- ADA traded near $0.64 on Oct 21, still below the $0.75 to $0.77 supply zone that guards trend repair.

- Weekly supports held at the late-2023 log trend and ~$0.56, keeping the macro uptrend viable.

- Leios and Midnight upgrades, a positive funding rate, and capital rotation themes frame the next leg.

Cardano’s price rebounded after the market’s recent twenty-billion-dollar washout but stayed below $0.75, which kept midterm sentiment cautious. Founder Charles Hoskinson defended ADA’s drawdown by pointing to the broader $20 billion crypto capitulation, a context that matters as traders weigh whether ADA can reclaim former support at $0.75 to $0.77 and reset bullish momentum.

Is Cardano Price Still in a Macro Bull Market?

Why ADA’s recovery depends on a clean $0.75 to $0.77 reclaim

In the weekly timeframe, the ADA/USD pair recently retested two crucial support levels during the 10/11 crypto crash. Evidently, the ADA/USD pair retested its rising logarithmic trend established since late 2023 and also rebounded from its year-to-date support level around 56 cents.

In a max pain scenario, the ADA/USD pair may retest both support levels before rallying to its all-time high. According to crypto analyst Lark Davis, ADA price must consistently rally above the supply range between $0.74 and $0.77 in addition to the falling logarithmic resistance trend established YTD.

Related: Cardano Price Prediction: ADA Faces Range-Bound Pressure as Momentum Cools

What Fundamentals Has ADA Accumulated to Consider?

Upcoming Network Upgrades

The Cardano’s core developers have been working on making the network more scalable in a privacy-centric fashion. The Cardano ecosystem is awaiting two major developments to enhance the network’s scalability, including the Leios upgrade and the Midnight Layer 2 scaling solution.

ETF Hype Amid Positive Funding Rate

The Cardano adoption by mainstream institutional investors will accelerate once the United States Securities and Exchange Commission (SEC) approves an ADA ETF. For instance, the Grayscale Cardano Trust ETF (GADA) is expected to be approved soon, especially once the U.S. government shutdown ends in the near term.

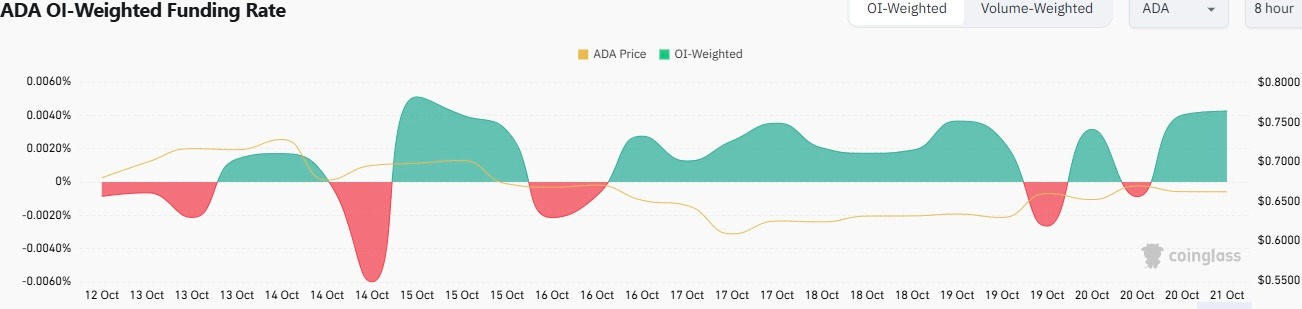

Meanwhile, Cardano’s funding rate has remained positive, which is historically associated with bullish sentiment and vice versa.

Capital Rotation from Bitcoin Increases Altseason Odds

Cardano price against Bitcoin has established a robust support level year to date to ensure the former’s bullish sentiment.

From a technical analysis standpoint, the ADA/BTC has formed a potential reversal pattern after being trapped in a falling trend since late 2021. Notably, the weekly Bollinger Bands have been squeezing in the recent past, thus suggesting higher volatility in the midterm.

Meanwhile, the weekly Relative Strength Index (RSI) has formed a rising divergence amid a possible inverse head and shoulders pattern. As such, it is safe to assume that Cardano price has not yet experienced a parabolic growth and is on the horizon.

Related: Cardano Price Prediction: Analysts Track $0.64 Recovery As Midnight Project Fuels Privacy DeFi Buzz

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.