- Bullish EMA alignment and Supertrend confirm CC’s short-term uptrend strength now

- Resistance near $0.18–$0.183 remains key trigger for volatility expansion ahead

- Rising open interest and steady spot inflows signal renewed trader confidence building

Canton Network continues to draw trader attention as CC/USDT holds a firm short-term uptrend on the 4-hour chart. Recent price action shows buyers regaining control after a steady advance through January.

Short-Term Structure Favors Buyers

Price action shows CC trading above its key moving averages on the 4-hour timeframe. The 20, 50, 100, and 200 EMAs now align upward, signaling trend strength. Additionally, the Supertrend indicator has flipped bullish and continues to follow price closely. This alignment often reflects sustained upside pressure.

However, price now challenges a heavy resistance band near recent highs. Sellers previously defended the $0.18 to $0.183 area with conviction.

Consequently, this zone represents the immediate hurdle for continuation. A decisive break could extend the move into the next expansion phase. Besides, traders may welcome a shallow pullback to reset momentum.

Support and resistance levels offer clear reference points. The $0.156 to $0.158 region, aligned with a higher Fibonacci retracement, now acts as a key flip level. Hence, buyers may defend this area during retracements.

Below, the $0.15 to $0.148 zone combines prior structure with an EMA cluster. This area underpins the current trend.

Related: Dogecoin Price Prediction: DOGE Breaks $0.12 As ETF Flows Dry Up

Significantly, a deeper support band sits near $0.135, which marks a stronger retracement level. A 4-hour close below this zone would weaken the bullish structure. Moreover, longer-term demand rests between $0.120 and $0.106, where accumulation previously emerged.

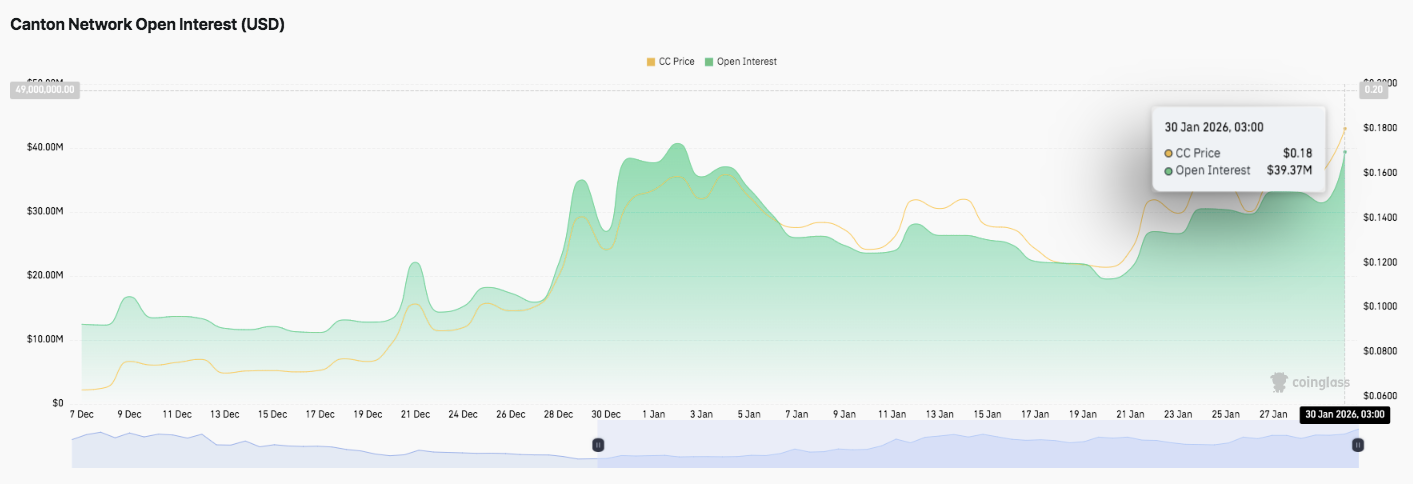

Derivatives Positioning Signals Renewed Interest

Canton Network’s open interest data adds context to the recent price behavior. Open interest expanded sharply from early December into January, reflecting rising derivatives participation. That expansion coincided with strong upside momentum, signaling aggressive positioning.

