- Dan Gambardello predicted that ADA prices might soon skyrocket to $0.55.

- Crypto markets might witness increased volatility after the Fed’s rate cut.

- Gambardello also warned investors to anticipate a “fall down for crypto.”

ADA, the native token of Cardano, a competitor to Ethereum, is expected to make a comeback in the crypto world and reclaim its spot among the top 10 cryptocurrencies by market capitalization. Crypto analyst and Cardano bull, Dan Gambardello, has said the altcoin will soon reach a price of $0.55 as a bullish scenario unfolds.

In a post on X (formerly Twitter), Gambardello predicted that with the Federal Reserve introducing rate cuts on Wednesday, the markets are likely to be “choppy,” meaning that the volatility of digital assets like ADA might increase in the short term.

Gambardello advised that it would be wise to anticipate and visualize a fall in crypto prices while cautioning investors about investing in ADA and other cryptocurrencies during this period of potential volatility. The analyst added that if ADA drops and creates a downtrend, the situation would turn out to be “a fake breakout,” leading to a massive price surge towards $0.55.

Read also: ADA Holders Gain Voting Power in Cardano’s Latest Upgrade

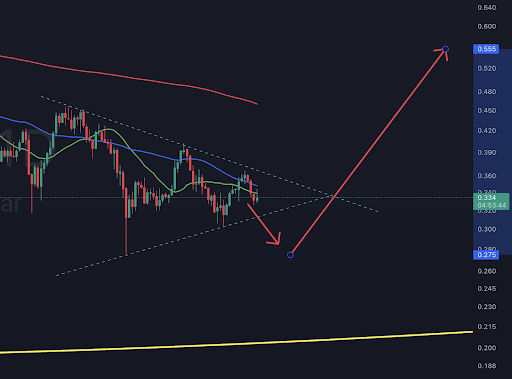

Gambardello posted the chart above on X which showed the chances of ADA skyrocketing from the current levels of $0.33 to $0.55. Interestingly, as per CoinMarketCap data, ADA is down 89.23% from its all-time high of $3.10 witnessed on September 2, 2021 and has crashed 1.79% in the past week but has surged 33.71% since September last year.

ADA Trading Volume Up 16.2%

In the past 24 hours, the trading volume of the ADA token rose a massive 16.2% and currently stands at $221 million. Further, the altcoin is ranked as the 11th-largest cryptocurrency by market capitalization and is valued at $11.9 billion.

The Relative Strength Index of the ADA token is at 44.06 which means that the bears are generally in control of the cryptocurrency’s price action, while the gradient of the line suggests that higher prices might be on the horizon. Further, the Accumulation/Distribution line shows that the accumulation of ADA is down and investor demand is down.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.