- Cardano price today trades at $0.81 after losing $0.83–$0.85 support, with $0.80 as key defense.

- Derivatives volume drops 36% to $2.13B, with futures liquidations leaning against bullish positions.

- ADA community sentiment ranks seventh globally, offsetting pressure as RSI signals oversold levels.

Cardano price today is trading near $0.81, extending its decline after slipping below the $0.83–$0.85 support zone. The breakdown has placed ADA under sustained pressure, with immediate resistance now forming at the 20-day EMA around $0.835. Traders are watching whether the $0.80 handle can hold as the next key defense.

Cardano Price Breaks Trend Support

The 4-hour chart shows ADA failing to sustain its ascending channel, with the rejection near $0.92 confirming a shift in market structure. The move has pulled the token below its 20, 50, and 100-period EMAs, reinforcing a bearish bias.

Fibonacci retracement levels highlight $0.83 (23.6%) as a lost pivot, while $0.78 emerges as the next key liquidity pocket. RSI readings hover near 29, underscoring oversold conditions, though no reversal signal has been confirmed. A push back above $0.835 would be needed to flip near-term sentiment back toward neutral.

On-Chain Flows Highlight Derivatives Weakness

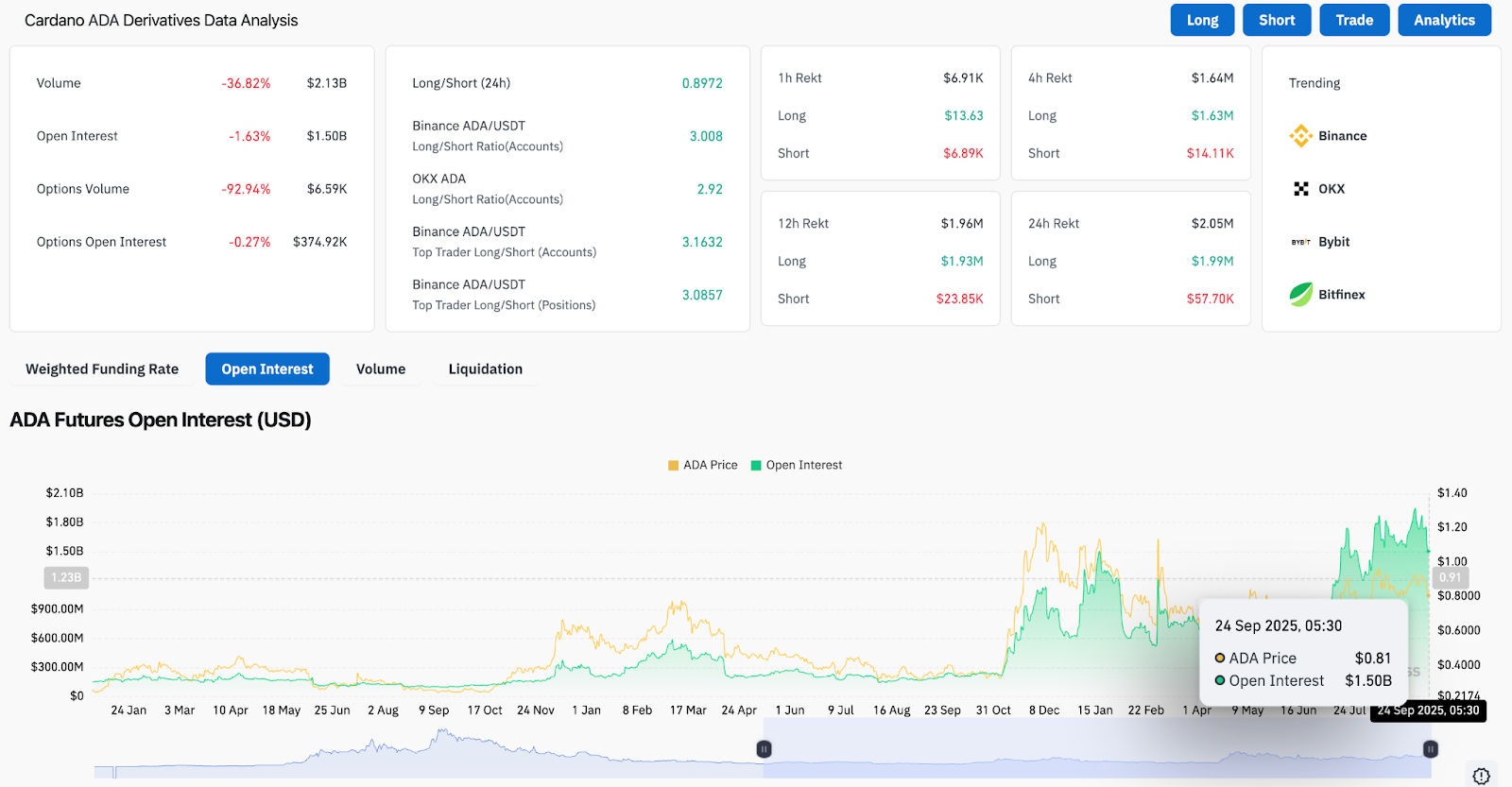

Cardano derivatives data reveals a cooling market backdrop. Daily trading volume fell 36% to $2.13 billion, while open interest slipped 1.6% to $1.5 billion. Options activity has collapsed, with volume down 93%, signaling a lack of speculative appetite.

Despite cautious positioning, long-to-short ratios remain skewed toward bulls, with Binance accounts showing a ratio above 3.0. This suggests that while broader participation is thinning, dedicated traders continue to bet on recovery. Still, futures liquidations have leaned heavily toward longs, exposing the fragility of bullish conviction.

Sentiment Ranks High Despite Price Pressure

Community support remains a notable counterweight to technical weakness. According to Mintern data, Cardano ranks seventh globally in community sentiment, highlighting its resilient retail base. This optimism comes even as ADA has shed nearly 8% in the past 24 hours, pointing to a divergence between sentiment and price action.

Such positioning reflects ADA’s historical reputation for strong grassroots backing. While it does not guarantee price recovery, it provides a narrative anchor that could attract opportunistic buyers during oversold stretches.

Hoskinson’s Bold Remarks And Regulatory Boost

Charles Hoskinson reignited speculation this week by declaring that “Cardano is going to break the internet.” Though vague, the statement coincides with positive regulatory momentum. The SEC’s approval of the Grayscale Digital Large Cap Fund, which includes ADA, opens a new channel for institutional exposure.

Historically, similar approvals for Bitcoin and Ethereum triggered fresh inflows from professional investors. Whether ADA can mirror that trajectory remains uncertain, but the combination of strong community sentiment and institutional pathways provides a supportive backdrop.

Technical Outlook For Cardano Price

Cardano price prediction for the short term hinges on key support and resistance:

- Upside levels: $0.835, $0.872, and $0.90 if recovery momentum builds.

- Downside levels: $0.80, $0.78, and $0.74 as critical defense points.

- Trend pivots: $0.92 as the breakout threshold to reclaim bullish structure.

Outlook: Will Cardano Go Up?

Cardano faces a delicate balance between technical weakness and bullish narratives. The loss of $0.83 support underscores bearish pressure, but oversold RSI levels and strong community backing suggest downside may be limited.

If ADA can defend the $0.80–$0.78 zone, a rebound toward $0.872 remains plausible. A failure here would shift focus toward $0.74 and risk deeper losses. For now, ADA’s trajectory rests on whether sentiment-driven resilience can offset fragile derivatives positioning and restore confidence above $0.83.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.