Cardano price today is trading around $0.82, stabilizing after a volatile August that left the token stuck inside a broad descending structure. ADA briefly dipped toward the $0.80 handle but found buying interest above the $0.756 support zone, a level reinforced by Fibonacci retracement and prior demand clusters.

The recovery attempt comes as traders weigh short-term technical pressure against longer-term bullish narratives. Analysts remain focused on whether ADA can reclaim the $0.85 barrier, which has repeatedly capped upside momentum in recent weeks.

ADA Price Consolidates Inside Falling Wedge Pattern

On the 4-hour chart, ADA continues to trade inside a falling wedge formation, with support aligning near $0.80 and resistance pressing down around $0.85–$0.86. The 20- and 50-EMAs cluster near $0.82–$0.83, creating a tight zone where direction will likely be decided.

The RSI sits at 47.3, reflecting neutral momentum as neither buyers nor sellers dominate. A breakout above $0.85 would confirm wedge resolution, potentially opening a run toward $0.90 and $0.95. Conversely, failure to hold $0.80 risks a slide back to $0.756, and a deeper breach could expose $0.70.

Related: Ethereum (ETH) Price Prediction for September 3, 2025

Whale Flows and DeFi Narratives Shape Sentiment

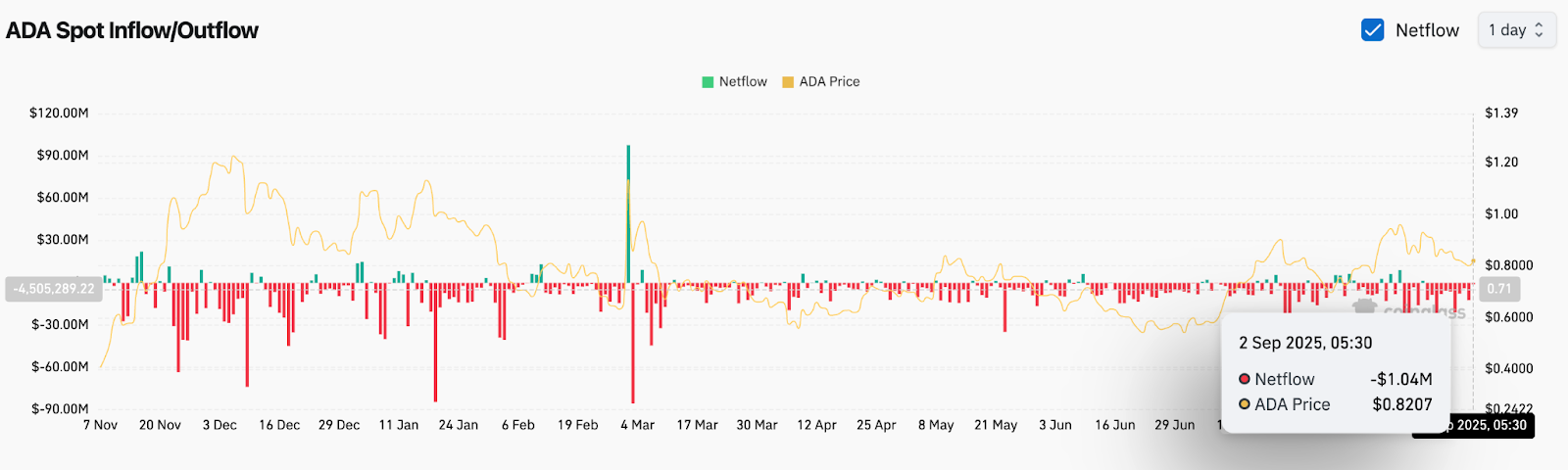

On-chain flows show $1.04 million in net outflows on September 2, suggesting mild selling pressure from larger holders. Persistent outflows have weighed on sentiment throughout the summer, limiting ADA’s ability to sustain rallies.

At the same time, Cardano’s ecosystem narrative is competing with newer DeFi contenders. Mutuum Finance (MUTM), a presale project, has drawn $15.2 million in early funding with a dual-lending model and high CertiK audit score. Analysts note that speculative capital chasing 200–300x potential returns has diverted attention away from ADA’s slow-moving structure, underlining the importance of price reclaiming technical levels to retain investor confidence.

