Cardano (ADA) has regained strength above the $0.83 mark, sparking renewed optimism after a turbulent correction. The recent recovery has drawn investor attention not only to ADA’s technical structure but also to its growing derivatives market.

While the spot price consolidates within a bullish channel, exchange flows and rising open interest hint at an increasingly speculative environment. This combination is shaping ADA’s next potential move toward the $1 psychological threshold.

Support and Resistance in Focus

The $0.824 level, aligned with the 0.618 Fibonacci retracement, has proven critical in sustaining bullish momentum. Holding above this point keeps ADA within a recovery range.

Beneath this area, stronger support emerges at $0.764, reinforced by the 100-day EMA and close to the 200-day EMA near $0.770. A breakdown below these zones could expose the asset to losses around $0.704.

On the upside, immediate resistance sits at $0.91, coinciding with a previous supply zone and the 0.786 Fib retracement. A decisive breakout here would open the door to a potential retest of the $1.01 yearly high. In the short term, ADA faces resistance from clustered EMAs in the $0.83–$0.84 zone, where the price is currently consolidating.

Related: Cardano Price Prediction: ADA Faces $0.80 Hurdle As $50M Liquidity Push Sparks Debate

Open Interest and Market Participation

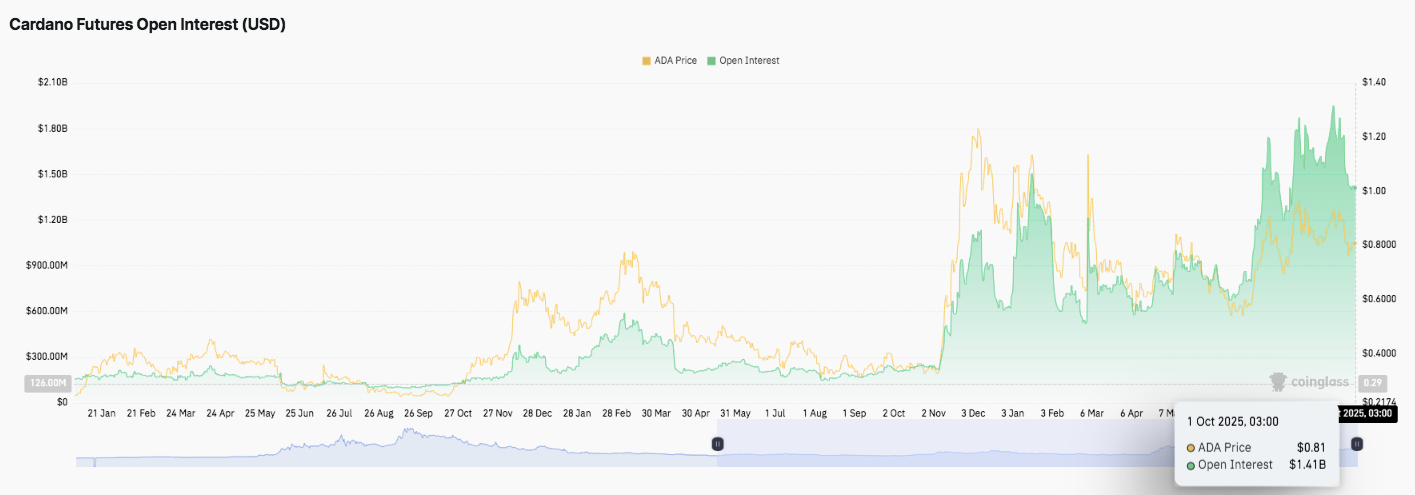

Beyond chart levels, derivatives activity provides valuable insight. Cardano’s futures open interest surged from under $300 million earlier this year to $1.41 billion by October. This steady climb reflects heightened participation and fresh long positions rather than short liquidations.

Consequently, it suggests confidence among traders anticipating higher prices. Increased leverage also signals greater volatility ahead, with investors positioning aggressively around the $0.80 support region.

Exchange Flows Point to Mixed Signals

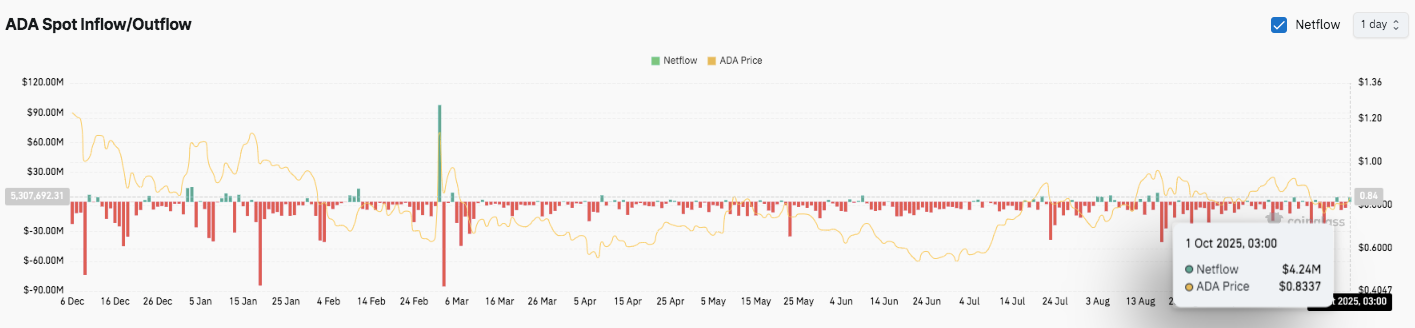

Spot inflows and outflows highlight another layer of sentiment. Since late 2024, persistent outflows have shown steady accumulation by long-term holders.

However, October 1 recorded a notable $4.24 million inflow, which may reflect profit-taking or preparation for near-term volatility. If inflows rise alongside resistance retests, ADA could face short-term selling pressure even as its broader trend remains constructive.

Technical Outlook For Cardano Price

Cardano price prediction for the short term shows consolidation within a recovery channel, with critical levels shaping the next move:

- Upside levels: $0.91 as immediate resistance, followed by $1.01 at the yearly high.

- Downside levels: $0.824 as near-term support, with $0.764 and $0.704 as deeper targets if weakness persists.

- Trendline base: The rising structure above the 100-day and 200-day EMA between $0.76–$0.77 remains the key defensive zone.

Will Cardano Push Toward $1?

The near-term outlook for ADA depends on buyers defending the $0.824 zone and overcoming clustered EMAs at $0.83–$0.84. Holding above this area would strengthen momentum toward $0.91 and eventually $1.01.

Futures markets add weight to the bullish case, with open interest climbing past $1.4 billion by October. This growth points to fresh long positioning and elevated speculative interest. However, the latest $4.24 million inflow on October 1 suggests some traders may be preparing for volatility around resistance.

Related: Cardano Price Prediction: ADA at $0.77 Support as Analysts Debate $10 Cycle Target

If Cardano price today stays firm above $0.824, analysts expect a retest of $0.91, with a breakout paving the way toward $1. On the flip side, a failure to defend $0.764 could expose ADA to $0.70, breaking the recovery structure. For now, the balance of technicals and derivatives positioning leaves Cardano at a pivotal stage, with market conviction set to determine the next trend.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.