- ADA struggles below key EMAs, signaling sustained bearish market control.

- Futures open interest drop shows fading trader confidence and reduced leverage.

- Continuous exchange outflows highlight weak accumulation and liquidity decline.

Cardano (ADA) continues to face bearish pressure as the cryptocurrency struggles to hold above the $0.49 support zone. The asset has maintained a downward trajectory for several weeks, with sellers dominating short-term momentum.

ADA currently trades around $0.534, remaining well below key moving averages. The persistent weakness reflects a broader market slowdown, as traders exit leveraged positions and sentiment cools across altcoins.

Sustained Downtrend and Resistance Clusters

ADA has been trading below its 20, 50, 100, and 200-EMA levels, underscoring sustained bearish momentum. Each rebound attempt toward the $0.60–$0.65 range has failed, creating a consistent pattern of lower highs since early October. The Supertrend indicator remains red, confirming that sellers still control the market.

Fibonacci retracement levels from the recent swing high near $0.94 to the low around $0.49 show significant resistance at $0.66 and $0.77. These zones coincide with the EMA100 and EMA200, forming strong supply regions. For ADA to shift sentiment, bulls must reclaim these levels and establish a firm close above $0.66.

Market Sentiment and Futures Activity

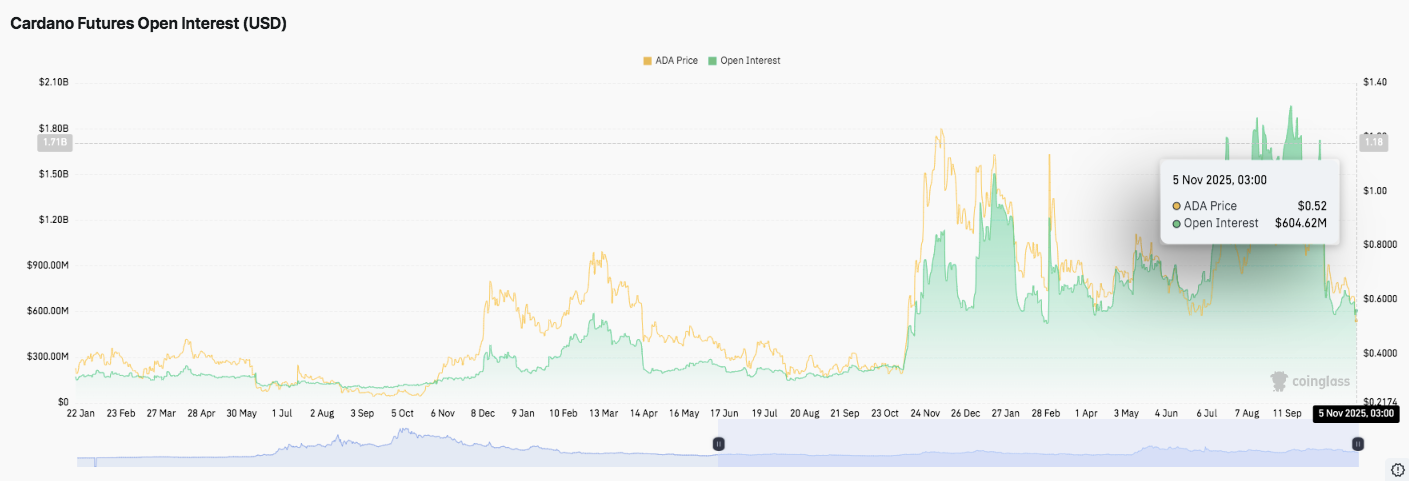

ADA’s futures open interest has declined sharply, reflecting fading enthusiasm among leveraged traders. Open interest, which peaked near $1.8 billion when prices were above $1.10, has dropped to around $604 million. This steep contraction suggests traders are closing positions instead of opening new ones. Consequently, the market appears less speculative and more cautious.

Besides, reduced leverage participation indicates that traders are waiting for confirmation of a clear bottom. A steady rise in open interest alongside higher prices would signal renewed conviction. Until that happens, ADA’s short-term rallies may remain limited.

Exchange Flows and Liquidity Trends

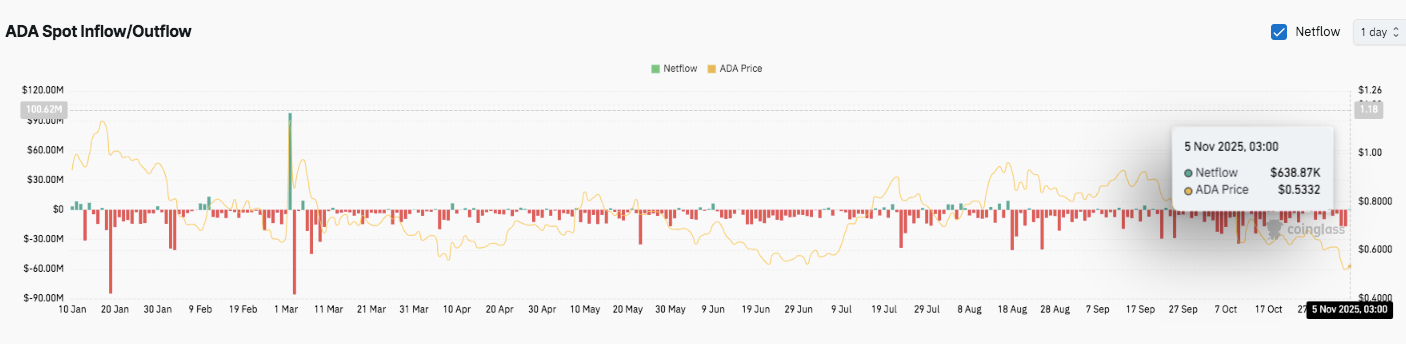

Throughout 2025, Cardano’s spot market has shown persistent outflows, a sign of continuous profit-taking and weakened accumulation. Despite minor inflow spikes in March and July, red-bar sessions have dominated, revealing sustained selling pressure. On November 5, ADA recorded a modest inflow of $638,870 while trading near $0.5332.

Moreover, the alignment between falling prices and steady outflows shows that liquidity continues leaving exchanges. Hence, without consistent inflows, ADA may struggle to sustain the $0.50 support through November. A decisive break below that threshold could open the path toward $0.45, while a strong rebound could trigger a short-term recovery toward $0.59.

Technical Outlook for Cardano (ADA) – Key Levels Remain Crucial Heading Into November

- Upside levels: $0.55, $0.59, and $0.66 stand as immediate resistance points. A confirmed breakout above $0.66 could extend gains toward $0.71 and $0.77.

- Downside levels: $0.49 remains the primary support, followed by $0.45 and $0.41 if selling pressure accelerates.

- Resistance ceiling: The 200-EMA near $0.77 is the key level to flip for a medium-term bullish reversal.

The technical picture shows Cardano compressing between a horizontal support base at $0.49 and declining trendline resistance near $0.60. The narrowing price action signals a possible volatility expansion once a breakout occurs.

Will Cardano Price Recover?

Cardano’s short-term outlook hinges on whether buyers can defend the $0.49 support long enough to reclaim the 20-EMA near $0.55. If momentum builds, ADA could attempt a recovery toward the $0.59–$0.66 cluster, confirming early signs of a trend shift.

However, failure to hold $0.49 would expose the token to deeper losses toward $0.45 and $0.41. Market sentiment, on-chain flows, and Bitcoin’s stability will play decisive roles in ADA’s next directional move. For now, the asset remains in a pivotal consolidation zone with limited bullish conviction but strong potential for a rebound once macro conditions improve.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.