- Cardano price holds $0.91 within rising channel, with $0.95 resistance key for a push toward $1.00.

- SEC approval of Grayscale fund including ADA fuels optimism over wider institutional exposure.

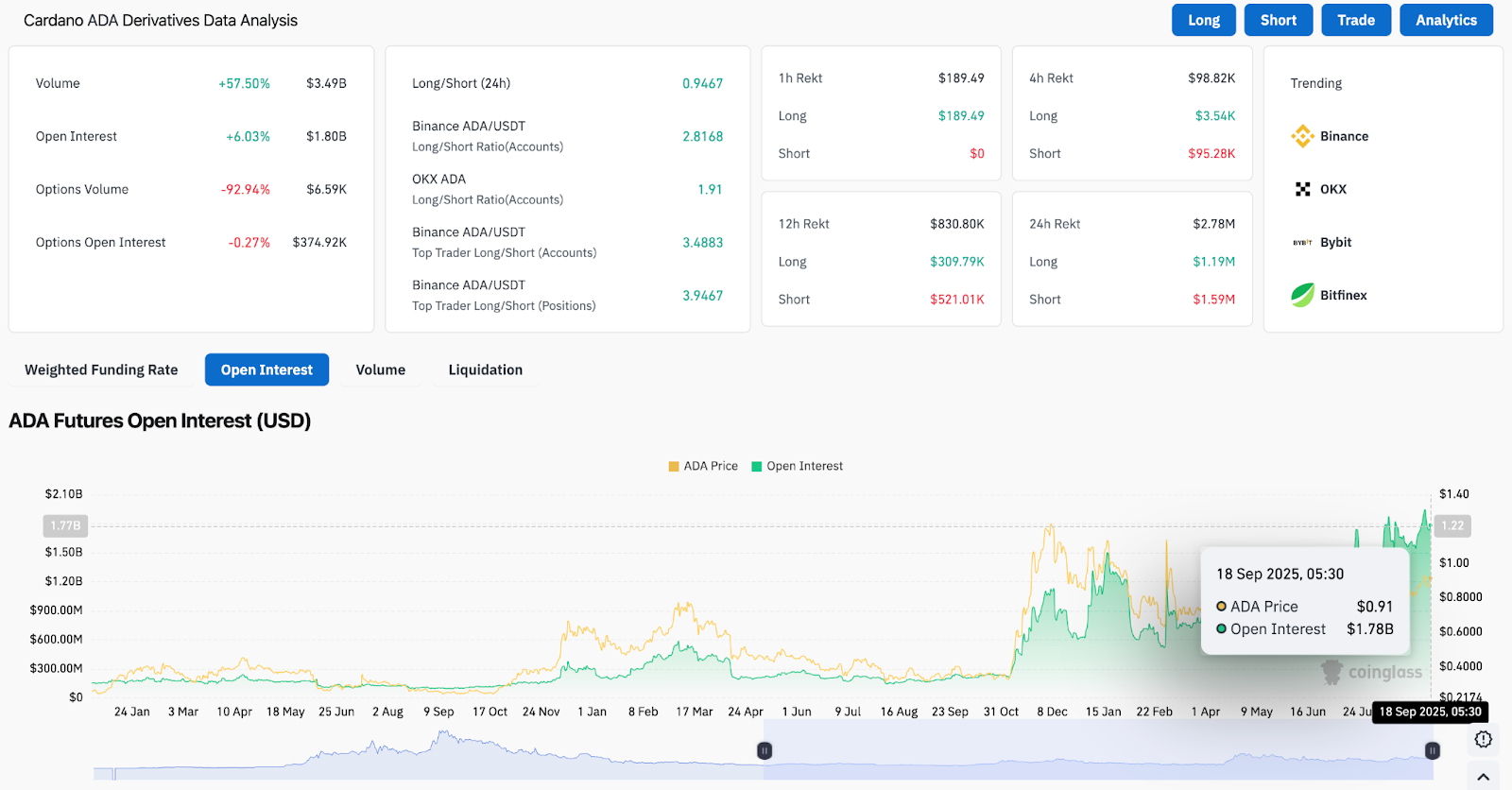

- Derivatives data shows $1.8B open interest and strong long positioning as traders prepare for breakout.

