- Cardano price today holds $0.63 support as bulls defend the long-term ascending trendline.

- On-chain flows show selling pressure easing, with outflows slowing after weeks of heavy exits.

- Charles Hoskinson shifts focus from Ethereum rivalry to privacy innovation with the Midnight blockchain.

Cardano price today trades near $0.63, holding firm at the base of its multi-month ascending trendline. After slipping to $0.62, ADA has rebounded modestly, signaling that bulls are attempting to prevent a deeper breakdown toward the $0.58 and $0.55 zones.

The structure on the daily chart shows Cardano pressing against its long-term support line while staying well below key moving averages — the 20-day EMA at $0.733, 50-day at $0.785, 100-day at $0.788, and 200-day at $0.766. This compression within the descending triangle highlights an inflection point where buyers must reclaim $0.70 to flip near-term momentum.

ADA Price Finds Strength At Key Trendline

The broader pattern suggests Cardano is nearing exhaustion after an extended sell-off. The RSI has dropped to 34, its lowest since August, signaling oversold conditions and possible recovery attempts.

Momentum remains weak, but a sustained close above $0.65 could trigger a short squeeze toward $0.70–$0.73, where EMA resistance converges. Below $0.60, the next major liquidity pool sits near $0.55, which has historically acted as a rebound zone.

Despite muted technicals, ADA’s long-term ascending base structure — intact since early 2024 — remains a crucial bullish element. As long as the price holds this rising support, the macro uptrend stays valid.

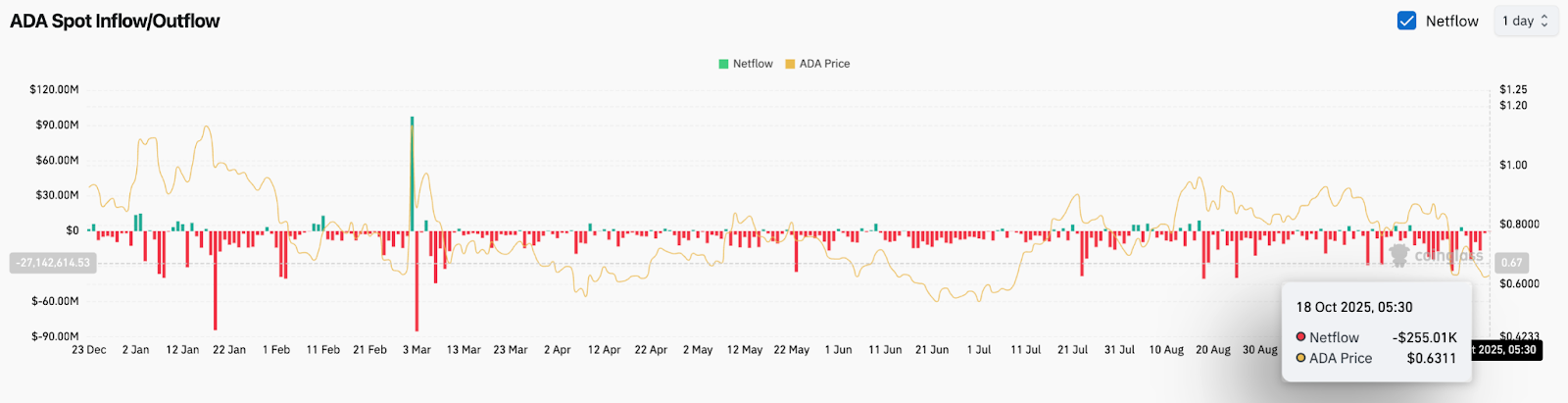

Outflows Ease As Buyers Regain Confidence

On-chain data from Coinglass shows that ADA recorded minimal outflows over the past two days, marking a clear slowdown after heavy selling earlier this month. On October 18, net outflows stood at just $255,000, a fraction of previous weeks’ averages.

This shift suggests that the market is stabilizing, with traders choosing to hold rather than exit positions. It reflects a change in sentiment — from panic selling to cautious accumulation — reinforcing the idea that Cardano price action could soon find footing if the broader market steadies.

Hoskinson Shifts Focus Beyond Ethereum Rivalry

In a recent interview, Cardano founder Charles Hoskinson dismissed the outdated “Ethereum killer” label, arguing that the next altcoin cycle will be led by innovation rather than rivalry. Hoskinson emphasized that projects addressing real-world issues — particularly privacy, scalability, and interoperability — will define the next growth wave.

He pointed to Midnight, Cardano’s zero-knowledge privacy blockchain, as a central piece of this evolution. Designed to combine confidentiality with compliance, Midnight aims to allow businesses and developers to build decentralized applications that protect data while staying transparent to regulators.

Hoskinson believes this approach positions Cardano for the coming privacy-driven altcoin rally, distancing it from the competitive narratives of past cycles.

Market analyst Emilio Bojan commented that “ADA momentum is back, and buyers are pushing hard,” highlighting growing accumulation near long-term support. He expects an early-stage revival if ADA breaks above $0.90, which could open the door to $1.10 in the weeks ahead.

Technical Outlook For Cardano Price

- Upside targets: $0.70, $0.73, and $0.90, followed by $1.10 if ADA confirms a breakout.

- Downside risks: $0.60 and $0.55 remain key support zones; a breakdown below $0.55 could expose $0.50.

- Indicators: RSI at 34 signals short-term exhaustion; EMAs above price imply resistance until ADA reclaims $0.70.

Outlook. Will Cardano Go Up?

Cardano’s ability to hold its ascending trendline while outflows ease adds early signs of stability. A rebound above $0.65–$0.70 could attract short-term buyers, but failure to close above the EMA cluster would keep the broader structure neutral-to-bearish.

With Hoskinson steering the narrative toward privacy innovation and market data showing sellers retreating, sentiment is gradually improving. For now, ADA sits at a pivotal crossroads — steady above $0.60, but still needing a clear breakout to confirm the start of a sustainable rally.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.