XRP has entered the final stretch of October 2025 with traders questioning whether the token can reclaim the $3 mark before Halloween. After showing strong momentum in Q3 of 2025, the cryptocurrency has faced a significant pullback, leaving investors watching closely for signs of a late-month breakout.

At press time, XRP is trading at around $2.40, reflecting a 1.0% decline in the past day and a 17% loss in the last 30 days. Despite this decline, XRP enjoys an uptick of 343% in its yearly performance.

Trading volume is currently running about 12% above the weekly average, suggesting continued participation from both retail and institutional investors.

Technical Levels to Watch

- Support: Around $2.35, which has held firm since mid-October.

- Resistance: Between $2.80 and $3.00. A strong move above $2.60 could hint at a rally.

- If XRP drops below $2.40, a retest of $2.25 is likely.

Whale activity and breakout patterns have some analysts comparing this to XRP’s 2017 rally. But many agree: without a major catalyst, a move above $3 soon is unlikely.

Legal and Institutional Factors

XRP’s price is also influenced by legal and institutional news. Ripple’s legal victories over the SEC have helped market confidence, but focus is now shifting to a possible XRP ETF.

The SEC’s decision on the proposed spot XRP ETF may now come in late November or December, rather than being finalized this month.

Notably, Grayscale, 21Shares, Bitwise, Canary Capital, WisdomTree, and CoinShares are awaiting SEC approval for their XRP ETF applications, delayed from October 18–25 due to the government shutdown. Similar holdups affect Litecoin, Solana, and Cardano ETFs.

Despite this, Polymarket data shows a 99% chance of XRP ETF approval by 2025. ETF analyst Nate Geraci called the delay inevitable, while Bloomberg’s Eric Balchunas described it as a temporary “rain delay.”

Meanwhile, Ripple-backed Evernorth announced plans to go public and raise over $1 billion, partly to expand its XRP holdings. The move has been interpreted as a signal that major investors still see long-term value in Ripple’s ecosystem.

