- Cardano trades below key thresholds, keeping sellers in control and limiting upside momentum.

- Immediate support lies at $0.348–$0.350, with $0.329–$0.330 at risk if it fails.

- Derivatives and spot flows show cautious sentiment, with weak inflows and persistent outflows.

Cardano continues to face short-term weakness as the 4-hour chart reflects sustained selling pressure and cautious market participation. ADA trades below key technical thresholds, while derivatives and spot flow data suggest traders remain defensive.

Although price volatility has eased, broader conditions still favor sellers rather than trend reversal. Consequently, market participants continue to monitor support resilience rather than chase upside momentum.

Bearish Structure Dominates the 4-Hour Chart

On the 4-hour timeframe, Cardano remains locked in a bearish structure defined by lower highs and limited rebound strength. Price holds below the Ichimoku cloud and the Kijun-sen, reinforcing downside bias.

Besides that, recent recoveries lack impulsive follow-through, which signals corrective behavior rather than renewed demand. Hence, sellers continue to control directional momentum.

Immediate price action centers around the $0.348 to $0.350 region, where ADA has repeatedly stabilized after sell-offs. This zone now acts as a short-term line of defense.

However, failure to hold this area would likely expose the $0.329 to $0.330 range. That level represents a major cycle low within the current Fibonacci structure. Consequently, a breakdown there could extend losses and confirm trend continuation.

Upside progress remains capped by several technical barriers. The $0.382 to $0.386 zone stands as the first meaningful resistance. This level previously supported price but now attracts selling interest.

Additionally, the $0.400 to $0.405 area continues to reject advances, marking a strong horizontal ceiling. Only a sustained close above $0.414 would shift market structure and weaken bearish control.

Related: Bitcoin Price Prediction: BTC Stuck Below 50 Day EMA as Gold Rally & Dollar…

Indicator readings also support caution. The Ichimoku cloud ahead remains flat to downward, limiting bullish expansion. Moreover, the Chaikin Money Flow hovers slightly above zero, reflecting mild inflows without clear accumulation strength. Significantly, this setup suggests capital rotation rather than conviction buying.

