- Cardano price today trades at $0.63, supported by $0.60 while resistance builds at $0.70–$0.77.

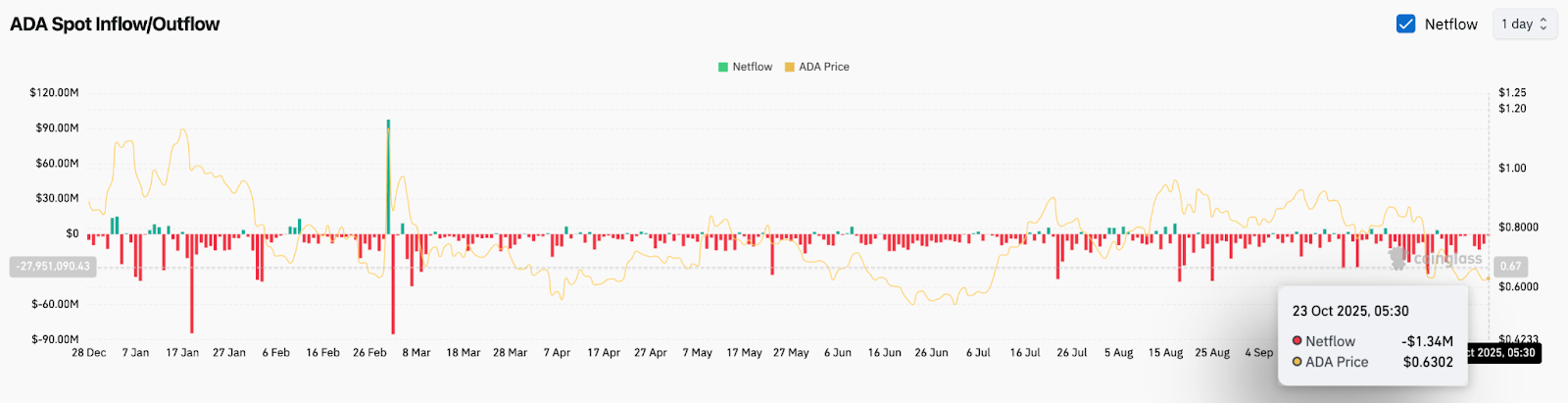

- Coinglass data shows $1.34M ADA net outflows on Oct. 23, reflecting cautious market sentiment.

- Cardano Foundation confirms plans for .ada and .cardano domains, boosting ecosystem visibility.

Cardano price today trades around $0.63, holding slightly above a key ascending trendline that has supported its structure since late 2024. Despite sustained selling pressure and weak inflows, the coin remains within a broader symmetrical triangle that continues to compress between resistance near $0.77 and long-term support at $0.60.

Buyers Defend Key Support As Triangle Narrows

The daily chart shows Cardano price action respecting the lower boundary of its multi-month ascending support, even after repeated rejections from the upper trendline drawn from April’s highs. Price has so far held above the 0.236 Fibonacci level at $0.605, which aligns with the base of this structure.

Clustered EMA resistance levels—the 20-day at $0.69, the 50-day at $0.76, and the 100-day at $0.77—define the overhead barrier zone. A clean break above this band could reestablish upside momentum toward the 0.382 Fibonacci retracement at $0.82 and potentially the 0.5 level at $0.92, both of which capped prior rallies.

At the same time, Parabolic SAR dots remain above the candles, confirming that near-term control rests with sellers. For buyers to regain momentum, ADA must close decisively above $0.70 in the coming sessions.

On-Chain Flows Highlight Cautious Sentiment

Data from Coinglass shows consistent negative spot netflows through October, including a $1.34 million outflow on October 23 as ADA price hovered near $0.63. These outflows indicate coins moving back to exchanges, often a sign of cautious positioning or profit-taking.

Despite the weak inflow profile, the absence of large liquidation spikes suggests no broad capitulation. This indicates that long-term holders are still maintaining positions, while shorter-term traders remain defensive.

Cardano Foundation’s Domain Push Sparks Fundamental Interest

In a notable development, the Cardano Foundation confirmed plans to apply for the .ada and .cardano generic top-level domains (gTLDs). The move comes ahead of the Internet Corporation for Assigned Names and Numbers (ICANN) application window opening in early 2026, marking the first such opportunity in over a decade.

The initiative, fully funded by the Foundation, aims to strengthen Cardano’s digital identity and expand its ecosystem across Web2 and Web3. If approved, users could register domains such as wallet.ada or dapp.cardano, potentially increasing accessibility and branding appeal.

Outlook: Will Cardano Go Up?

For now, Cardano price prediction remains balanced between the resilience of its long-term support and the weight of persistent resistance overhead. If ADA holds the $0.60 zone and reclaims $0.70, buyers could target the $0.82 to $0.92 range in the near term.

Failure to hold the ascending trendline could open the door toward $0.55 or even a retest of $0.51, where the next Fibonacci base aligns with prior consolidation.

With on-chain flows still showing outflows but fundamentals turning constructive, the next few sessions will determine whether ADA’s current pause becomes a setup for recovery or a deeper retest before a late-year rebound.

Technical Forecast Table

| Metric | Level / Reading | Bias |

| Current Price | $0.630 | Neutral |

| Immediate Support | $0.605 / $0.55 | Bullish defense zone |

| Immediate Resistance | $0.70 / $0.76 | Bearish cluster |

| RSI (Daily) | 41 | Neutral-bearish |

| MACD | Below signal line | Bearish momentum |

| Fibonacci Levels | 0.236 – $0.605, 0.382 – $0.82, 0.5 – $0.92 | Key reaction zones |

| EMA Cluster (20/50/100) | $0.69 / $0.76 / $0.77 | Overhead resistance |

| Parabolic SAR | $0.75 | Bearish signal |

| On-chain Netflow (Oct 23) | -$1.34M | Outflows persist |

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.