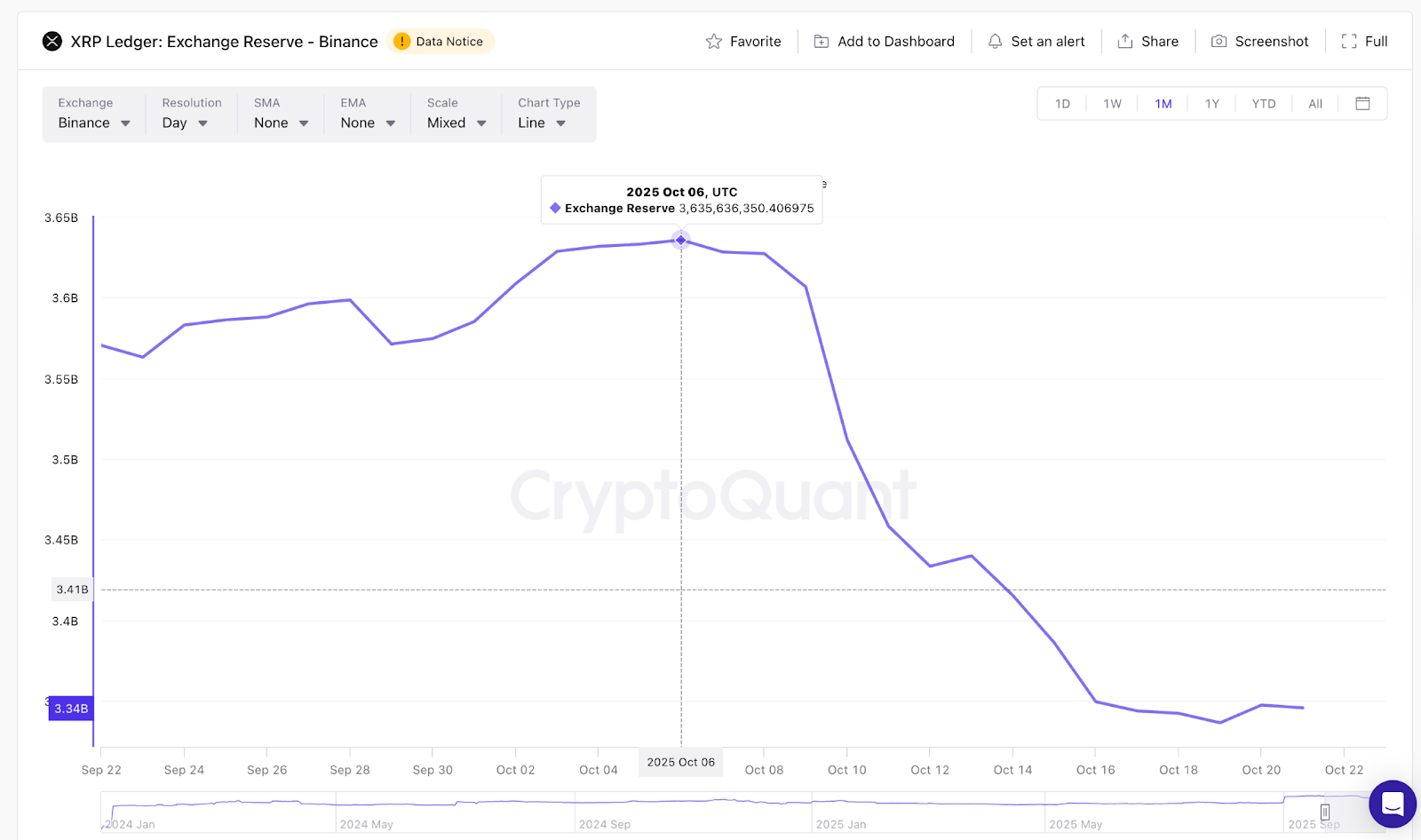

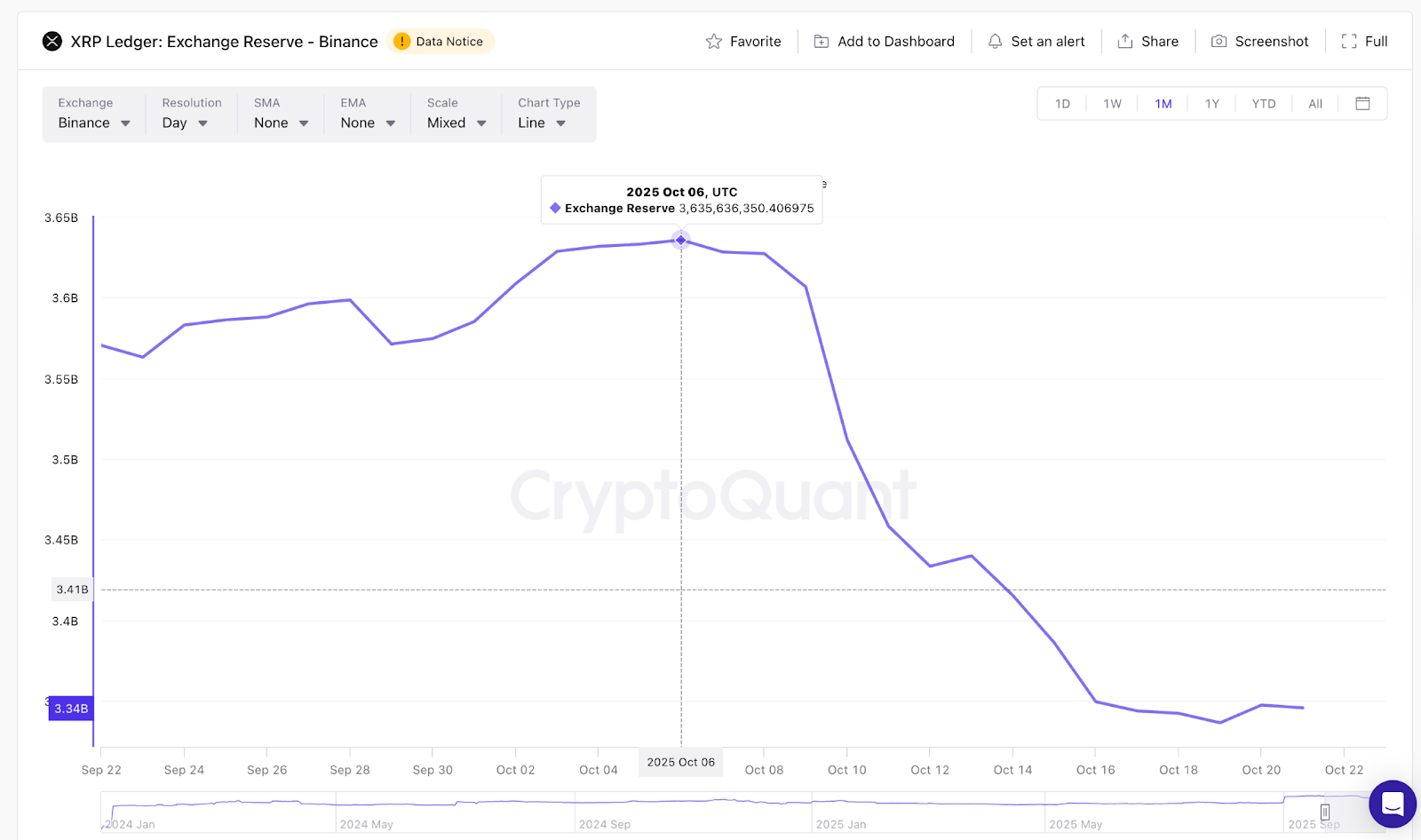

Similarly, on-chain data from CryptoQuant suggests confidence among long-term holders. On-chain report reveals an increasing drop in exchange reserves.

In October, XRP on the Binance exchange dropped from 3.6 billion to the current level of 3.3 billion, strengthening the “supply shock” narrative. This suggests that shrinking exchange balances could tighten supply and boost XRP’s price in the near future.

Market Sentiment and Technical Outlook

Market sentiment remains cautiously optimistic. Derivatives data show that options traders have started to position for upside movement.

CoinGlass data reveals rising derivatives activity, with open interest down by a paltry 0.06% and futures volume surging 38.4% to nearly $8.57 billion. This suggests traders are rebuilding positions instead of exiting, signaling expectations of an imminent XRP price move.

From a technical perspective, XRP breaks above a multi-year descending trendline amid a 30 million XRP whale accumulation in 24 hours.

Analyst CryptoKaleo compared the move to the 2017 breakout that led to a surge toward $3.50, noting resistance between $3.30 and $3.50 and potential upside to $5–$7 if momentum holds.

Ali Martinez also highlighted renewed whale activity supporting the rebound from $2.25. On shorter timeframes, XRP holds support at $2.42 and faces resistance at $2.60; a close above could drive it to $2.85–$3.00, while a dip below $2.40 may trigger a retest of $2.25.

However, most experts agree that the lack of a near-term catalyst makes a move above $3 less likely before Halloween.

Broader Market Dynamics

Macroeconomic factors continue to play a role in XRP’s trajectory. The crypto market has been sensitive to shifts in U.S. interest rate expectations, global liquidity, and ETF-related sentiment.

