Cardano price today is trading near $0.836, consolidating after reclaiming the $0.830 level. The 4-hour chart shows ADA coiling inside a triangle that is getting smaller. There is immediate resistance at $0.840 and layered support at $0.829 and $0.815. Traders are weighing bullish technical compression against mixed on-chain flows and new hope from the most recent updates on protocol development.

Cardano Price Tests Key Breakout Level

The 4-hour chart shows that ADA is pushing against a downward trendline that has stopped rallies since mid-August. The first barrier is at $0.840, which is where the 50 and 100 EMAs are at $0.838 and $0.832, respectively. If the price closes above this level, it could confirm bullish breakout signals and aim for higher supply zones around $0.865 and $0.880.

Related: Pi Coin Price Prediction: Smart Contract Upgrade Fuels $0.36 Breakout

Early signs of strength are showing in momentum indicators. RSI is at 55, which means it is leaning toward bullish but not yet overbought, so it can keep going. The 200 EMA is still steady around $0.829, which is a technical floor that has helped recent pullbacks. Analysts argue that this alignment suggests ADA price action is reaching an inflection point, with $0.84 emerging as the key trigger level.

Analysts Highlight Bullish Wedge Setup

Market strategist Ali Charts emphasized the importance of the $0.84 level, noting that Cardano must push beyond this point to confirm a bullish breakout. His analysis showed a falling wedge structure on the 4-hour chart, a pattern often associated with reversal setups. A successful breakout could pave the way toward $0.90 and $0.92 in the near term.

The pattern highlights how ADA price prediction remains tied to whether bulls can reclaim trendline resistance. A rejection here, however, risks extending consolidation back toward $0.815, leaving traders cautious despite the bullish setup.

Related: Solana (SOL) Price Prediction: Nasdaq Listing Sparks Optimism

On-Chain Flows Reflect Investor Hesitation

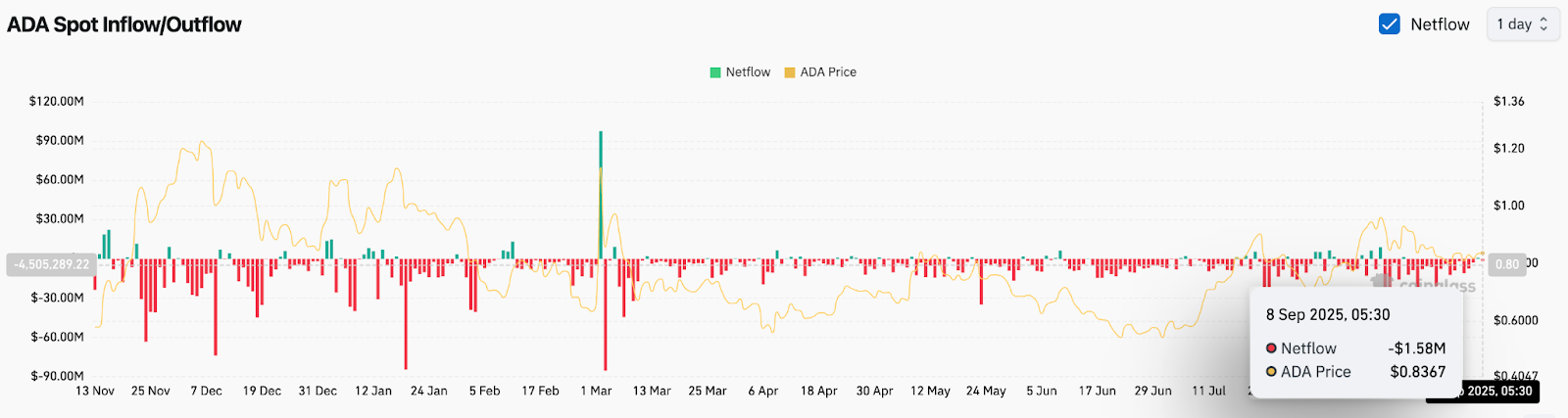

Exchange netflow data shows ADA recorded a $1.58 million outflow on September 8, reflecting continued pressure after months of negative flows. While smaller than previous spikes, the persistent outflow trend suggests investors are cautious in deploying fresh capital.

Active participation remains below summer levels, with subdued spot demand keeping rallies shallow. This divergence between price stability and weak flows underlines why Cardano price volatility could expand sharply once conviction returns. Analysts warn that without stronger inflows, upside attempts may lack follow-through.

Development Upgrade Sparks Optimism

Fundamentally, Cardano is gaining attention after Charles Hoskinson revealed a 24/7 global development operation to accelerate the LEIOS upgrade. The “Follow the Sun” model, where teams across time zones push continuous updates, has been described as a fast-track to one of Cardano’s most important technical milestones.

The news injects fresh optimism into the broader narrative. Market participants argue that protocol upgrades often act as sentiment drivers, reinforcing investor confidence in long-term adoption. Combined with ADA’s compressed chart structure, this catalyst could provide momentum if technical resistance gives way.

Related: Dogecoin (DOGE) Price Prediction: Rising ETF Odds Spark Bullish Momentum

Technical Outlook For Cardano Price

Cardano price today remains rangebound but primed for a directional move. On the upside, clearing $0.840 would target $0.865 and $0.880, with Fibonacci extensions opening the path toward $0.920. On the downside, failure to hold $0.829 exposes $0.815, followed by $0.780 if selling pressure accelerates.

The balance between bullish wedge structure, weak on-chain flows, and fresh development catalysts leaves ADA at a critical juncture. Traders are positioning around the $0.84 breakout zone, where near-term trajectory will be decided.

Outlook: Will Cardano Go Up?

Cardano’s near-term path hinges on whether buyers can force a clean breakout above $0.84. Analysts remain cautiously optimistic, pointing to bullish wedge compression and developer-driven sentiment as key positives.

If ADA secures a close above $0.84, upside targets toward $0.88 and $0.92 could come into play quickly. Failure to break higher may result in continued consolidation, with $0.815 as the pivotal support to watch. For now, ADA remains coiled, with technical and fundamental factors setting the stage for a decisive move.

Related: Ethereum (ETH) Price Prediction for September 9

Forecast Table: Cardano (ADA) Price Levels

| Level | Support/Resistance | Indicator Alignment |

| $0.920 | Major resistance | Fibonacci 0.382 extension |

| $0.880 | Resistance | Supply cluster |

| $0.865 | Resistance | Trendline + short-term target |

| $0.840 | Key breakout level | EMA cluster + wedge |

| $0.829 | Support | 200 EMA |

| $0.815 | Support | Recent accumulation |

| $0.780 | Major support | Broad base level |

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.