $52,190.

Furthermore, considering the projected targets, the analyst noted that the trade opportunity is to open a long position for Bitcoin at its current market price. He urged viewers to set a step loss at the lower support threshold of $50,798.

Also, the analyst pointed out that this point offers a risk-reward ratio of approximately 1.87. Additionally, he cautioned against increasing the risk of being liquidated by lifting the stop-loss too high.

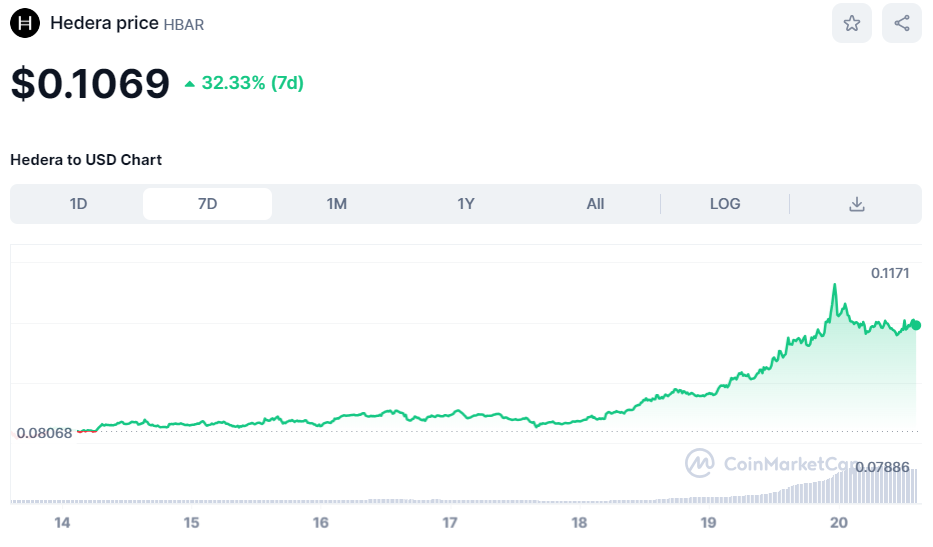

In a parallel analysis session, the analyst at the Cheeky Crypto channel assessed the potential for Hedera Hashgraph (HBAR) to sustain its bullish momentum. Notably, HBAR has surged by over 30%, moving from $0.08068 to $0.1171 over the past seven days.

HBAR seven-day chart | CoinMarketCap

Considering HBAR’s recent bullish performance and a noticeable retracement, the analyst expressed a lack of confidence in the asset’s ability to sustain its bullish trajectory.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.