- Cardano price today trades at $0.82 after breaking below key $0.87–$0.90 support.

- On-chain data shows $26.6M in outflows, signaling bearish sentiment among traders.

- Hoskinson’s roadmap adds long-term optimism, but near-term momentum stays weak.

Cardano price today is trading near $0.82, down sharply after breaking below the $0.87–$0.90 support zone. The drop pushed ADA into oversold territory on the RSI, while heavy selling pressure has raised concerns over further downside. Traders are watching whether fundamentals such as Charles Hoskinson’s new roadmap can offset bearish on-chain signals.

Cardano Price Breaks Key Support Levels

The 4-hour chart shows ADA sliding beneath its ascending channel after failing to defend the 0.382 Fibonacci retracement at $0.87. Price tested a low of $0.81 before bouncing slightly, with immediate resistance now seen around $0.86 and $0.88 where the 100 and 200 EMA cluster.

Related: Ethereum (ETH) Price Prediction For September 23

Momentum indicators confirm weakness. The RSI has dropped near 28, signaling oversold conditions, while the MACD has accelerated downward, reflecting strong bearish momentum. A sustained close below $0.81 would expose ADA to deeper support at $0.78 and $0.75, while bulls must reclaim $0.87 to ease selling pressure.

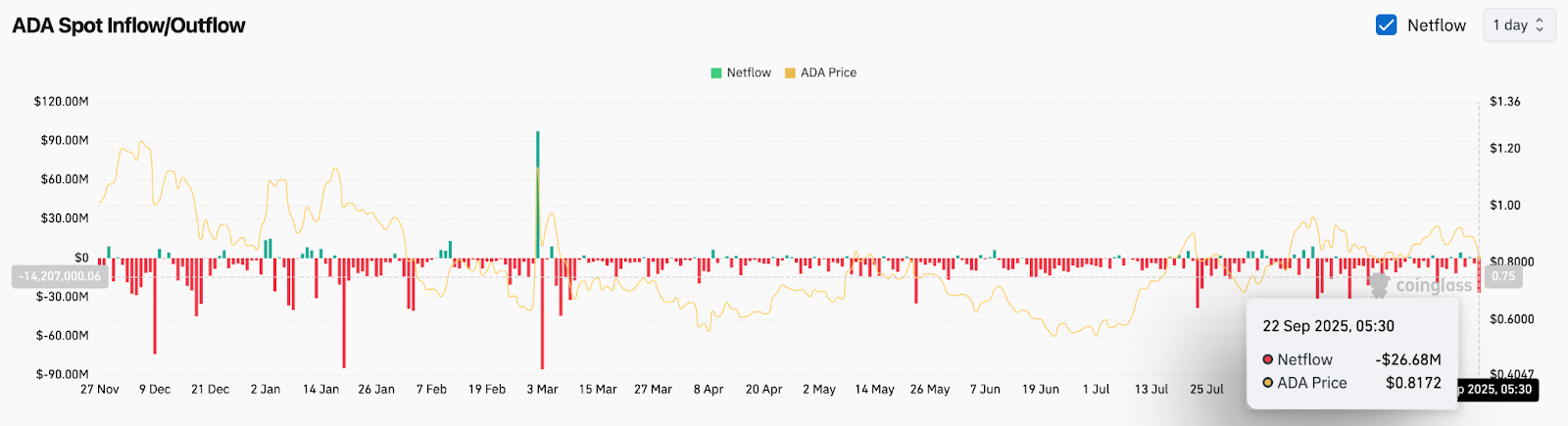

On-Chain Outflows Highlight Bearish Sentiment

Exchange flow data shows significant outflows, with ADA posting a $26.6 million net withdrawal on September 22. This mirrors the persistent trend of red bars seen throughout the month, reflecting steady selling rather than accumulation. Despite occasional green spikes earlier in the year, current flows suggest that traders are reducing exposure rather than building positions.

Without consistent inflows, ADA price action risks staying under pressure even if broader market sentiment improves. Analysts note that spot demand has failed to keep pace with derivatives positioning, leaving Cardano vulnerable to further volatility.