After peaking above $40 million, open interest cooled gradually as traders reduced leverage. However, the recent recovery toward $39 million changes the tone.

Moreover, the rebound suggests fresh positions rather than forced liquidations. Traders appear willing to reengage as price stabilizes above trend support. Hence, leverage could rebuild if price pushes higher. This setup increases the likelihood of volatility expansion during a breakout attempt.

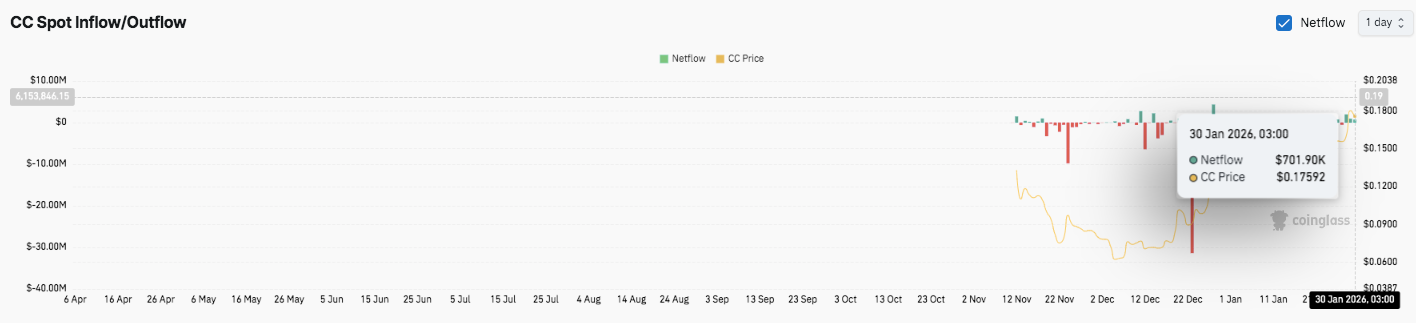

Spot Flows Point to Gradual Accumulation

Spot inflow and outflow data also shows a constructive shift. Recent sessions recorded modest net inflows, indicating cautious accumulation. Earlier periods showed sharp outflows during pullbacks, reflecting defensive profit-taking. Significantly, those aggressive outflow spikes have faded.

The latest data shows a net inflow near $700,000, aligning with a short-term price rebound. Consequently, sell pressure appears to ease as buyers regain confidence. Overall, flows suggest stabilization rather than distribution.

Technical Outlook for Canton Network (CC) Price

Key levels remain clearly defined for Canton Network as price trades within a constructive short-term structure.

On the upside, immediate resistance sits at $0.18–$0.183, where sellers previously capped advances. A confirmed breakout above this zone could unlock further upside expansion and extend the ongoing uptrend. Below current price, the $0.156–$0.158 area stands out as a critical flip zone, marking former resistance that now acts as support on pullbacks.

Downside levels remain well-structured. Initial support lies at $0.15–$0.148, reinforced by an EMA cluster and prior market structure. A deeper support zone rests at $0.135, aligned with the 0.618 Fibonacci level. A loss of this area on a 4-hour close would weaken the bullish setup and expose CC to the $0.120–$0.106 demand range.

The broader technical picture suggests CC is consolidating just below resistance after a strong impulsive move higher. This compression phase favors continuation if buyers maintain control above $0.15. Open interest recovery and stabilizing spot flows support the view of renewed participation rather than distribution.

Will Canton Go Up?

Canton Network’s near-term direction depends on whether buyers can defend the $0.15 region and generate enough momentum to challenge $0.18. A successful breakout could accelerate upside volatility.

However, failure to hold $0.135 would shift focus toward deeper demand. For now, CC remains in a pivotal zone, with trend structure favoring continuation while confirmation remains key.

Related: Chainlink Price Prediction: LINK Drops 22% In Two Weeks Despite ETF Inflows And Turtle Partnership

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.