- ADA remains capped under key EMAs, signaling continued bearish pressure in the short term.

- Rising open interest hints at higher volatility despite weak spot performance in ADA.

- December inflows indicate early accumulation, showing renewed investor interest near $0.44.

Cardano continues to trade in a vulnerable position as price action remains trapped below major moving averages and broader sentiment stays cautious. The asset has struggled to gain traction for several weeks, even though it recently bounced from its November low.

Many traders now watch ADA closely because rising derivatives activity, renewed inflows, and growing volatility hint at an upcoming decisive move. The market wants clarity after weeks of compression, and Cardano sits near levels that may determine its next trend.

Price Retains a Bearish Structure Despite Short-Term Rebound

ADA remains stuck in a clear downtrend on the 4-hour chart, where the 50-EMA, 100-EMA, and 200-EMA continue to cap every attempt to recover. Moreover, repeated rejections at these levels show strong overhead supply. The price still forms lower highs and lower lows, which signals ongoing bearish pressure.

Cardano trades near the $0.44 area after a brief recovery from $0.37. However, the structure remains fragile. The $0.4170 to $0.4190 zone acts as the first important support. Losing this range exposes $0.4050 and then the major $0.3705 demand level. A breakdown below $0.3705 would confirm continued weakness.

On the upside, price reacts around the 0.236 Fibonacci level near $0.4468. A clean break above this level is required for any shift in short-term sentiment.

Related: XRP Price Prediction: XRP Price Holds Key Support as Market Sees…

Additionally, the heavy resistance band between $0.4700 and $0.4920 holds the EMA cluster and the upper Donchian level. The next resistance sits at $0.4940 and then $0.5320. ADA stays in a bearish trend as long as it trades under the 200-EMA.

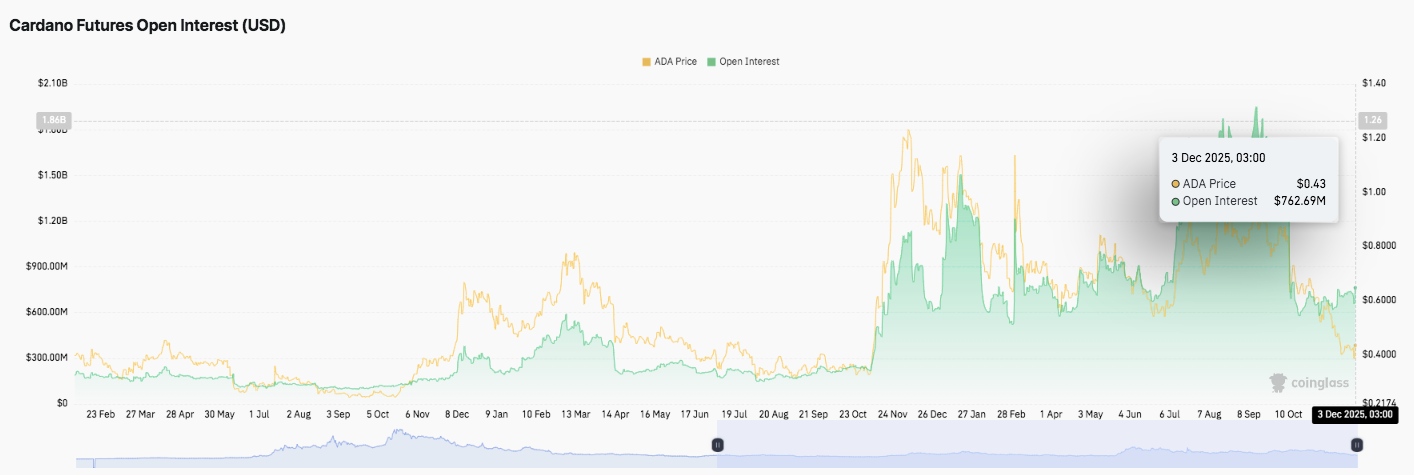

Open Interest Climbs as Traders Position for Higher Volatility

Open interest has risen steadily from late October into December. It climbed from around $400 million to more than $760 million. This increase came during a period when ADA moved lower toward $0.43.

