- ADA’s struggle below key Fibonacci levels highlights persistent market resistance zones.

- Rising open interest above $600M reflects sustained trader speculation and confidence.

- Continuous ADA exchange outflows suggest strong long-term accumulation and staking intent.

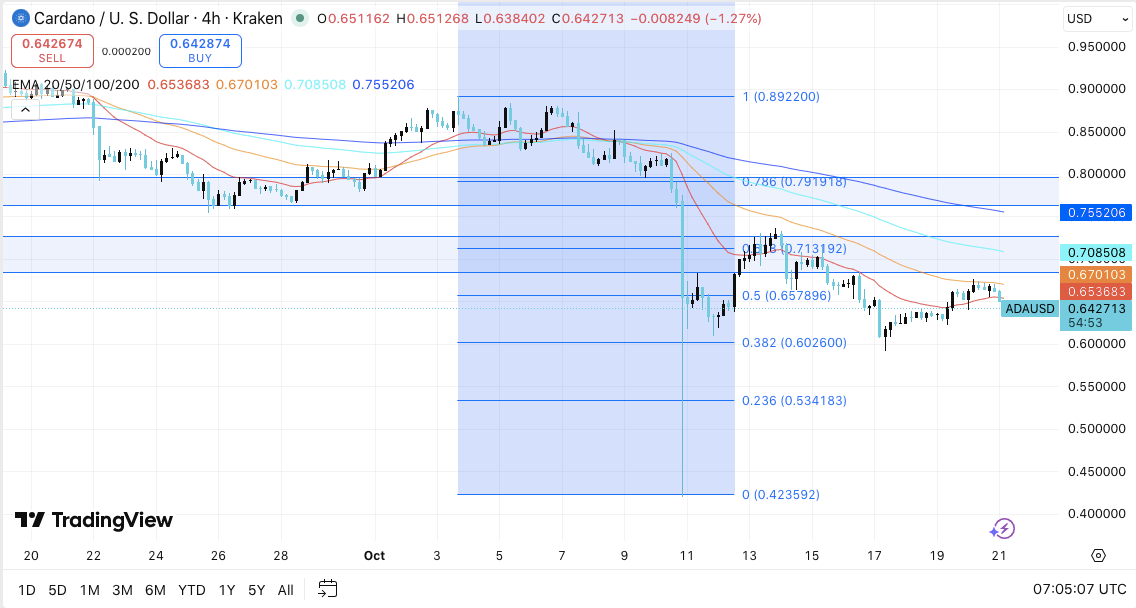

Cardano (ADA) continues to face selling pressure after failing to hold above the 0.5 Fibonacci retracement level near $0.6579. The price recently slipped to $0.6427, marking a mild decline of 1.27% over the last session. This move reflects waning momentum following ADA’s earlier rebound from the $0.60 region. Consequently, traders remain cautious as ADA struggles to build enough strength for a sustained breakout.

Key Levels Suggest Persistent Resistance

ADA’s structure remains technically confined between key Fibonacci levels. The 0.5 retracement level at $0.6579 has emerged as a strong rejection zone, while the next resistance sits at the 0.618 level around $0.7131.

If bulls reclaim this zone, the 0.786 level near $0.7911 could become the next upside target. However, beneath the current range, $0.6026 serves as immediate support, followed by deeper retracement levels at $0.5341 and $0.4236.

Additionally, the moving averages reinforce this mixed structure. The 20-day and 50-day EMAs are flattening around $0.65 and $0.67, signaling short-term indecision.

Related: Chainlink Price Prediction: Will Fed Recognition And Oracle Strength Be Enough To Halt The Slide?

Meanwhile, the 100-day and 200-day EMAs, positioned above $0.70, confirm that ADA remains within a mid-term downtrend. For a meaningful reversal, traders are watching for a daily close above $0.71, aligning with both the 0.618 Fibonacci level and the 100-EMA zone.

