- Cardano price today trades near $0.67, holding support at $0.65–$0.63.

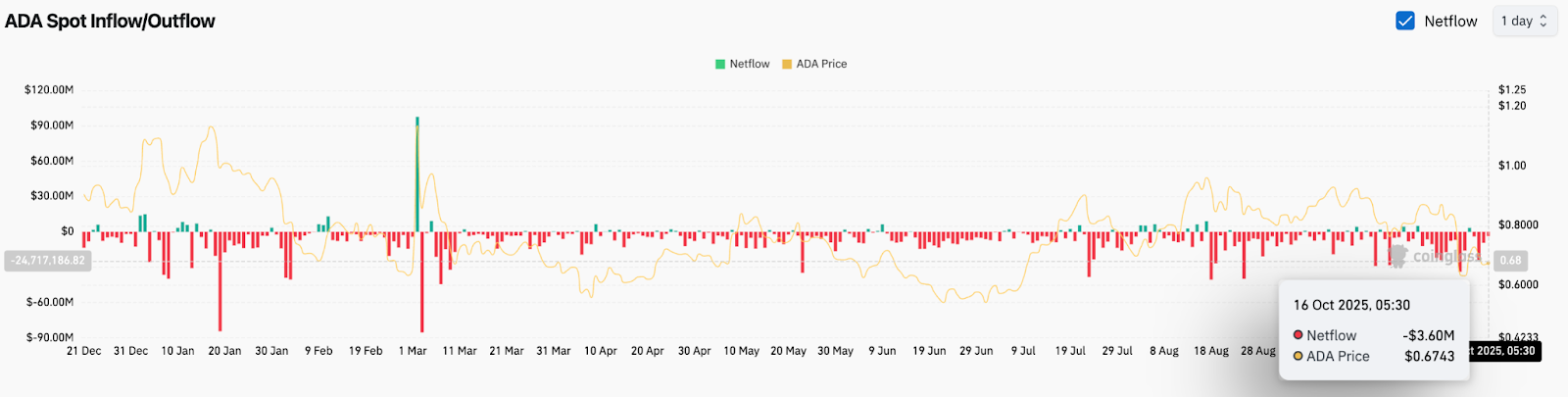

- On-chain flows show a $3.6M net outflow, signaling mild accumulation but weak conviction.

- ISO 20022 chatter fuels sentiment, but price still needs a breakout above $0.70 to confirm momentum.

Cardano (CRYPTO: ADA) price today trades near $0.67, steady after a volatile week that saw buyers defend the ascending trendline from December lows. The market remains divided between cautious optimism over macro stability and skepticism toward speculative narratives around ISO 20022 readiness.

Cardano Price Defends Long-Term Structure

The daily chart shows Cardano price locked inside a symmetrical triangle that has shaped since November 2024. Support remains firm near $0.65–$0.63, aligned with the ascending trendline and 200-day EMA at $0.77 overhead. Resistance layers stretch between $0.79 and $0.83, where the 50- and 100-day EMAs cluster with the Supertrend barrier.

Related: Ethereum Price Prediction: Traders Eye Key Support as BitMine Adds $417M in ETH

Despite recent weakness, ADA continues to respect its higher low structure. The RSI has rebounded from the 40 zone, suggesting that bearish momentum is easing. The price now needs a clean move above $0.70 to confirm a short-term shift toward bullish territory. Failure to hold the $0.65 base could invite further declines toward $0.58 and $0.52.

On-Chain Flows Reveal Mixed Sentiment

Exchange flow data from Coinglass shows Cardano recorded a $3.6 million net outflow on October 16, indicating mild accumulation but lacking strong conviction. Broader flow trends since September reveal alternating red and green prints, reflecting uncertain investor positioning.

Persistent outflows during early October followed ADA’s rejection near $0.95, while the latest stabilization near $0.67 hints at cautious buying. However, analysts warn that consistent net inflows above $20 million would be needed to confirm renewed bullish momentum. Futures open interest has also plateaued, suggesting subdued participation and low leverage exposure.

ISO 20022 Narrative Gains Traction

Social discussions around Cardano’s alignment with ISO 20022 standards have surged this week after viral posts claimed ADA is “ready for the global financial reset.” The post cited the November 22, 2025 transition deadline for cross-border payments using ISO 20022 formats.

While this narrative attracted community enthusiasm, no official confirmation from BNY Mellon or the Cardano Foundation has been issued verifying direct compliance. The topic underscores growing interest in blockchain integration within global banking infrastructure but remains speculative at present.

Traders note that such narratives can temporarily lift sentiment but are unlikely to influence price action unless validated by institutional or regulatory statements.

Key Technical Levels In Focus

Cardano price faces a narrow window between short-term resistance and trendline support. A close above $0.70 could open upside targets at $0.77 and $0.83, followed by a potential retest of $0.95 if momentum strengthens.

On the downside, $0.65 remains the primary defense zone. Below this, sellers may target $0.58, which marks the July base, and $0.52 as the last strong demand zone before the broader bullish structure weakens.

Related: Bitcoin (BTC) Price Prediction: Bulls Defend $111K as Analysts See Catch-Up With Gold

Momentum indicators are turning neutral, with MACD lines flattening and Bollinger Bands beginning to contract — a sign of compression before potential breakout. The direction of the next move will depend heavily on whether buyers can defend the trendline into late October.

Outlook: Will Cardano Go Up?

Cardano’s short-term outlook hinges on the $0.65–$0.70 corridor. Holding above the rising trendline keeps the bullish structure intact, but sustained resistance below the EMA cluster caps upside momentum.

If ADA breaks above $0.70 with volume support, a move toward $0.77 and $0.83 appears likely in the coming sessions. Conversely, a daily close below $0.65 would expose downside risks toward $0.58, neutralizing the bullish pattern that began mid-year.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.