- Cardano (ADA) has climbed to the top position in social and market activities.

- The rise of Cardano in social ranking reflects the extent of its community’s engagement.

- ADA’s social engagement metrics rose by 71.4% in 24 hours.

Cardano (ADA) has climbed to the top position in social and market activities, among other altcoins. This new metric was delivered by LunarCrush, the social market intelligence platform, using a self-developed “Altrank” algorithm.

The LunarCrush Altrank algorithm tracks a cryptocurrency’s community traction across social networks. It also measures a crypto’s market relevance compared to other cryptocurrencies on the platform.

The rise of Cardano in social ranking reflects the extent of its community’s engagement. It suggests a significant level of loyalty from participants in the Cardano network. Despite the token’s recent challenges, Cardano’s community of users remains resolute. They appear optimistic about a brighter future for the altcoin.

According to data from LunarCrush, ADA’s social engagement metrics rose by 71.4% in 24 hours. That reflects a surge in social interaction across multiple platforms by community members. The increased social activity coincides with a brief recovery of ADA’s price. ADA fell by 39.07% in the past week with the rest of the crypto market. However, a bounce from a local low saw the price climb by about 20.1%. ADA traded at $0.2767 at the time of writing.

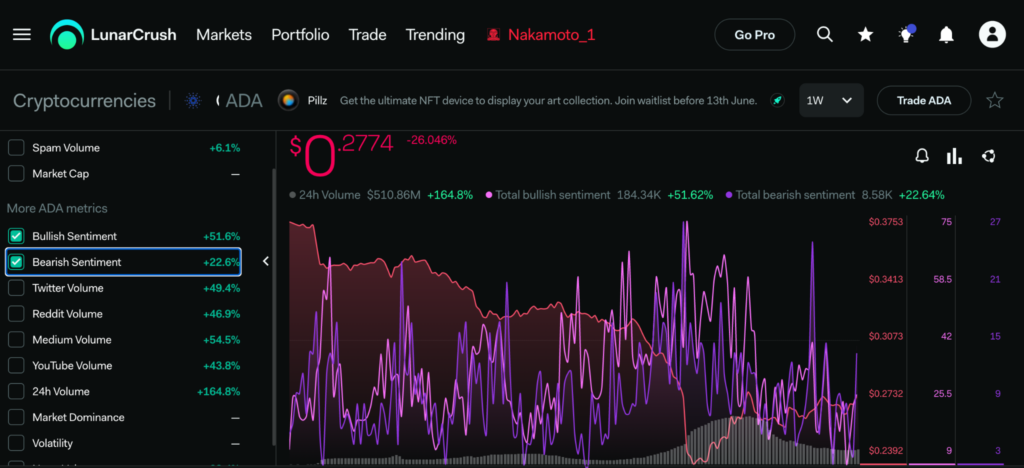

ADA’s recent recovery appears to have changed the price sentiments. Data from LunarCrush further reveals that ADA’s bullish sentiment has suppressed its bearish perception. At the time of this report, ADA’s bullish sentiment was 51.6%, while the bearish sentiment was 22.6%. That reflects an improved optimism about ADA’s price action by users in the short term.

Adding to Cardano’s ongoing social buzz, its founder, Charles Hoskinson, has opposed the SEC’s claim that ADA is a security. The SEC listed ADA among several other crypto tokens as part of its recent lawsuit against Coinbase. The regulator claimed that Coinbase offered and sold investment contracts for ADA, SOL, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, and NEXO. Therefore, it considered them to be securities.

Hoskinson stated that the project did the ADA financing in Japan, no ADA was sold, only vouchers. Marketing was in Japanese, priced in Yen and Bitcoin. Users later converted the vouchers into ADA in an AirDrop in 2017.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.