- Cardano price today trades near $0.798, consolidating below $0.83–$0.85 resistance reinforced by EMA and Fibonacci levels.

- Prediction markets assign a 91% chance of U.S. Cardano ETF approval by October 26, fueling optimism.

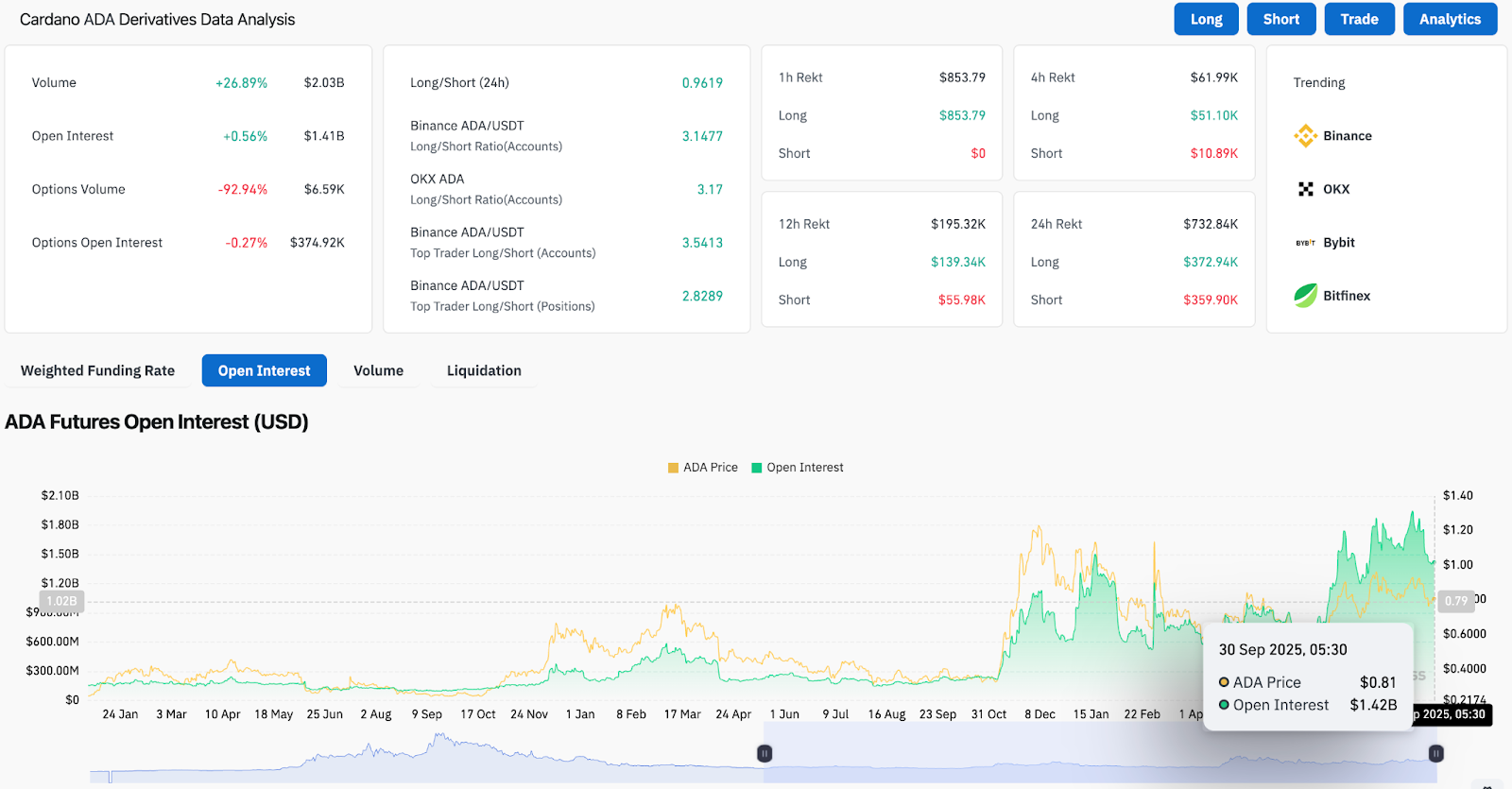

- Open interest rises to $1.41B with long/short ratios skewed bullish, but subdued options activity signals caution.