Consequently, the divergence shows heavy leveraged positioning despite weak spot performance. Traders appear to expect a larger swing as liquidity returns.

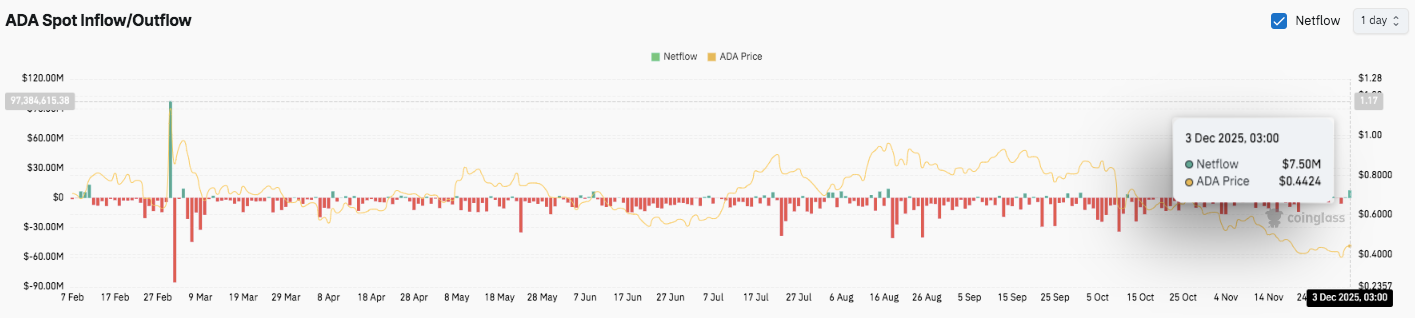

Inflows Suggest Accumulation Interest Is Returning

Spot flows remained negative through most of the year as outflows dominated the trend. Besides a few short spikes, demand stayed weak.

However, December 3 recorded a $7.5 million inflow. This shift suggests early accumulation near current levels. Moreover, it signals renewed interest even as the price struggles.

Technical Outlook for Cardano (ADA) Price

Key levels remain clearly defined as Cardano enters a critical phase on the charts.

Upside levels sit at $0.4468, $0.4700, and $0.4920 as near-term hurdles. A breakout above this zone could extend gains toward $0.4940 and $0.5320, marking the first meaningful shift in medium-term momentum.

Related: Bitcoin Price Prediction: BTC Stabilizes Above Support as Open Interest…

Downside levels sit at $0.4170, followed by $0.4050, with the major demand zone anchored at $0.3705. The 200-EMA near $0.49 remains the key ceiling to flip for any broader bullish case.

The technical picture shows ADA compressing beneath a cluster of major EMAs, forming a tight structure where each rebound faces immediate pressure. This setup mirrors prior phases where volatility expansion followed prolonged compression, suggesting that ADA sits near an inflection point.

Will Cardano Reclaim Its Trend?

ADA’s price prediction for the coming sessions hinges on whether buyers can defend the $0.4170–$0.4190 region while building enough momentum to challenge the $0.4468 threshold.

Holding above short-term support strengthens the recovery attempt, while a decisive move above $0.4700–$0.4920 opens the path toward a deeper retracement of the broader downtrend.

Historical behavior shows ADA often accelerates once it reclaims its 200-EMA, making the $0.49–$0.50 area the crucial battleground. Stronger inflows and rising open interest support the case for a larger move if buyers maintain pressure.

Failure to defend support at $0.4170, however, risks a retest of $0.4050, and losing that floor exposes ADA to $0.3705, the major macro low that has anchored demand for months. A breakdown there would confirm continuation of the long-term bearish trend.

Related: Ethereum Price Prediction: Triangle Breakout Attempts As Flows And…

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.