Analysts Highlight Long-Term Resilience Despite Short-Term Weakness

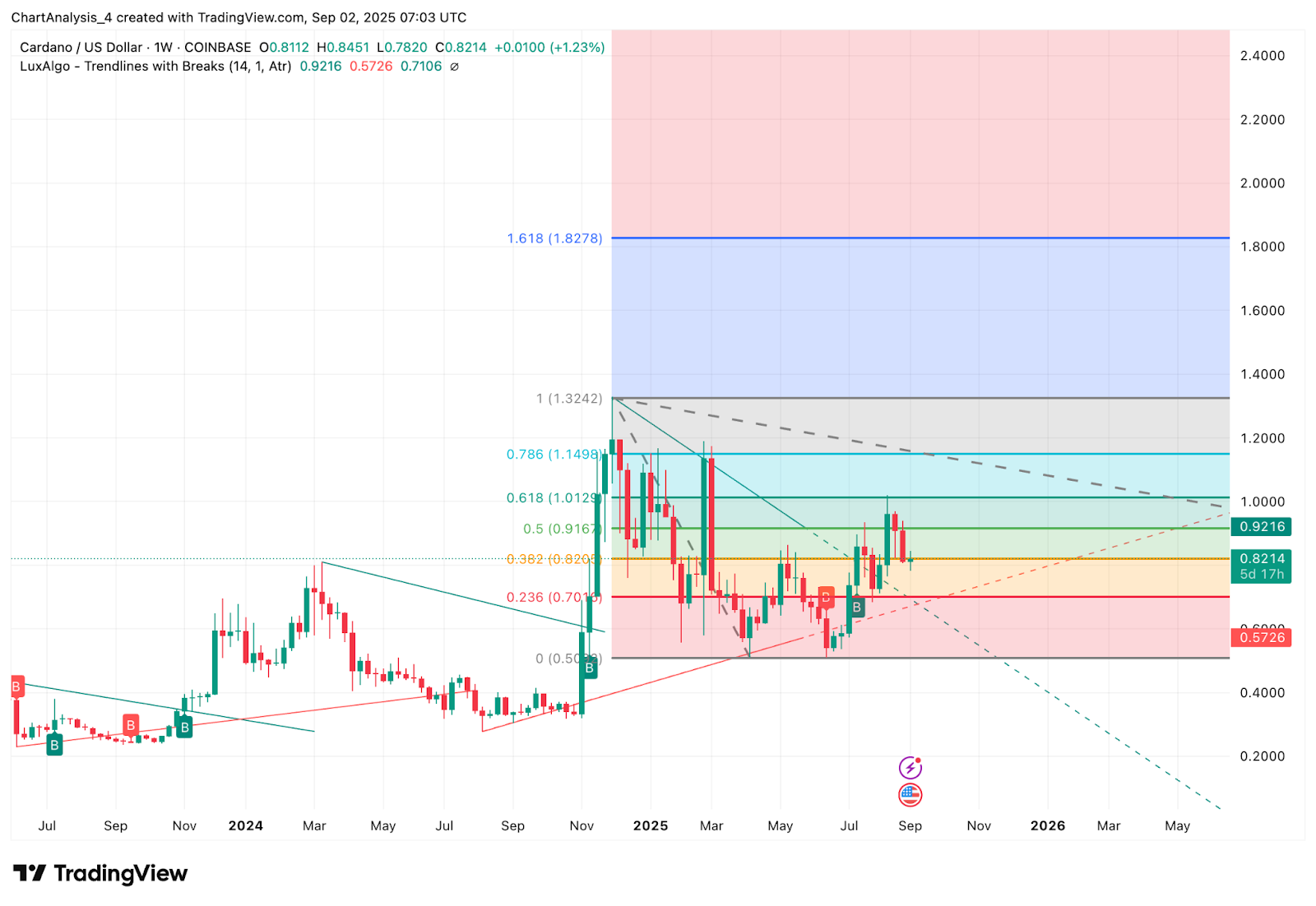

Despite recent weakness, some analysts remain constructive on ADA. Hailey LUNC noted that Cardano has stayed above key weekly moving averages — EMA55, EMA89, and MA200 — for seven consecutive weeks, calling this “an edge for the bulls.” She expects momentum to remain positive if ADA avoids breakdowns below $0.756.

The weekly chart also shows ADA holding a broad ascending channel, with the MA200 acting as dynamic support near $0.59. Long-term projections include upside targets toward $1.32 and potentially $4.86, aligning with Fibonacci extensions if bullish structures reassert.

Contrasting Views: Bulls Eye Breakout, Bears Warn Of Deeper Slide

Bulls argue that the falling wedge is a reversal pattern, and a breakout above $0.85 would confirm renewed strength. Clearing this level could shift focus toward $0.92 (Fib 0.5 retracement) and $1.01 (Fib 0.618). Defending $0.756 would preserve the broader higher-low structure on the weekly chart.

Bears counter that persistent outflows and ecosystem competition reduce the probability of immediate breakout. They warn that a decisive drop below $0.756 would unlock downside to $0.70 and potentially $0.59, where the MA200 sits as last-resort support. Failure there could unravel ADA’s broader bullish case.

Related: XRP (XRP) Price Prediction: Breakout or Breakdown Ahead?

Cardano Short-Term Outlook: Recovery Hinges On $0.85 Breakout

In the short term, Cardano price action is coiled between $0.80 and $0.85, with traders awaiting a decisive move. A close above $0.85 would flip the bias constructive, opening the door to $0.90–$0.92. That move would also validate the falling wedge breakout, improving confidence in ADA’s ability to sustain a larger rally.

If price stalls again at resistance and drifts lower, ADA could retest $0.80 and the critical $0.756 support zone. Market volatility is likely to increase around these levels as bulls and bears battle for control heading into September.

Cardano Price Forecast Table

| Indicator | Signal | Levels/Notes |

| Price Today | $0.82 | Consolidating near wedge resistance |

| Support | $0.80 / $0.756 / $0.70 | Key downside thresholds |

| Resistance | $0.85 / $0.90 / $0.92 | Breakout triggers |

| RSI | 47.3 | Neutral, no extremes |

| MACD | Flat | No clear momentum |

| Pattern | Falling wedge | Potential bullish reversal |

| Flows | –$1.04M outflow | Mild selling pressure |

| Supertrend | Bearish below $0.85 | Needs breakout confirmation |

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.