- ADA struggles below key moving averages, keeping short-term bullish momentum limited.

- Critical $0.38 support may decide ADA’s next move amid weak price structure.

- Reduced derivatives exposure and spot outflows signal cautious trader sentiment.

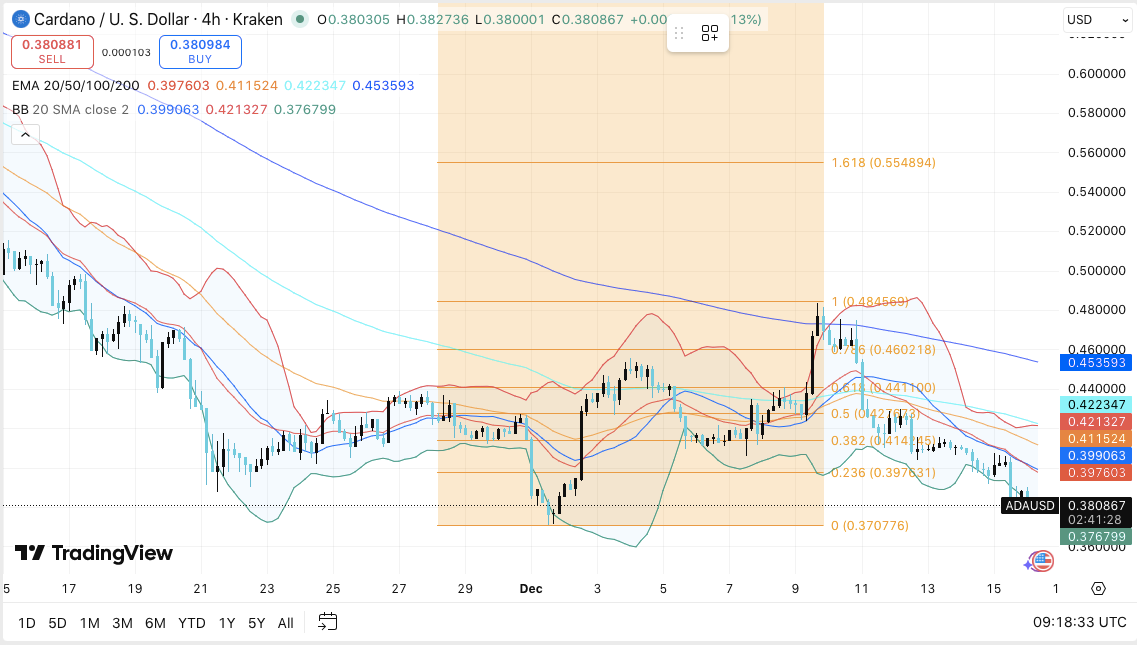

Cardano price continues to face pressure on the four-hour chart as buyers struggle to regain short-term control. ADA trades near the $0.38 level after failing to hold above mid-range resistance earlier this month.

The market now watches whether current support can hold amid weak momentum, cooling derivatives activity, and persistent spot outflows. Consequently, short-term direction depends on how price reacts around critical demand zones while traders remain cautious.

Price Structure Signals Cautious Consolidation

ADA maintains a fragile structure as it trades below major moving averages on the four-hour timeframe. The token remains capped beneath the 100-period and 200-period exponential moving averages, which continue to limit upside attempts. Besides that, recent rebounds stalled well below prior rejection zones, confirming sellers still dominate higher price levels.

Price currently hovers just above the $0.38 support area, which has acted as a short-term demand zone. Hence, this region now serves as a critical pivot for near-term price action. A decisive breakdown below $0.37 could shift focus toward deeper support near $0.36 and $0.35. These levels previously absorbed selling pressure during consolidation phases.

Related: Ethereum Price Prediction: ETH Consolidates While Open Interest Cools…

On the upside, ADA must reclaim the $0.40 to $0.41 zone to improve short-term structure. Additionally, stronger resistance sits near $0.42 and $0.43, where trend indicators converge. A move above this region could allow a test of the broader $0.45 to $0.48 supply zone. However, the market has not confirmed such strength.