Derivatives and Spot Flows Reflect Cautious Sentiment

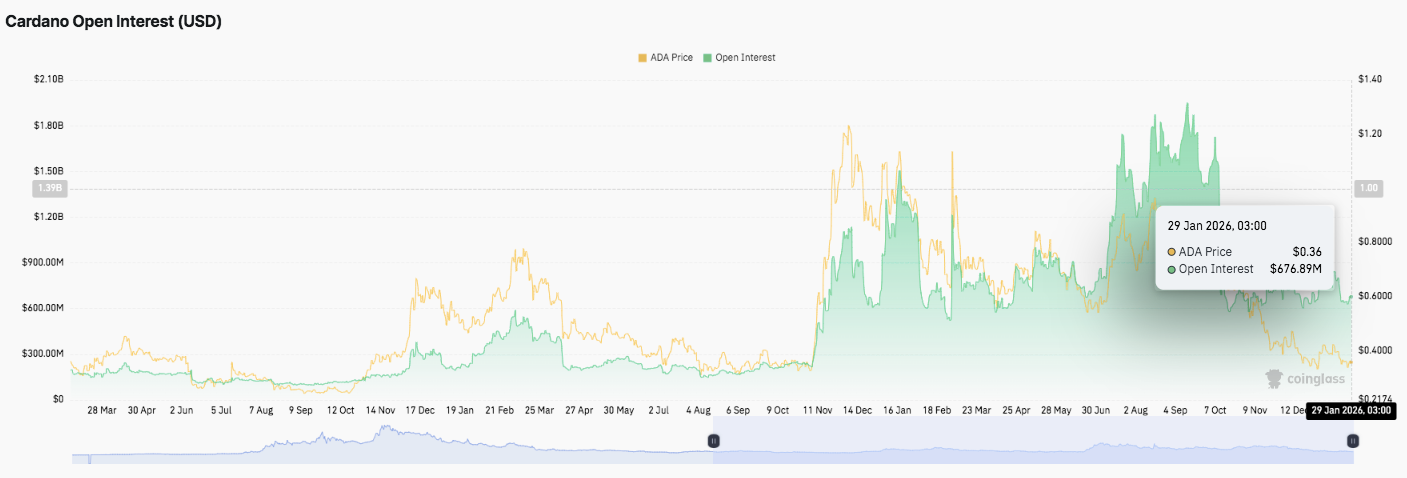

Derivatives data adds to the cautious outlook. Open interest shows repeated cycles of expansion followed by sharp contractions. Peaks above $1.5 billion aligned with strong rallies but quickly unwound. Recently, open interest trended lower despite price stabilization. This divergence suggests traders prefer reducing risk rather than adding exposure.

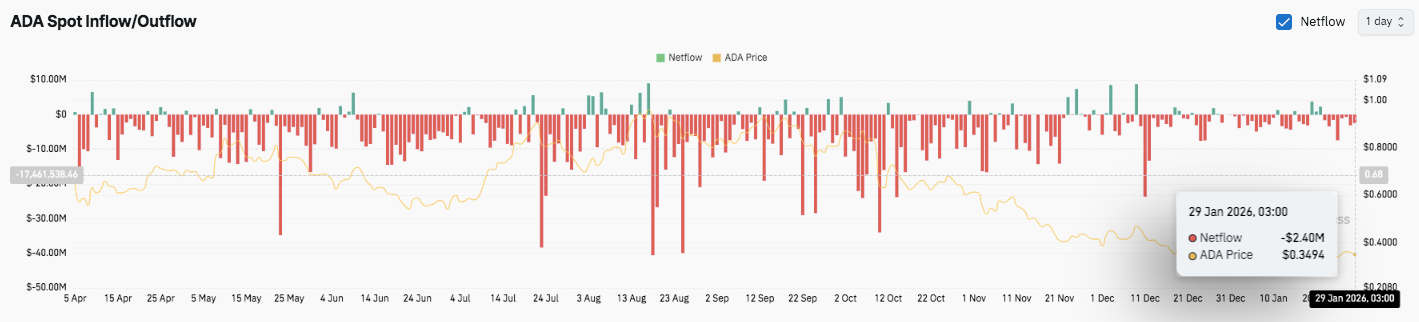

Spot flow data reinforces this view. Analysts observe consistent net outflows, indicating persistent distribution. Although selling pressure eased slightly into January, flows remain negative. Significantly, inflows stay too small to confirm accumulation. Therefore, demand conditions remain fragile.

Related: Shiba Inu Price Prediction: SHIB Faces Bearish Pressure Despite 1,200% Burn Rate Spike

Technical Outlook for Cardano (ADA) Price

Key levels remain clearly defined for Cardano as the market moves through the current consolidation phase.

On the upside, $0.382–$0.386 stands as the first resistance cluster, where sellers have repeatedly stepped in. A clean breakout above this zone could open the door toward $0.400–$0.405, which marks a critical horizontal ceiling. Beyond that, the $0.414–$0.437 range represents the upper resistance band, where a decisive break would signal a broader bullish structure shift.

On the downside, immediate support sits at $0.348–$0.350, a zone that has absorbed multiple sell-offs. Below that, $0.329–$0.330 remains the key downside level and cycle low. A loss of this area would likely accelerate bearish continuation.

The technical picture suggests ADA is compressing below key resistance, with rebounds lacking strong follow-through. This structure keeps volatility risks elevated in both directions.

Will Cardano go up?

ADA’s near-term direction depends on whether buyers can defend $0.348 long enough to challenge the $0.382–$0.400 resistance band. Stronger inflows and reclaiming $0.405 would shift momentum in favor of bulls.

However, failure to hold $0.348 risks exposing ADA to $0.33 and lower. For now, Cardano remains in a pivotal zone, where conviction and volume will determine the next decisive move.

Related: Solana Price Prediction: WisdomTree RWA Expansion Meets Critical Trendline Test

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.