- ADA’s value has dropped by over 10% in the last week.

- Coin accumulation has lost momentum on the daily chart.

- Investors have preferred to remove liquidity from the ADA market.

Cardano (ADA) has trended downward since the year began, shedding 11% of its value in the last seven days, according to data from CoinMarketCap.

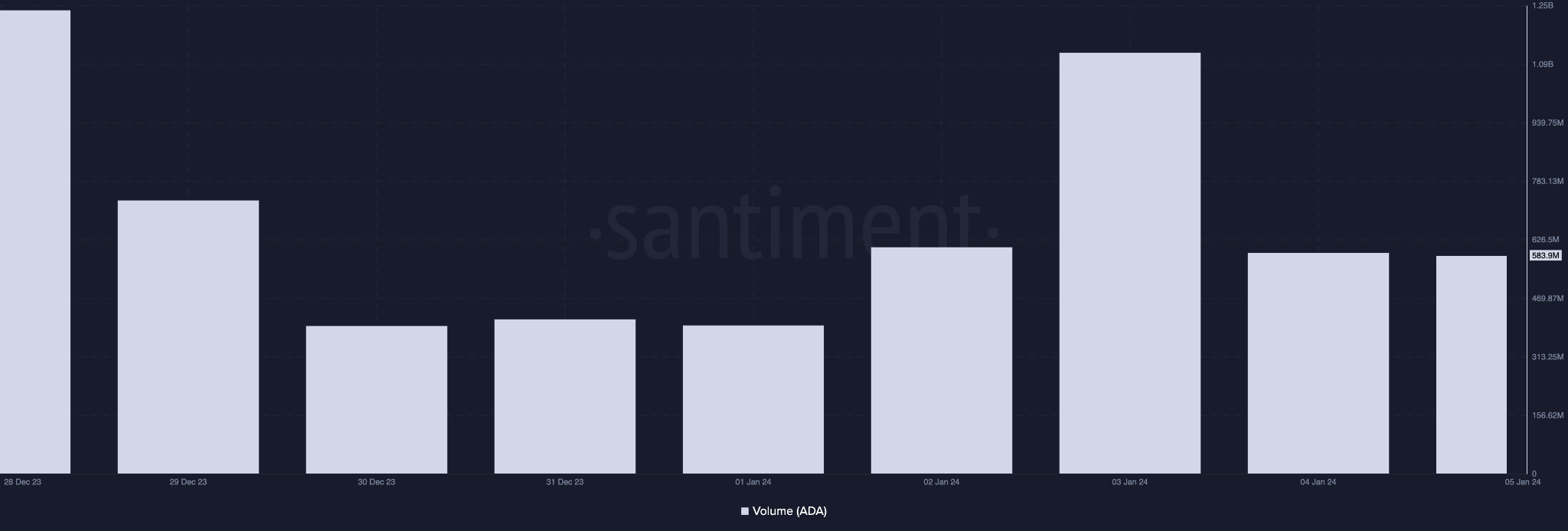

Due to low price action, daily trading volume has also plummeted significantly. Data from Santiment showed that ADA’s daily trading volume has fallen by 52% in the last week. For context, on December 29, the coin’s trading volume totaled $1.24 billion. Whereas, as of January 4, it closed the day with a trading volume of $591 million.

Cardano Trading Volume (Source: Santiment)

Sell-off Activity Rallies

The decline in ADA’s price in the last week is due to the decline in accumulation amid a rise in coin sell-off. An assessment of its price movement on a daily chart showed that market participants have favored coin distribution since the beginning of the year.

ADA/USD 24-Hour Chart (Source: TradingView)

For example, readings from ADA’s Parabolic SAR (Stop and Reverse) indicator showed the dotted lines that make up the indicator resting above the coin’s price at press time. It has been positioned in this manner since January 3.

The Parabolic SAR indicator is used to identify potential trend direction and reversals. When its dotted lines hang above an asset’s price, it means that the market is in a downtrend. Many traders interpret it as the time to exit long positions or initiate short positions.

Confirming the rise in selling pressure, ADA’s key momentum indicators declined at press time. Its Relative Strength Index (RSI) was 45.45. Likewise, its On-Balance-Volume (OBV) was 44.63 billion, witnessing a 1% decrease since the year began.

At these values, these indicators showed ADA buying momentum has dwindled. Poised to cross below its center line, the coin’s Chaikin Money Flow (CMF) rested on the zero line. A CMF value below this line is a sign of weakness in the market as it suggests capital outflow, known to result in a price decline.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.