- Cardano price today trades at $0.78, struggling below $0.80 after rejection from the $0.82–$0.84 EMA cluster.

- $2.54M in net outflows highlight weak demand, with traders cautious as failed rallies pressure ADA support.

- Cardano Foundation unveils $50M liquidity plan to strengthen DeFi adoption, sparking debate on supply risks.

Cardano price today is trading at $0.78 after failing to reclaim the $0.80 resistance zone. The drop followed heavy selling pressure across the $0.82–$0.84 range, but buyers are trying to defend the $0.75–$0.76 support cluster. The market now weighs technical weakness against the Cardano Foundation’s $50 million liquidity roadmap.

Cardano Price Struggles At Resistance

The 4-hour chart shows ADA stuck below key Fibonacci retracement levels after sliding from its September peak. Price was rejected at the 23.6% retracement near $0.83 and now trades just under the 20-day EMA at $0.79. The 50-day EMA at $0.82 and the 100-day EMA at $0.84 form a heavy ceiling that bulls must overcome for any sustained rebound.

The Parabolic SAR flipped bearish earlier this week and continues to trail above price, reinforcing downside momentum. If ADA fails to hold $0.76, the next demand zones are clustered near $0.75 and deeper support at $0.68. Conversely, a daily close above $0.83 could trigger a push toward $0.87 and $0.90.

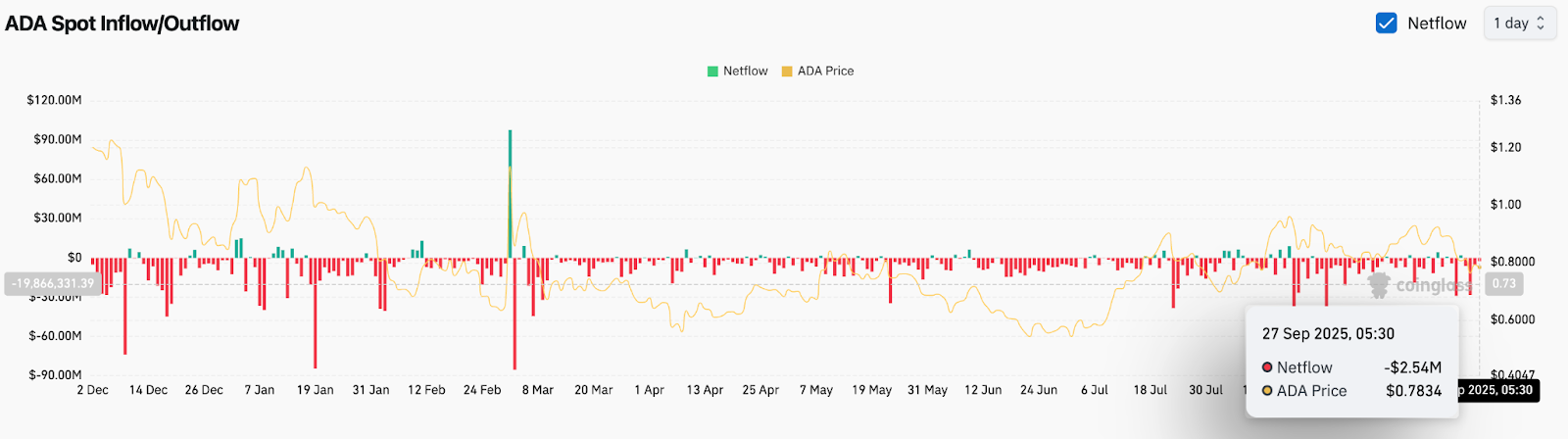

On-Chain Data Shows Persistent Outflows

Exchange flow data highlights fragile demand conditions. On September 27, Cardano recorded $2.54 million in net outflows, extending weeks of inconsistent activity. While occasional inflows have appeared, the overall trend since midyear has leaned negative, suggesting investors remain cautious.

The lack of consistent inflows undermines the case for a sharp rebound in ADA price today. Open interest has also been muted, showing that traders are reluctant to commit aggressively at current levels. Analysts warn that unless outflows reverse, ADA could remain stuck in a cycle of failed rallies and repeated retests of support.

Foundation Liquidity Plan Provides Tailwind

Fundamentally, optimism is building after the Cardano Foundation announced a $50 million liquidity initiative targeting stablecoins, DeFi, and real-world asset adoption. The roadmap aims to strategically deploy ADA to strengthen liquidity pools and attract developers to the ecosystem.

This plan has sparked debate in the community. Supporters argue it could boost long-term adoption and attract institutional attention, while critics worry that heavy deployment of ADA into liquidity may create short-term supply risks. Still, the announcement underscores the Foundation’s commitment to positioning Cardano as a major player in DeFi infrastructure.

Technical Outlook For Cardano Price

Cardano price prediction in the near term hinges on whether ADA can stabilize above support while absorbing Foundation-led liquidity news.

- Upside levels: $0.83, $0.87, and $0.90 if buying volume accelerates.

- Downside levels: $0.76, $0.75, and $0.68 as critical defense points.

- Trend levels: $0.84–$0.85 remains the ceiling that must break to restore bullish momentum.

Outlook: Will Cardano Go Up?

The immediate question is whether Cardano can overcome technical weakness before sentiment erodes further. On-chain flows remain bearish, but the Foundation’s $50 million plan provides a potential tailwind for long-term confidence.

As long as ADA holds $0.75, analysts see scope for recovery attempts toward $0.83–$0.90. Failure to defend that floor, however, would likely invite a deeper correction toward $0.68. For now, Cardano price action remains locked in a fragile equilibrium, with buyers looking for a catalyst to regain control.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.