Today, Cardano’s price is around $0.83, down 1.2% from the last session. The token is still under pressure in a downward channel that has been guiding price action since mid-August.

Flows data show that money is still leaving, and technicals say that ADA needs to break through the key resistance level at $0.88 to show that it can recover. Without that, the overall structure will continue to lean bearish as we move into September.

Cardano Price Stuck Inside Descending Channel

On the 4-hour chart, ADA trades inside a clear downward channel, capped by resistance near $0.88 and supported around $0.81. The 20- and 50-period EMAs, at $0.83 and $0.84 respectively, are converging just above spot levels, reinforcing the weight of near-term resistance.

The RSI hovers around 47, suggesting momentum is neutral but leaning weak. Unless buyers force a breakout above the channel top, ADA risks further drift toward $0.80 and potentially $0.76, the next support level aligned with the 0.618 Fibonacci retracement.

Related: XRP Price Prediction: XRP Struggles Against Descending Resistance

Outflows Add Pressure on Sentiment

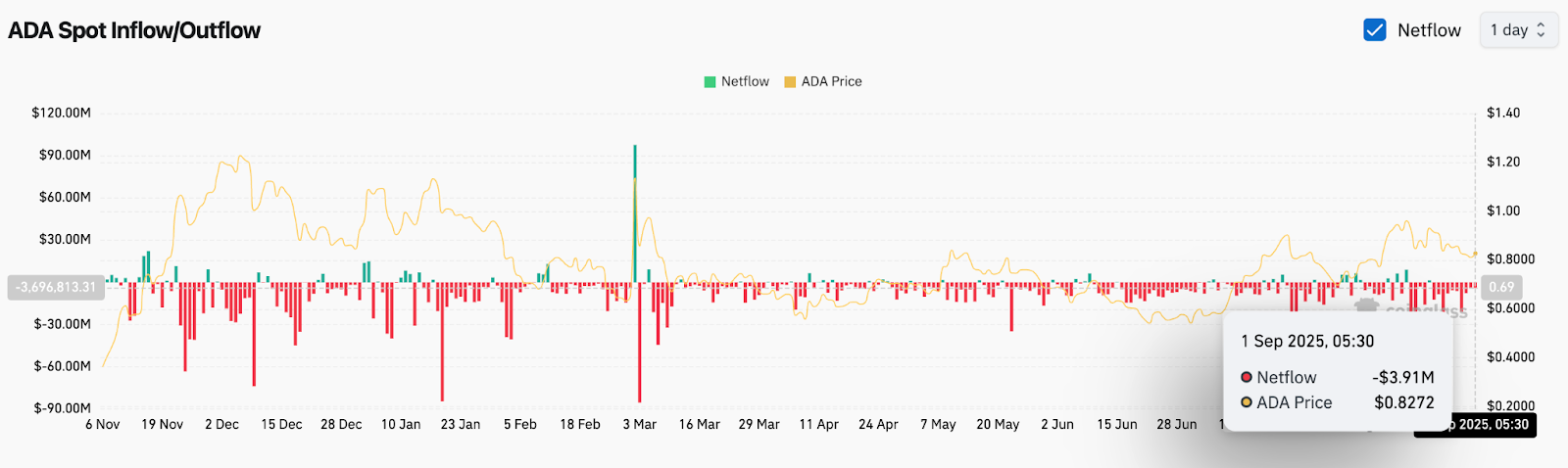

Spot flows confirm ongoing bearish pressure. On September 1, ADA recorded $3.91 million in net outflows, extending a negative streak that has defined August. This reduction in exchange liquidity points to sustained selling from larger holders.

The daily Bollinger Bands show volatility tightening, with price testing the midline around $0.82. The upper band sits at $0.97, leaving upside potential if ADA can reclaim resistance. However, repeated closes under the band midpoint emphasize that control remains with sellers.

Related: Bitcoin (BTC) Price Prediction: Breakout or Breakdown Next?

Contrasting Views: Bulls Pin Hopes on $0.88, Bears Warn of Breakdown

Analyst Ali Martinez highlighted on X that Cardano must break $0.88 to confirm a rally toward $1.20. His projection shows upside potential if buyers reclaim the critical pivot, aligning with the Fibonacci extension levels that project targets at $1.02 and $1.23.

Bulls argue that the broader structure since July still shows higher-lows on the larger timeframe, suggesting resilience so long as $0.80 holds.

Bears counter that persistent outflows and repeated failures near $0.90 point to weakening demand. If ADA fails to defend $0.81, the next support sits at $0.76, with a deeper safety net near $0.72, where the 200-period EMA clusters. A breakdown below that zone could extend losses toward $0.66.

Related: Ethereum (ETH) Price Prediction and Analysis for September 2

Cardano Short-Term Outlook: Recovery Hinges on $0.88 Break

Heading into September 2, ADA’s short-term outlook depends on whether it can retake $0.88. A breakout would flip momentum bullish, opening a path toward $0.95 and $1.02 in quick succession. Failure to break resistance, however, risks further downside toward $0.80 and $0.76.

The Cardano price prediction for the coming sessions tilts bearish in the absence of inflow support, though traders remain focused on the $0.88 pivot as the key trigger for recovery.

Cardano Price Forecast Table

| Indicator | Signal | Levels/Notes |

| Price Today | $0.83 | Trading inside descending channel |

| Support | $0.81 / $0.76 | Channel base and 0.618 Fib |

| Resistance | $0.88 / $0.95 / $1.02 | Breakout triggers upside |

| RSI | 47 | Neutral-weak momentum |

| MACD | Flat bias | No strong trend shift |

| Pattern | Descending channel | Pressure remains below $0.88 |

| Flows | –$3.91M outflow | Persistent selling pressure |

| Bollinger Bands | Neutral-bearish | Price below midline |

| Supertrend | Bearish bias | Needs breakout above $0.88 |

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.