- ADA vs ETH adoption gap shows Ethereum dominates usage, inflows, and developer traction.

- Can Cardano overtake Ethereum? Adoption, not math, decides ADA’s path to higher value.

- Cardano vs Ethereum math points to $13 ADA, but adoption gap makes it unlikely today.

Cardano could only reach Ethereum’s market cap if it first closes a massive adoption gap. Price math suggests ADA would trade at $13.52 if it matched ETH’s valuation, but without the users, developers, and institutional flows that power Ethereum, the number is just theory.

Ethereum’s Lead Is in Adoption, Not Supply

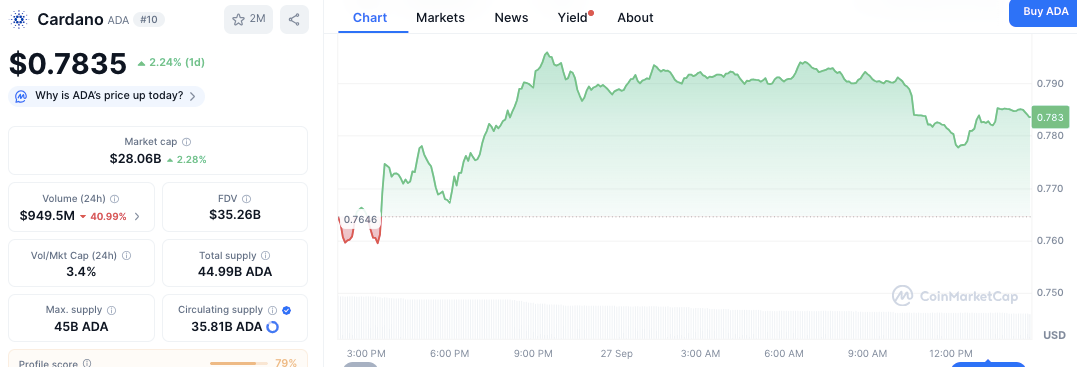

Cardano trades around $0.78 with a market cap near $28 billion. Ethereum, priced close to $3,998, holds a market capitalization of about $485 billion. In simple terms, Ethereum today is valued at 17 times the size of Cardano.

Ethereum also secures the largest share of decentralized finance (DeFi). On DeFiLlama’s chain leaderboard, Ethereum accounts for more than half of all total value locked (TVL), far ahead of Cardano’s smaller footprint. CoinGecko’s blockchain rankings confirm Ethereum as the dominant chain by TVL, while Cardano trails well down the list. These adoption metrics explain why Ethereum commands such a wide valuation lead.

Where Cardano Trails

Cardano processes fewer daily transactions and supports smaller liquidity pools than Ethereum, reflecting its limited DeFi presence. Developer participation is also smaller. DeveloperReport’s ecosystem data shows Ethereum hosting thousands of monthly active developers, compared with a much smaller number for Cardano.

Still, there are bright spots. A Forbes analysis noted that Cardano temporarily surpassed Ethereum in core development activity, a sign of resilience in its builder base. Still, those gains have not translated into capital flows or usage that could rival Ethereum’s.

Related: Cardano Could Join 2025’s Leaders With $1.25 and $5 Targets

While ADA has a loyal holder base and fixed supply of 45 billion tokens, those fundamentals don’t automatically raise valuation. Without stronger adoption, Cardano remains locked at a fraction of Ethereum’s market share.

What ADA Would Need to Catch Up

If ADA is ever to approach ETH’s market cap, it must:

- Boost on-chain activity reflected in wallet counts and daily transactions.

- Expand DeFi liquidity and stablecoin adoption, where Ethereum leads by multiples.

- Attract more developers and builders into its ecosystem.

- Secure institutional recognition comparable to ETH’s ETF inflows.

These are the benchmarks that would move ADA closer to parity, not just the supply math.

Short-Term Still Matters

ADA’s long-term comparison with ETH won’t matter if it cannot clear short-term hurdles. The token has repeatedly stalled at $0.79, with $0.80 acting as strong resistance. Until ADA breaks higher, its long-term aspirations remain in the background.

ADA Technicals

Intraday data shows ADA opened near $0.7646, gained through the evening, and tested highs near $0.79. The token repeatedly challenged the $0.79 level overnight, consolidating near $0.78 after profit-taking by midday.

Analysts monitoring the charts pointed to the $0.80 resistance as the immediate level to watch. While ADA’s near-term performance shows small gains, the long-term projection tied to Ethereum’s market capitalization gives a large positive scenario.

Related: Cardano Price Prediction: ADA Faces $0.80 Hurdle As $50M Liquidity Push Sparks Debate

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.