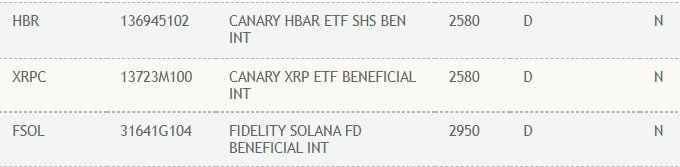

- Canary XRP ETF listed on DTCC alongside Solana and Hedera ETFs.

- SEC ETF deadlines near: Oct. 18 for Grayscale, Oct. 23 for Canary.

- XRP price broke $3; whales sold 40M XRP despite bullish sentiment.

The U.S. Securities and Exchange Commission (SEC) is nearing deadlines for several spot altcoin ETF decisions, with XRP leading the pack.

Ahead of those rulings, the Canary XRP ETF appeared on the Depository Trust and Clearing Corporation (DTCC) website, joining listings for Solana and Hedera. While the entry is a technical step and not a trading approval, it drew attention as XRP’s price broke out above $3 on strong market sentiment.

Related: XRP Exchange Reserves Jump Over 1.2 Billion Tokens as Analysts Eye $4.5 Breakout Target

Why the DTCC Listing Matters

The DTCC entry for the Canary XRP ETF is not an official SEC authorization, but traders often view such listings as a signal of readiness. The SEC still holds the final word on whether a spot XRP ETF can launch.

Still, the DTCC appearance fueled optimism. Regulators have already cleared some hurdles for XRP, including ending the Ripple lawsuit earlier this year. Bloomberg ETF analyst Eric Balchunas noted that ETFs listed on DTCC rarely remain inactive, raising expectations for eventual approval.

“That said, how many tickets are added [on DTCC] that are never launched, probably almost none,” Balchunas noted.

Key Deadlines for SEC Decisions

The SEC faces several key deadlines for XRP ETF decisions in October:

- October 18, 2025: Grayscale’s application to convert its XRP Trust into an ETF.

- October 19, 2025: The 21Shares Core XRP Trust application.

- October 23, 2025: Deadline for the Canary XRP ETF.

- October 25, 2025: Final decision for the WisdomTree XRP ETF.

Because these dates are clustered, analysts suggest the SEC could announce batch approvals, as it did last year for Bitcoin and Ethereum ETFs.

Whale Activity Remains Subdued

Despite XRP’s breakout above $3, whales have shown limited appetite. Santiment data showed that wallets holding 10 million to 100 million XRP sold 40 million coins in the past 24 hours, reducing their combined balance to about 7.74 billion tokens. The selling indicates large holders are trimming exposure even as retail demand strengthens.

XRP Midterm Technical Outlook

Technically, XRP has traded inside a descending triangle since peaking at an all-time high of $3.65 in July 2025. Analyst Ali Martinez noted the token recently broke above a falling logarithmic trendline, a move that opens the door to retest its July peak.

Related: XRP (XRP) Price Prediction For September 12

For now, $3 serves as key support. If XRP holds that floor, the breakout could extend toward previous highs. A drop back under $3, however, would point to further downside pressure.

With a fully diluted market cap near $307 billion, XRP remains one of the most closely followed altcoins heading into the SEC’s October decisions.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.