Derivatives Data Reflects Reduced Risk Appetite

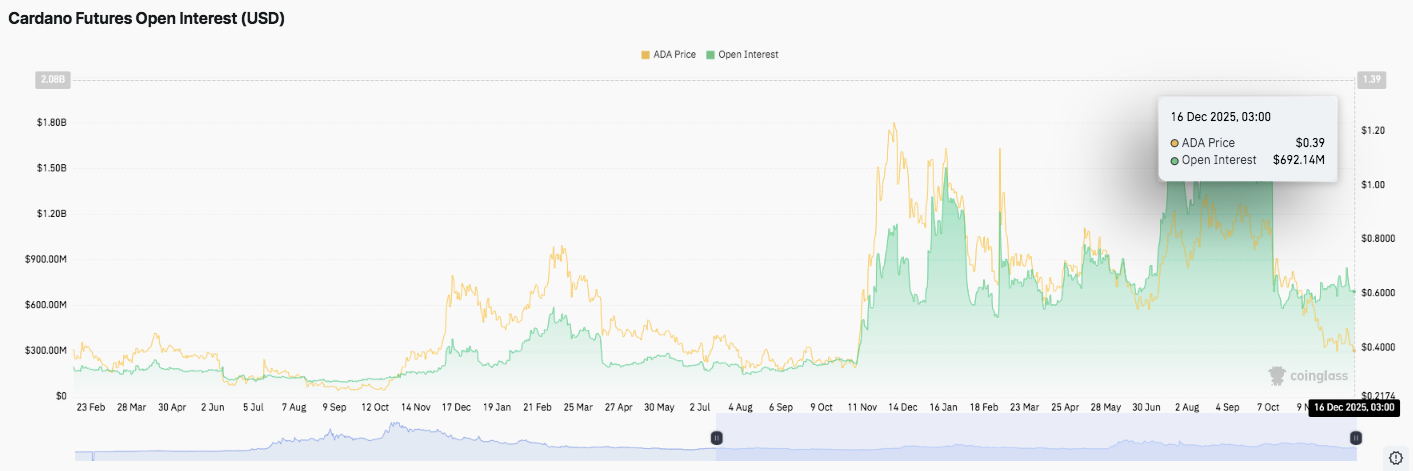

Futures market data shows a clear reduction in speculative positioning. Open interest expanded sharply during earlier rallies, then contracted as prices reversed. Significantly, peaks in leveraged exposure aligned with local price tops, followed by swift unwinding.

Currently, open interest sits near $690 million while ADA trades around $0.39. This pullback suggests traders reduced leverage after recent volatility. Moreover, the contraction indicates a pause in directional conviction rather than aggressive accumulation. Hence, derivatives data supports a wait-and-see approach across the market.

Spot Flows Highlight Ongoing Distribution

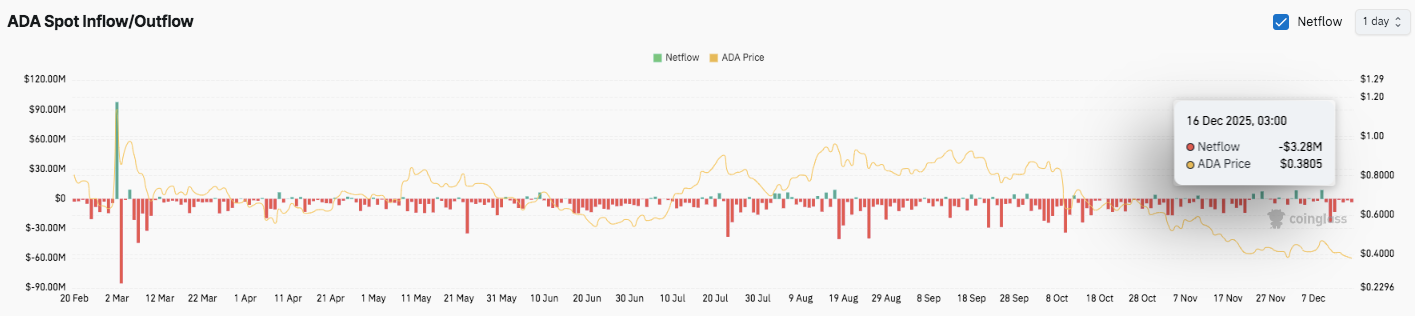

Spot flow trends further reinforce cautious sentiment. ADA has recorded consistent net outflows for an extended period, showing capital leaving exchanges. Although brief inflow spikes appeared, they failed to shift the broader trend.

Related: Bitcoin Price Prediction: Treasury Buying Fails To Shift Market Psychology

Notably, outflows intensified during recent price weakness, signaling continued risk reduction. The latest data shows approximately $3.28 million in net outflows, aligning with ADA’s current trading range. Consequently, spot flows point to limited accumulation interest and defensive positioning.

Technical Outlook for Cardano (ADA) Price

Key levels remain clearly defined for Cardano as price trades near a pivotal zone on the four-hour chart.

Upside levels include $0.40 and $0.42 as immediate hurdles, followed by $0.45 and $0.48 as higher resistance targets. A sustained breakout above $0.42 could open the door for a retest of the $0.45–$0.48 supply zone.

On the downside, $0.38 remains the first support to watch, followed by $0.37 and $0.35 if selling pressure accelerates.

The resistance ceiling sits near $0.42–$0.43, aligned with the 100 EMA, which remains the key level to flip for short-term recovery momentum. Technically, ADA appears compressed inside a narrow consolidation range after a bearish move, suggesting volatility expansion ahead.

Will Cardano Go Up?

Cardano price direction hinges on whether buyers can defend the $0.37 support zone long enough to challenge $0.40–$0.42. Technical compression and weakening momentum point to a decisive move approaching.

If inflows strengthen and price reclaims $0.42, ADA could revisit $0.45 and higher. However, failure to hold $0.37 risks exposing $0.35 and extending the corrective phase. For now, ADA remains at a critical inflection point, with confirmation needed for the next directional move.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.