- Cardano price today trades at $0.77, holding above the $0.76 floor after rejection from the $0.90–$0.92 Fibonacci cluster.

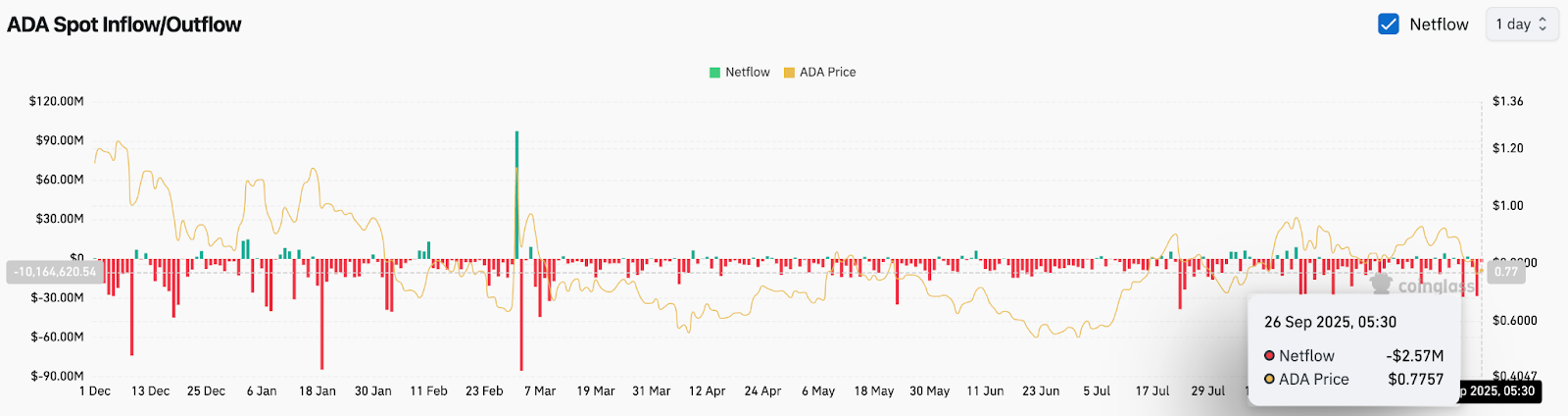

- $2.57M in net outflows highlight cautious positioning, with weak inflows keeping ADA near its lowest in a month.

- Analysts remain split on long-term targets, with some projecting a $10 cycle rally while skeptics cite weak adoption.

Cardano price today is trading near $0.77 after sliding below the $0.80 support zone earlier this week. The rejection from the $0.90–$0.92 Fibonacci cluster triggered a selloff that pulled ADA toward its lowest levels in over a month. Traders are now watching whether buyers can defend the $0.76–$0.77 floor or if downside momentum will extend toward deeper retracement zones.

Cardano Price Struggles Below Key EMAs

The 4-hour chart highlights ADA trapped under its 20, 50, 100, and 200 EMA cluster, which is now stacked between $0.83 and $0.85. The breakdown below this supply zone shifted momentum firmly in favor of sellers. Immediate resistance remains at $0.80, while stronger ceilings align at $0.83 and $0.84.

Related: Ethereum Price Prediction: Analysts Warn of Whale Selling as ETH Tests $4K

The RSI sits near 34, hovering close to oversold territory but not yet flashing a reversal signal. Momentum remains weak, and unless ADA closes back above $0.80, short-term bias stays bearish. Fibonacci retracement levels place downside risks toward $0.74 and $0.70 if $0.76 fails to hold.

On-Chain Flows Show Net Outflows

Coinglass data shows a $2.57 million net outflow on September 26, underscoring the cautious positioning among traders. While net outflows typically suggest accumulation, the absence of strong inflows highlights a lack of conviction. Futures open interest has also cooled, reflecting defensive positioning rather than aggressive bullish bets.

For sustained recovery, analysts point to the need for consistent positive flows above $10 million, which historically mark cycle-driven rallies. Without such confirmation, ADA’s price action risks prolonged consolidation near current levels.

Analysts Debate Long-Term Cycle Potential

Market sentiment remains divided. A viral post from Minswap’s intern suggested that ADA could “easily” hit $10, pointing to historical cycle pumps of 6,000% and 3,000% in 2018 and 2021. The projection argues for a potential 1,500% rally from current levels, aligning with long-term cycle patterns.

Related: XRP Price Prediction: Futures Data Highlights Cautious Positioning

Skeptics argue that while Cardano has shown explosive growth in past cycles, current on-chain activity and institutional flows remain subdued. They highlight that without ecosystem expansion or new adoption catalysts, ADA may struggle to replicate previous percentage gains. Still, historical cycle analysis remains a strong narrative among long-term holders who see ADA as undervalued below $1.

Technical Outlook For Cardano Price

Cardano price prediction in the near term remains shaped by the $0.76–$0.80 range.

- Upside levels: $0.80 as first hurdle, followed by $0.83 and $0.90. A close above $0.92 would open the door toward $0.97.

- Downside levels: $0.76 as immediate support, with $0.74 and $0.70 as deeper risk zones. Long-term cycle defense sits at $0.62.

The broader structure remains bearish in the short term, but historical cycle comparisons suggest long-term upside potential remains intact if macro conditions stabilize.

Outlook: Will Cardano Go Up?

The outlook for Cardano depends on whether buyers can reclaim lost ground above $0.80 before sellers extend control. On-chain data shows mild accumulation, but conviction remains weak compared to prior cycle bottoms.

In the near term, ADA risks retesting $0.74 if it fails to hold the $0.76 floor. A rebound above $0.83 would shift sentiment toward recovery and open the door for a retest of the $0.90 zone.

Related: Solana Price Prediction: SOL Struggles at $196 as Futures Interest Drops

Long-term narratives, including cycle-based projections of a $10 ADA, remain alive but hinge on whether adoption and liquidity inflows align with historical precedents. For now, ADA remains at a pivotal juncture where technicals lean bearish but broader cycle patterns keep optimism alive for patient investors.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.