As traders await clarity on the ETF approvals, XRP has found itself oscillating within tight ranges, mirroring the consolidation seen across major digital assets.

Still, several recent XRP news updates, including Ripple’s expansion in Asia-Pacific and new partnerships focused on cross-border payments, have provided a fundamental backdrop that could support the next major move if overall market momentum improves.

Can XRP Reach $3 Before Halloween?

Realistically, XRP faces an uphill battle to reach $3 before October 31. The setup is technically sound, and sentiment remains neutral to positive, but time is running short for a major catalyst to materialize.

Without an unexpected announcement, such as an early ETF decision or a significant partnership reveal, the price is more likely to fluctuate between $2.30 and $2.90 for the remainder of the month.

Conclusion

XRP’s October run has been filled with hope and hesitation. The token is holding up above key support, but reaching $3 before Halloween would need a strong catalyst.

With regulatory updates and institutional moves on the horizon, XRP remains a top asset to watch as 2025 nears its end.

While social media discussions have amplified optimism, the data suggest that $3 remains a stretch in the short term. It’s possible if a strong catalyst emerges, but unlikely under current conditions.

Analysts estimate that XRP could climb as high as $3.05 in a bullish scenario, though a more realistic expectation lies within the $2.50–$2.90 range.

The SEC’s review of the XRP ETF proposal has been delayed, with most reports pointing to late November or December 2025 as the new decision window.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.