- Cardano nears key EMAs as traders eye potential breakout above $0.75 level

- Rising open interest signals renewed speculative activity in ADA futures market

- Exchange outflows hint at investor accumulation despite ongoing market pressure

Cardano (ADA) is showing early signs of recovery after a steep correction from $0.89 to $0.42. The cryptocurrency has regained ground, trading near $0.70 as traders watch for a possible trend reversal. Despite persistent selling pressure across 2025, recent on-chain and derivatives data suggest renewed speculative interest in the asset.

Market Recovers from Deep Correction

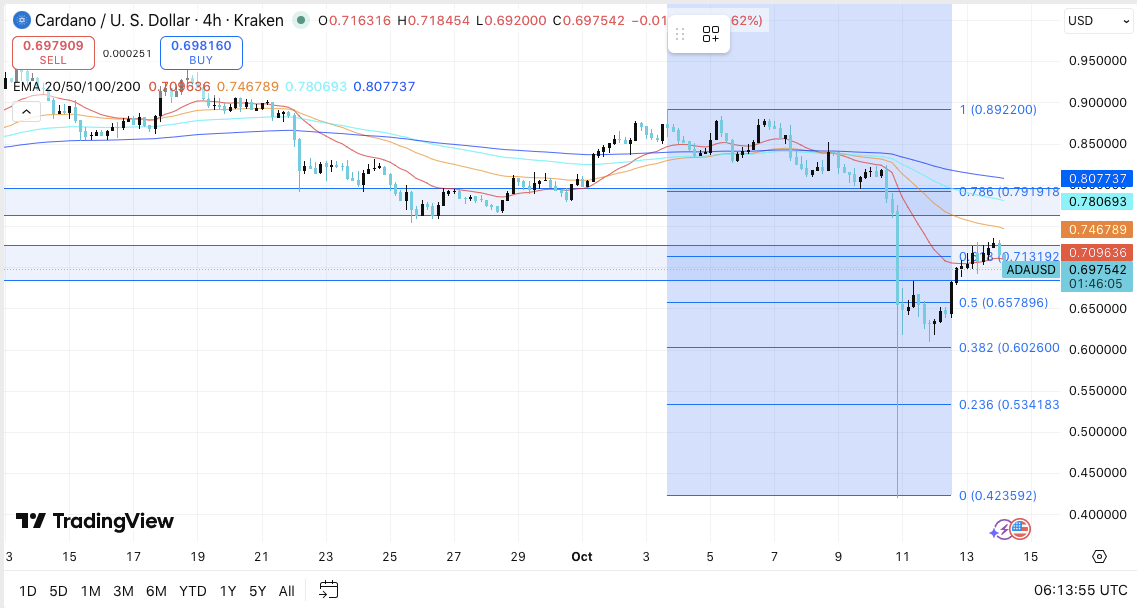

Cardano’s recent rebound began after the price tested support near $0.65, a level aligning with the 50% Fibonacci retracement zone. The token is now consolidating below key exponential moving averages (EMAs), including the 20-EMA and 50-EMA, both clustered between $0.71 and $0.75. This tight compression zone typically precedes a decisive move in either direction.

However, ADA remains beneath its 100-EMA and 200-EMA, located near $0.78 and $0.80 respectively. Reclaiming these averages will be crucial for confirming a structural reversal. A breakout above $0.75 could accelerate momentum toward the next resistance region at $0.79–$0.80. Conversely, failure to sustain above $0.65 may trigger another drop toward $0.60 or even $0.53.

Exchange Outflows Reflect Investor Caution

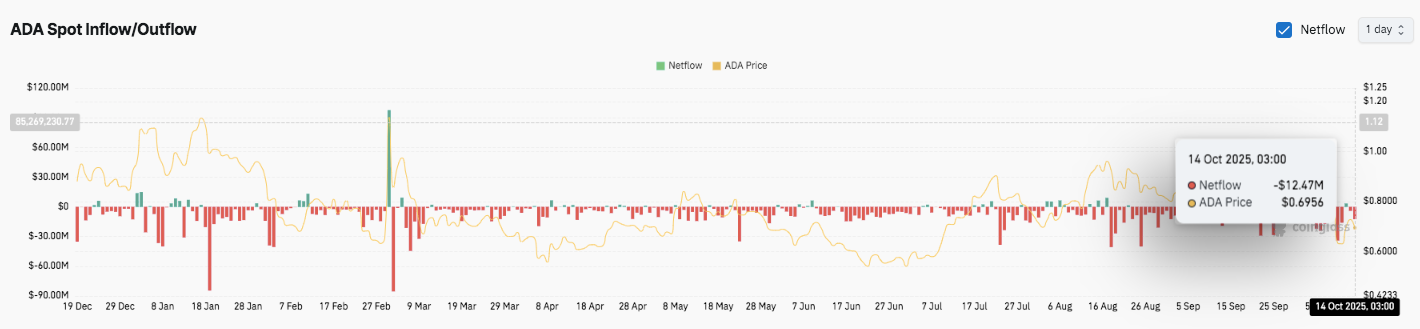

Throughout 2025, Cardano has seen more consistent outflows than inflows across exchanges, indicating cautious investor behavior. On October 14, the network recorded a net outflow of $12.47 million while ADA traded near $0.6956. This movement may imply that traders are shifting assets into self-custody wallets, either for long-term holding or as a response to weaker short-term sentiment.