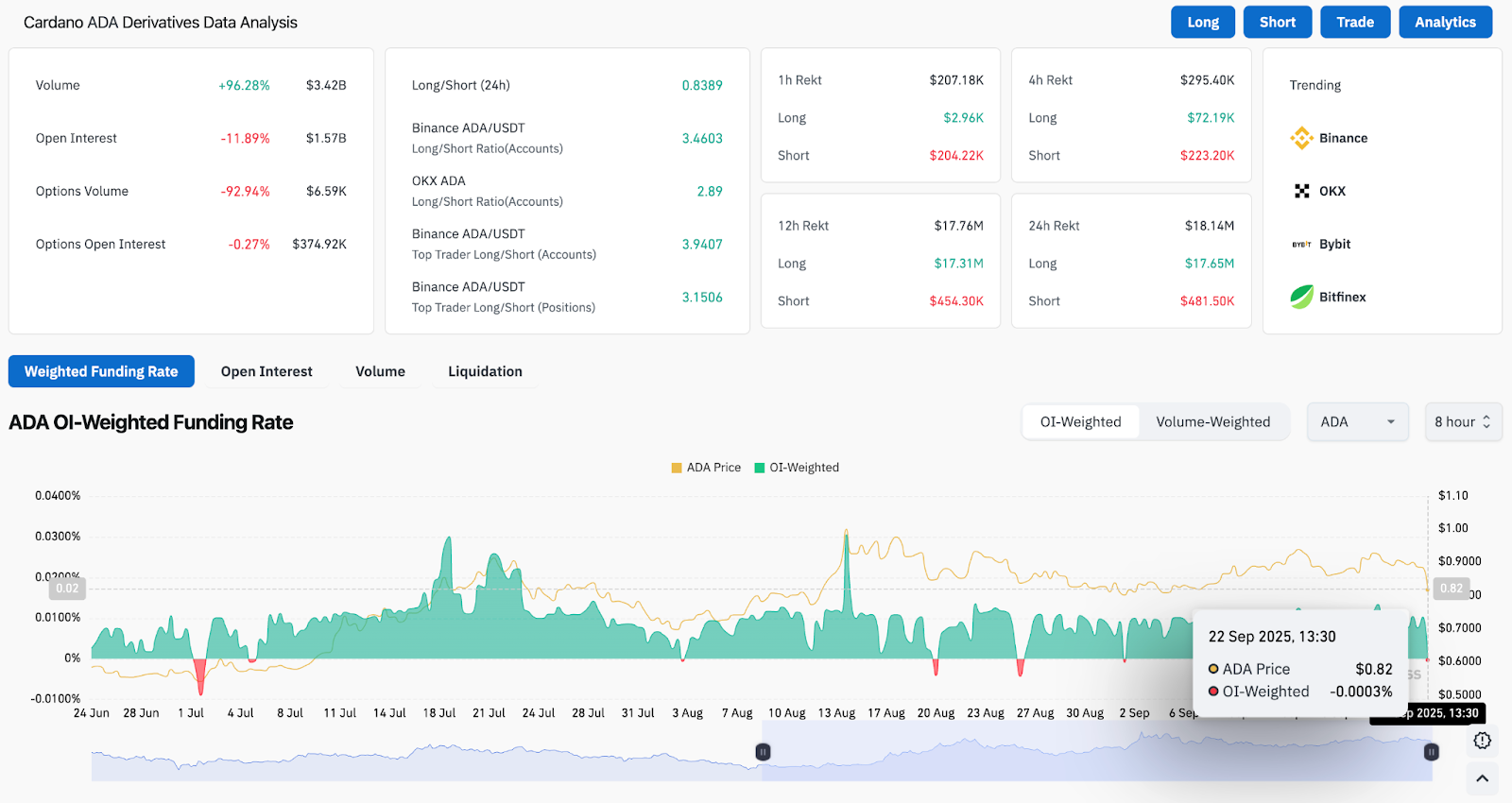

Derivatives Data Shows Mixed Positioning

Derivatives markets added to the cautionary picture. Open interest in ADA futures fell by nearly 12% to $1.57 billion, while options volume collapsed by over 90%. This sharp decline points to unwinding positions as volatility spiked. Funding rates have flipped negative, showing that shorts are paying longs, but the incentive has been marginal.

Related: Solana (SOL) Price Prediction For September 23

Despite the unwinding, long/short ratios remain skewed toward longs, with Binance’s top traders holding more than three long contracts for every short. This creates a risk of forced liquidations if price continues downward, amplifying short-term volatility around the $0.80 handle.

Cardano Roadmap Sparks Fundamental Optimism

While price action leans bearish, Cardano’s long-term outlook received a boost from Charles Hoskinson’s latest announcement. In a recent update, he outlined Cardano’s roadmap to “infinite scale,” emphasizing progress with Hydra scaling, the Midnight privacy framework, and integration with Bitcoin DeFi. Hoskinson described the network as self-sustaining and built for mass adoption, with use cases spanning ATMs, vending machines, and enterprise-grade applications.

These developments strengthen Cardano’s fundamental narrative, but traders remain cautious, noting that adoption-driven tailwinds often take longer to reflect in near-term price movements.

Technical Outlook For Cardano Price

Cardano price prediction for the near term points to a critical battle around $0.81–$0.83 support.

- Upside levels: A recovery above $0.87 would shift momentum toward $0.90 and the 0.618 Fibonacci retracement at $0.92. Clearing $0.93 could reopen the path toward $0.96.

- Downside levels: Failure to hold $0.81 would expose $0.78 and $0.75, with $0.72 acting as the last major line of defense.

- Trend structure: The broader uptrend from July remains intact above $0.72, but short-term sentiment has flipped bearish.

Outlook: Will Cardano Go Up?

The near-term outlook for ADA depends on whether buyers can defend $0.81 support after the steep sell-off. On-chain outflows and falling open interest underline bearish sentiment, while oversold RSI conditions leave room for a relief bounce. Fundamentally, Hoskinson’s roadmap underscores Cardano’s long-term strength, but traders may require stronger inflows before embracing upside momentum again.

Related: Dogecoin (DOGE) Price Prediction For September 23

Analysts remain cautious in the short term. A decisive close below $0.81 could drag ADA toward $0.75, while a rebound above $0.87 would help restore bullish confidence and reframe the discussion toward higher Fibonacci targets near $0.92.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.