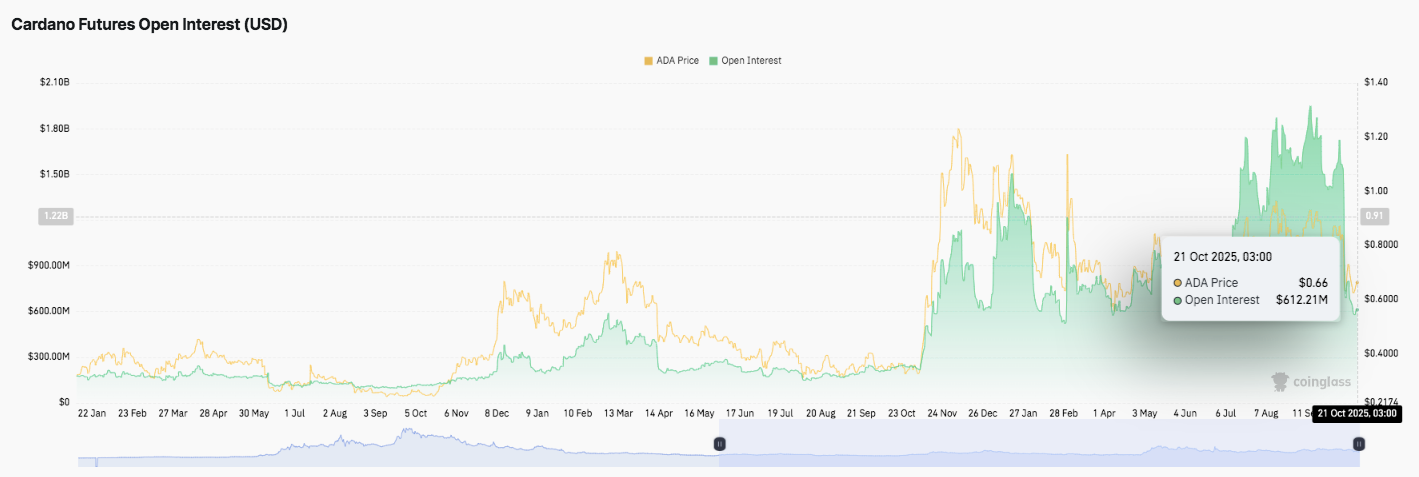

Open Interest Signals Active Speculation

Despite subdued price action, futures open interest has shown an impressive rebound since mid-2024. From below $300 million earlier in the year, ADA’s open interest has surged beyond $600 million as of October 21, 2025. This increase indicates growing trader participation and liquidity.

Moreover, open interest spikes have historically coincided with price rallies, showing leveraged long positions entering during bullish periods. Hence, sustained activity above $600 million reflects continued speculative confidence, even as spot prices remain range-bound.

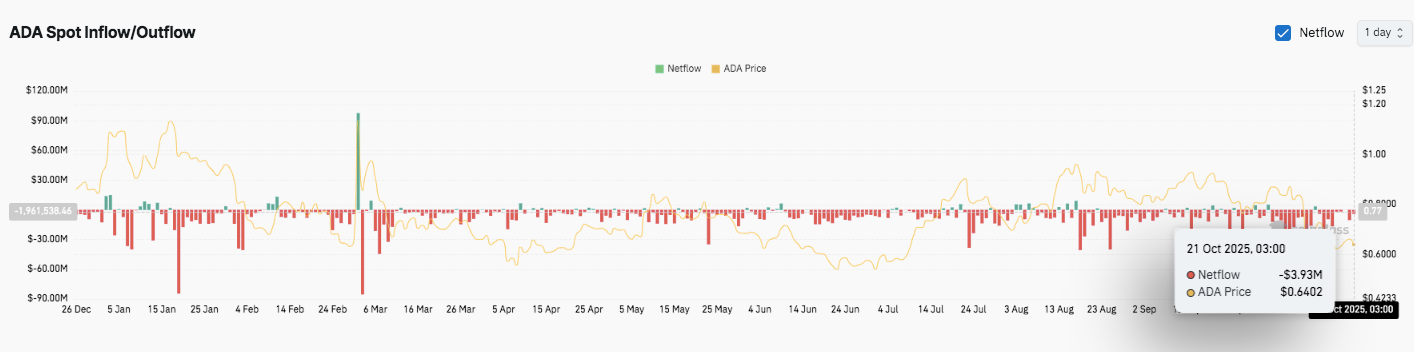

Exchange Outflows Indicate Long-Term Accumulation

Exchange flow data presents a different picture. Throughout 2025, ADA has recorded consistent outflows, signaling reduced short-term selling pressure and potential accumulation behavior. On October 21, net outflows of $3.93 million accompanied ADA’s price dip to $0.64. This movement suggests that holders are transferring tokens off exchanges, possibly for long-term storage or staking.

Technical Outlook for Cardano Price

Key levels remain well-defined as ADA trades within a tightening range.

- Upside levels: $0.6579 (0.5 Fib) and $0.7131 (0.618 Fib) act as immediate hurdles. A breakout beyond these could open targets toward $0.7911 (0.786 Fib) and $0.84.

- Downside levels: $0.6026 (0.382 Fib) is the first major support, followed by $0.5341 and $0.4236. A drop below $0.60 could expose deeper corrective levels before buyers re-emerge.

- Resistance ceiling: The 100-day EMA near $0.7085 aligns closely with the 0.618 Fibonacci level, forming a critical pivot for medium-term bullish momentum.

The technical structure shows ADA compressing within a corrective range, with moving averages flattening and momentum indicators signaling indecision. A decisive breakout above $0.71 could trigger a fresh impulse wave targeting the $0.79–$0.84 zone. Conversely, failure to reclaim $0.65–$0.67 may lead to renewed selling toward $0.60.

Can Cardano Reclaim Bullish Strength?

Cardano’s short-term direction depends on whether buyers can defend the $0.60 region while absorbing profit-taking pressure. Sustained open interest above $600 million shows active speculative participation, suggesting traders anticipate a directional move soon.

Related: Bittensor Price Prediction: TAO Targets $500 as Bullish Momentum Builds

If volume expands alongside a breakout above $0.71, ADA could signal the start of a mid-term recovery. However, consistent exchange outflows indicate investors are favoring long-term holding strategies rather than aggressive trading. Hence, ADA remains in a pivotal zone where conviction and momentum will determine whether October ends with a bullish reversal or continued range-bound movement.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.