- Cardano’s trading volume spiked by 49.42%, signaling increased investor interest amidst a bearish market trend.

- Ali Martinez forecasts a bullish turn for Cardano, mirroring its late 2020 surge, as ADA whales transact $13B.

- ADA’s current pattern echoes 2020’s rally, hinting at a potential leap from $0.60 to $7 despite recent price dips.

According to crypto analyst Ali Martinez, the Cardano (ADA) network is on the brink of a significant surge, reminiscent of its late 2020 behavior. Martinez’s insights suggest that Cardano could see a substantial upward trend starting as early as April.

Whale Movements Indicate Emerging Trends

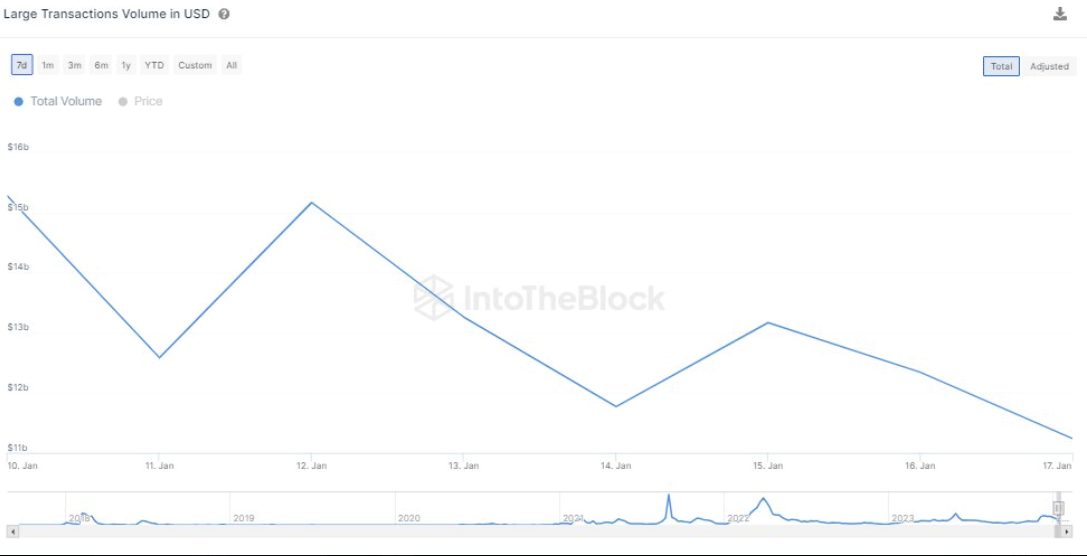

Recent developments have shown a massive increase in transaction activity within the Cardano network. ADA whales have initiated transactions amounting to a staggering $13 billion. This surge in large transactions is remarkable in its scale and timing, aligning with Martinez’s predictions. Compared to Ethereum’s $5 billion in similar transaction activities, this spike in Cardano’s activity marks a notable shift in investor behavior within the ecosystem.

ADA/USD Whales chart (source: Intotheblock)

Despite the recent spike in whale transactions, ADA’s price performance has been relatively subdued. The cryptocurrency has seen a loss in momentum, breaking through key support levels, including the 50-day EMA. This indicator often reflects short to medium-term market sentiment, and its breach indicates a bearish outlook. However, the next significant level of support lies at the 100 EMA, which might offer some resistance against further declines.

Martinez’s Prediction for ADA

Martinez parallels the current market conditions and the patterns observed in late 2020. He suggests that if these patterns hold, ADA could experience a significant rise, initially reaching $0.80, followed by a brief correction to $0.60, before an ambitious climb to $7.

ADA/USD price chart (source: Alicharts)

This projection is based on a detailed analysis of ADA’s price chart and its similarities with the 2020 market scenario. During that period, ADA saw a nearly 3,000% increase following months of downward consolidation, reaching an all-time high of $3.06 in 2021.

ADA/USD Analysis

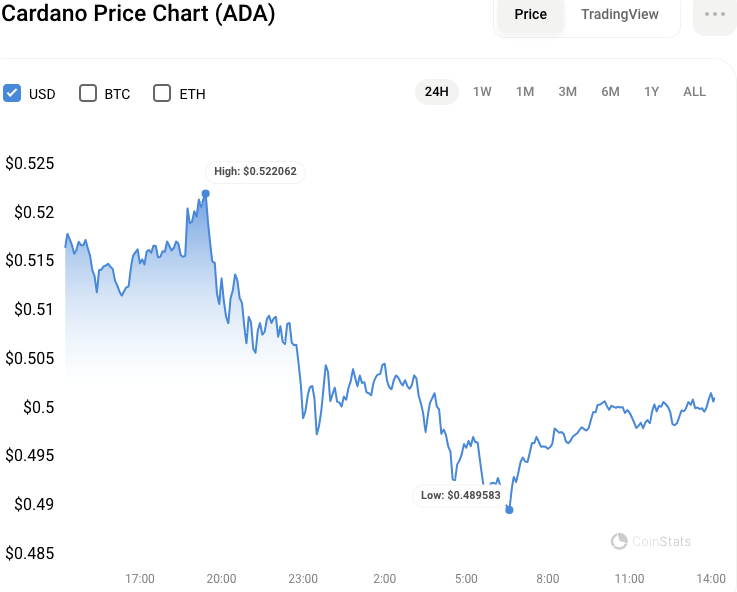

Bearish momentum in the Cardano (ADA) market has been robust in the last week, with bulls failing to breach the high of $0.59. This trend has persisted over the previous 24 hours, with the ADA price falling from $0.5343 before support was established at $0.48. ADA was priced at $0.5005 at press time, a 3.18% dip from the intra-day high.

ADA/USD 24-hour price chart (source: CoinStats)

During the slump, ADA’s market capitalization sank by 3.09% to $17,723,506,083, while the 24-hour trading volume rose by 49.42% to $428,003,420. This trend suggests that ADA’s trading activity has increased significantly despite the drop in market capitalization. This pattern implies more purchasing and selling of ADA tokens during this time, as buyers regarded the token dip as a possibility for profit.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.