- ADA consolidates near $0.823, holding $0.80 support amid cautious trader sentiment.

- Break above $0.842 could target $0.878 and $0.906, signaling bullish momentum ahead.

- Institutional adoption and ETF inclusion may boost liquidity and trigger short-term rallies.

Cardano (ADA) continues to navigate a period of consolidation as it trades near $0.823. After a pullback from recent highs, ADA’s short-term outlook reflects caution among traders awaiting confirmation of its next major move.

Market data shows that the cryptocurrency has entered a tightening range between $0.805 and $0.842, signaling indecision but also the potential for a rebound if buying momentum strengthens near current levels.

Technical Structure and Key Levels

The 4-hour chart indicates ADA remains below its 20, 50, and 100-period exponential moving averages (EMAs), pointing to short-term bearish pressure. Immediate resistance stands between $0.840 and $0.842, a zone that aligns with the EMA-100 and a prior rejection area. Should ADA break above this region, it could advance toward $0.878 and $0.906 the next Fibonacci targets.

On the downside, the $0.805–$0.810 support zone remains critical, supported by the 2.618 Fibonacci level. A sustained decline below $0.783 could expose ADA to a retest near $0.754, where the 4.236 extension lies. However, buyers appear to be defending the $0.80 range, suggesting potential accumulation before another attempt higher.

Futures and Market Sentiment

Futures market data highlights growing speculation around ADA. Open interest has surged to $1.57 billion as of October 8, marking a significant rise from $300 million in early 2024. Historically, ADA’s price has shown a close correlation with open interest levels.

Related: Ethereum Price Prediction: Jack Ma’s ETH Reserve Report Boosts Market Sentiment

Key thresholds remain at $1.2 billion for medium support and $1.8 billion as resistance, where prior liquidations occurred. Sustained levels above $1.5 billion may point to renewed bullish activity and increased investor confidence.

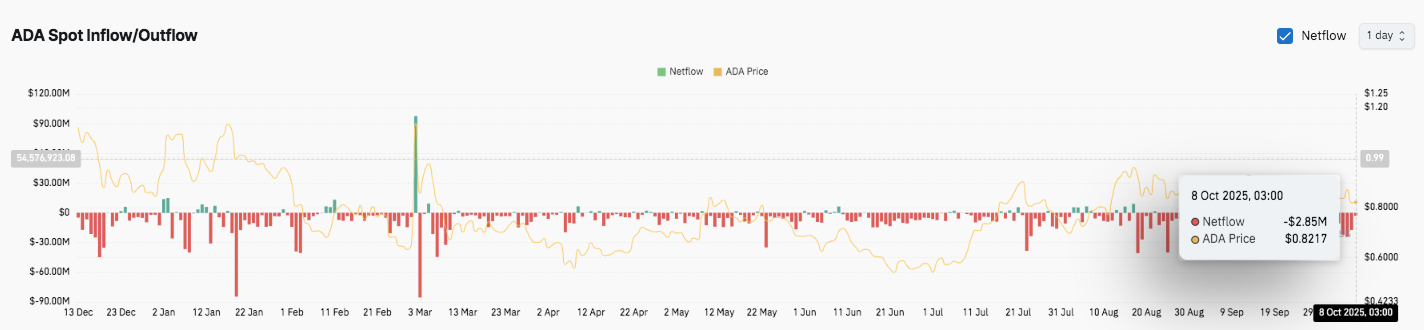

Spot inflows and outflows reinforce this mixed sentiment. Throughout 2025, ADA has seen persistent outflows, indicating profit-taking among short-term holders. October data shows a net outflow of $2.85 million, reflecting cautious sentiment following the late-August high near $0.99.

Institutional Growth and Ecosystem Expansion

Despite the technical consolidation, Cardano’s fundamentals continue to strengthen. The inclusion of ADA in the S&P Broad Crypto Index Fund and Hashdex’s decision to add ADA to its Nasdaq Crypto Index U.S. ETF mark growing institutional interest. These developments are expected to boost liquidity and visibility across traditional finance markets.

The Cardano Foundation’s 2025 roadmap further underscores this momentum. The foundation plans to allocate 220 million ADA to new governance representatives and inject 2 million ADA into its Venture Hub. Additionally, a $10 million real-world asset initiative and a 12% marketing budget increase signal its commitment to long-term ecosystem expansion.

Technical Outlook for Cardano (ADA) Price

Key levels remain well-defined as Cardano (ADA/USD) trades in a consolidation phase near $0.823 heading into mid-October.

- Upside levels: Immediate resistance stands between $0.840 and $0.842, aligning with the 100-EMA and prior rejection zone. A sustained breakout could open the path toward $0.878 (1.618 Fib extension) and $0.906 (Fib 1.0 level). If momentum strengthens, extended targets lie at $0.93 and $0.97, matching previous swing highs.

- Downside levels: Initial support sits around $0.805–$0.810, with a broader demand zone between $0.78 and $0.80. Losing this area may expose the $0.754 region (Fib 4.236 level), acting as a critical invalidation zone for the bullish setup.

The technical picture suggests ADA is compressing within a narrow range, signaling a buildup of volatility before the next directional move. The Relative Strength Index (RSI) is neutral, indicating equilibrium between buyers and sellers, while volume patterns show a gradual decline typical before breakout phases.

Will Cardano Rebound in October?

Cardano’s price outlook for October depends on how buyers react around the $0.80 support cluster. Holding this range could trigger a short-term rally toward $0.84 and $0.87, reinforcing bullish confidence. However, failure to sustain above $0.78 could confirm weakness and drive ADA toward deeper retracement zones.

Related: Monero Price Prediction: Bulls Eye $343 as Market Interest Rebounds

Additionally, the recent inclusion of ADA in the S&P Broad Crypto Index Fund and Hashdex’s Nasdaq Crypto Index ETF may enhance liquidity and investor participation. If these institutional inflows align with improving on-chain activity, ADA could stage a recovery rally in the coming weeks.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.