Cardano price today is trading near $0.883, holding steady after breaking above its descending trendline. The move has shifted attention toward the $0.90–$0.95 resistance area, where broader market catalysts and the Midnight sidechain narrative could drive the next leg.

Cardano Price Breaks Out Of Compression

On the 4-hour chart, ADA has finally broken above a descending structure that contained price for nearly three weeks. Buyers defended the $0.82 support floor multiple times, with momentum building as moving averages began to converge.

The breakout took price above the 20-day EMA at $0.85 and the 50-day EMA at $0.84, turning them into immediate support. A successful hold above these levels keeps the path open for $0.90 retests. Beyond this, the $0.95 supply zone looms as a critical test for bulls.

Related: Ethereum (ETH) Price Prediction For September 10

Bollinger Bands on the daily chart are widening after a period of contraction, signaling that volatility is returning in ADA’s favor.

Midnight Sidechain Launch Sparks Optimism

Fundamentals have added to ADA’s breakout narrative. Developers confirmed that Midnight’s mainnet is set for launch in Q4 2025, positioning the sidechain as a privacy-first solution within the Cardano ecosystem.

The announcement has fueled optimism around Cardano’s ability to attract institutional and enterprise-level adoption. Traders argue that network-side innovations often provide the type of narrative fuel required to sustain technical rallies, particularly when timed with chart breakouts.

On-Chain Flows Reflect Mixed Sentiment

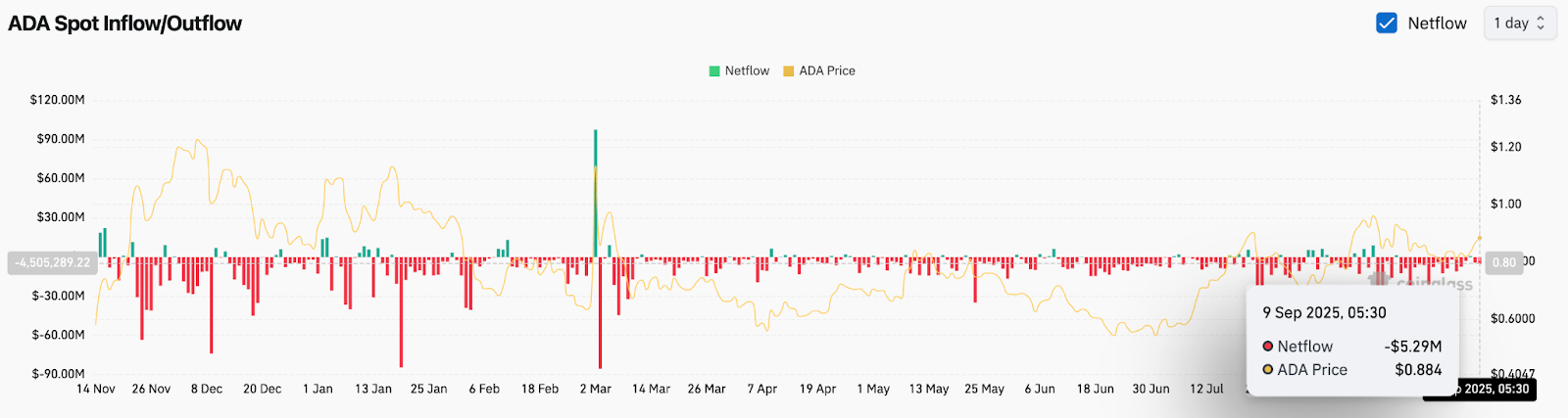

Despite the bullish technical setup, exchange flows highlight some caution. Spot data on September 9 recorded $5.29 million in net outflows, suggesting that some holders are moving ADA away from exchanges.

Related: OpenLedger (OPEN) Price Prediction

Historically, persistent outflows reflect accumulation or long-term staking, which may reduce immediate sell pressure. However, low inflows also mean that fewer traders are positioning aggressively for short-term upside. Analysts caution that inflows must turn positive to confirm conviction around a sustained push toward $0.95.

Daily Bollinger Bands Signal Expanding Volatility

The daily chart shows ADA trading comfortably above the midline of its Bollinger Bands, now sitting around $0.85. Bands are beginning to expand after a period of narrowing, which often signals an upcoming volatility spike.

Related: MYX Finance (MYX) Price Prediction

The upper Bollinger Band near $0.92 lines up closely with resistance, meaning a breakout could accelerate price discovery toward $0.95 and beyond. Meanwhile, the Supertrend indicator has flipped bullish, holding a support level around $0.75, reinforcing the broader positive setup.

Technical Outlook For Cardano Price

Immediate upside targets sit at $0.90 and $0.95, with momentum likely to accelerate if ADA clears the latter. Above this, the next resistance zone is between $0.98 and $1.00.

On the downside, losing $0.85 would weaken the bullish breakout, exposing $0.82 as the key support. A deeper failure could drag ADA back toward $0.78, where the 200-day EMA offers structural backing.

Outlook: Will Cardano Go Up?

Cardano’s near-term trajectory depends on whether technical breakout momentum aligns with positive flows. The Midnight sidechain launch adds a powerful narrative, but inflows will be key to confirming conviction.

Related: Worldcoin (WLD) Price Prediction

As long as ADA holds above $0.85, the setup favors a push toward $0.95. A clean break above that level could extend toward $1.00, while a slip below $0.82 would threaten to reset bullish expectations.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.