Cardano price today is trading near $0.798, attempting to recover after last week’s slide below the $0.81–$0.83 support band. Buyers are defending the $0.78 zone, but the market remains trapped below key short-term moving averages.

The focus now shifts to whether ADA can reclaim $0.83–$0.85, a resistance cluster reinforced by the 50-day EMA and Fibonacci confluence.

Cardano Price Struggles At Resistance

The 4-hour chart shows ADA consolidating between $0.78 and $0.83 after a sharp pullback from September’s highs above $0.95. Price is currently sitting under the 20-day EMA at $0.80 and faces overlapping resistance from the 50-day and 100-day EMAs at $0.82 and $0.83.

The 200-day EMA remains higher at $0.84, forming a dense resistance zone. A breakout through this cluster would clear the way for a move toward $0.87 (Fib 0.382) and then $0.90 (Fib 0.5). On the downside, immediate support sits at $0.78, with deeper liquidity pockets near $0.75 and $0.71.

Momentum indicators remain mixed. The RSI is recovering from oversold territory but has yet to confirm bullish divergence. Parabolic SAR dots remain above price, signaling lingering bearish bias.

Related: Ethereum Price Prediction: Analysts Watch $4,359 Level As Short Squeeze Threatens Bears

ETF Approval Odds Add Tailwind

Market sentiment around ADA has brightened after prediction markets placed a 91% probability on a U.S. Cardano spot ETF approval by October 26. The potential green light has triggered fresh debate on whether institutional exposure could replicate the inflows seen in Bitcoin and Ethereum earlier this year.

Analysts argue that even partial capital rotation into ADA from ETF products could provide a meaningful liquidity boost. However, they caution that the approval timeline may not align perfectly with short-term technical breakouts, leaving traders to weigh hype against current chart pressure.

On-Chain Data Signals Cautious Positioning

Derivative flows show renewed activity. Cardano open interest stands at $1.41 billion, up 0.56% in the past 24 hours, while trading volume has surged 26% to $2.03 billion. The long/short ratio on Binance is skewed heavily bullish at 3.14, suggesting that leverage is tilted toward upside bets.

Yet, options activity remains subdued, with volumes down 92% compared to prior weeks. This lack of hedging may expose traders to volatility shocks if ADA fails to reclaim resistance. Liquidation data also shows $732k wiped in the past 24 hours, with longs absorbing the larger share of losses, underscoring how fragile the recovery has been.

Fundamentals Reinforce Long-Term Case

Beyond technical swings, Cardano continues to build its credibility as a resilient blockchain. Community data highlights that the network has been operational for over eight years without downtime or hacks, a track record unmatched by many competitors.

This narrative of stability provides institutional investors with confidence as ETF speculation grows. It also underpins the case that Cardano’s valuation may be less speculative than peers in the long run, especially if broader adoption of decentralized applications accelerates.

Technical Outlook For Cardano Price

Key levels for ADA remain tightly defined heading into October:

- Upside levels: $0.83–$0.85 (EMA cluster), $0.87 (Fib 0.382), $0.90 (Fib 0.5).

- Downside levels: $0.78 immediate support, followed by $0.75 and $0.71.

- Trend support: $0.68 remains the last major defense line.

Traders will be watching whether ADA can close daily candles above $0.83, which would flip structure bullish and validate a move toward $0.90. Failure to do so leaves risk of another retest of $0.75 support.

Outlook: Will Cardano Go Up?

Cardano price prediction for October hinges on whether buyers can reclaim the $0.83–$0.85 resistance zone. Technicals still point to caution, but rising open interest, strong long/short ratios, and the looming ETF decision create potential catalysts for upside momentum.

If ETF optimism sustains, ADA could test $0.90 and potentially $0.93 into October. Conversely, if price loses $0.78, sellers may regain control and drive ADA back toward $0.75 or lower.

For now, Cardano remains in a consolidation range, with ETF speculation providing a strong narrative tailwind but technical levels dictating near-term direction.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.