Cardano price today is trading near $0.91, holding within a rising channel after bouncing from the $0.88–$0.89 EMA cluster. The immediate resistance lies at $0.94–$0.95, where repeated rejections in September have capped upside momentum. The question now is whether buyers can force a breakout toward $1.00 or if ADA stalls again and slips back toward $0.88 support.

Cardano Price Holds Rising Channel Support

The 4-hour chart shows ADA trending within an ascending parallel channel, with higher lows consistently defended since early September. Buyers recently reclaimed $0.91, aligning with mid-channel support, while the 20-EMA at $0.89 continues to provide a technical cushion.

Related: Solana Price Prediction: ETF Greenlight And Cup-And-Handle Pattern Target $550 Upside

Momentum indicators lean cautiously bullish. The RSI is recovering from neutral levels, while short-term EMAs have crossed above the 200-EMA at $0.85, reinforcing the broader uptrend. A decisive close above $0.95 would open the path toward $1.00–$1.02, while failure to sustain current levels risks a pullback to $0.88 and deeper toward $0.85.

SEC Approval Adds A Fundamental Tailwind

Sentiment for ADA strengthened after the SEC approved Grayscale’s Digital Large Cap Fund for trading, which includes Cardano alongside Bitcoin, Ethereum, XRP, and Solana. The news sparked optimism that ADA is now part of a recognized basket of institutional-grade assets, potentially widening its investor base.

Community reactions reflected this boost, with traders noting that regulatory recognition could shift ADA’s perception beyond speculative positioning. Analysts highlight that inclusion in such funds often translates into sustained institutional exposure, a key driver for long-term demand.

Derivatives Data Shows Bullish Positioning

On-chain derivatives metrics reinforce the bullish tilt. ADA futures open interest has climbed 6% to $1.8 billion, while daily trading volumes surged 57% to $3.5 billion. Long-to-short ratios on Binance remain skewed bullish, with top traders positioned nearly 4:1 in favor of longs.

Related: Ethereum (ETH) Price Prediction For September 19

Despite options activity remaining muted, leveraged futures data shows aggressive accumulation. Liquidation records highlight shorts absorbing most of the losses in recent sessions, consistent with pressure building toward an upside breakout attempt.

Broader Narrative Aligns With Cycle Expansion

Longer-term charts show ADA carving out a bullish structure, with analysts on social media pointing to a “severely bullish” setup on the monthly timeframe. ADA is attempting to confirm a breakout from its multi-year consolidation range, with projections targeting well above $1.20 in the coming cycle.

The combination of institutional recognition, strong derivatives participation, and constructive chart structures positions ADA to capitalize on broader market momentum if Bitcoin and Ethereum maintain stability.

Technical Outlook For Cardano Price

The short-term Cardano price prediction centers on the $0.95 resistance ceiling and the $0.88 support floor. A clear move above $0.95 could potentially lead to the $1.00 and $1.02 levels, providing opportunities for momentum buyers to drive further gains.

On the other hand, if ADA fails to sustain its current trajectory, immediate support lies at $0.88, with $0.85 acting as a critical secondary defense. Deeper liquidity is positioned around $0.82, which remains the broader trend support within the rising channel. This structure highlights the balance between bullish breakout potential and downside risk, keeping traders focused on whether ADA can reclaim the $1.00 threshold in the coming sessions.

Outlook: Will Cardano Go Up?

Cardano’s path forward depends on whether buyers can break the $0.95 barrier before losing $0.88 support. Fundamentals have turned supportive following Grayscale inclusion, and derivatives data shows traders are positioning for upside.

Related: Bitcoin (BTC) Price Prediction For September 19

As long as ADA holds above $0.88, analysts expect further attempts to reclaim $0.95 and test the $1.00 psychological threshold. A confirmed breakout would validate the bullish channel, while rejection at resistance could extend consolidation. For now, ADA’s setup favors cautious optimism with upside bias intact.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.