Related: Ethereum Price Prediction: Bhutan Adopts Ethereum For National Digital ID

Consequently, the declining exchange balances could signal a reduced selling supply in the medium term. Historically, such conditions have preceded accumulation phases, suggesting that large holders might be positioning for a potential rebound once the broader market stabilizes.

Rising Open Interest Hints at Speculative Return

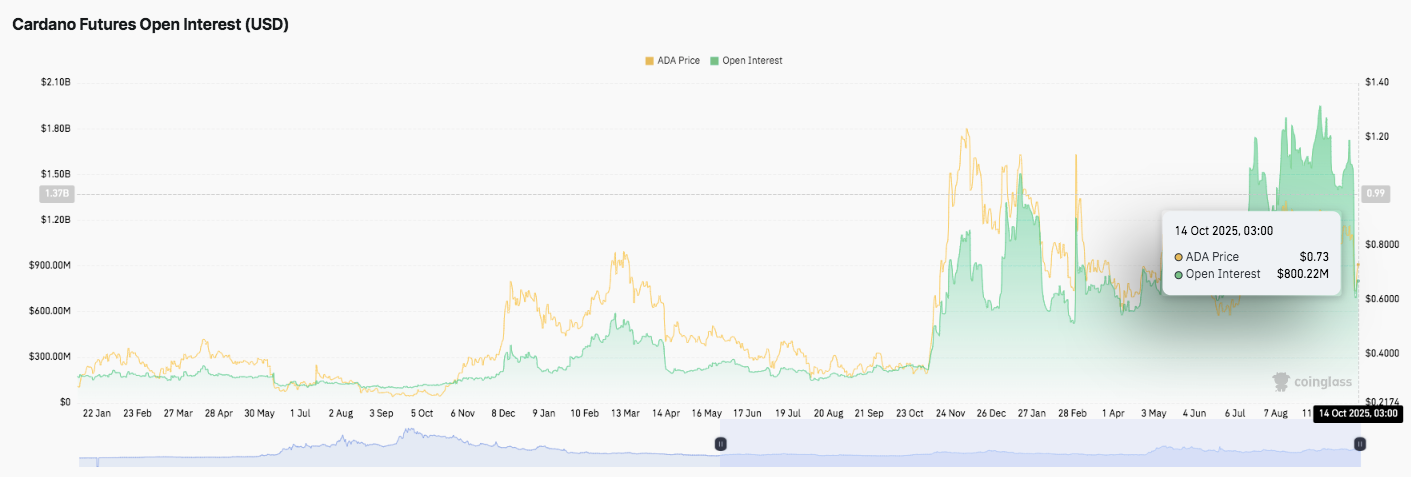

Cardano’s derivatives market also reflects changing dynamics. Open interest, which measures total futures contracts, surged to around $800 million by mid-October after months of decline. The metric had previously peaked at $1.5 billion during earlier rallies before retreating during periods of liquidation.

The rebound in open interest suggests that traders are reentering positions with higher leverage, anticipating increased volatility ahead. Moreover, the combination of growing derivatives activity and strong exchange outflows points to renewed market engagement an early signal that ADA may be preparing for its next major move.

Technical Outlook for Cardano (ADA) Price

Key levels remain clearly defined as ADA trades within a corrective recovery phase.

Upside levels: $0.713 and $0.750 act as immediate resistance barriers, followed by $0.785 and $0.800 (100-EMA and 200-EMA cluster). A sustained breakout above $0.800 could extend the rally toward $0.870 and $0.920.

Related: Bitcoin Price Prediction: BlackRock’s Fink Backs BTC As ‘Digital Gold’

Downside levels: $0.660 serves as short-term support, followed by $0.600 and $0.530. The $0.420 zone remains the ultimate demand floor if selling pressure resumes.

Resistance ceiling: The $0.800–$0.820 range marks the structural pivot. A daily close above this zone would confirm a medium-term bullish reversal and shift ADA’s market structure upward.

Technical structure: Cardano’s price is compressing between converging EMAs, forming a symmetrical triangle that signals upcoming volatility expansion. The RSI hovers near the neutral 50 mark, showing equilibrium between buyers and sellers, while volume remains subdued — often a precursor to a breakout attempt.

Will Cardano Continue Its Recovery?

The short-term trend of Cardano depends on the ability of the bulls to maintain the base of $0.65-$0.66 and close over the neckline of $0.75. Should the buyers recover their pace and on-chain inflows get more powerful, ADA may revisit $0.80-$0.87 and even move to $0.92. Nonetheless, the inability to support $0.65 can cause a slump to $0.60 or even less to prolong the consolidation period.

Related: Solana Price Prediction: SOL Price Rebounds as Open Interest Surges Past $10 Billion

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.