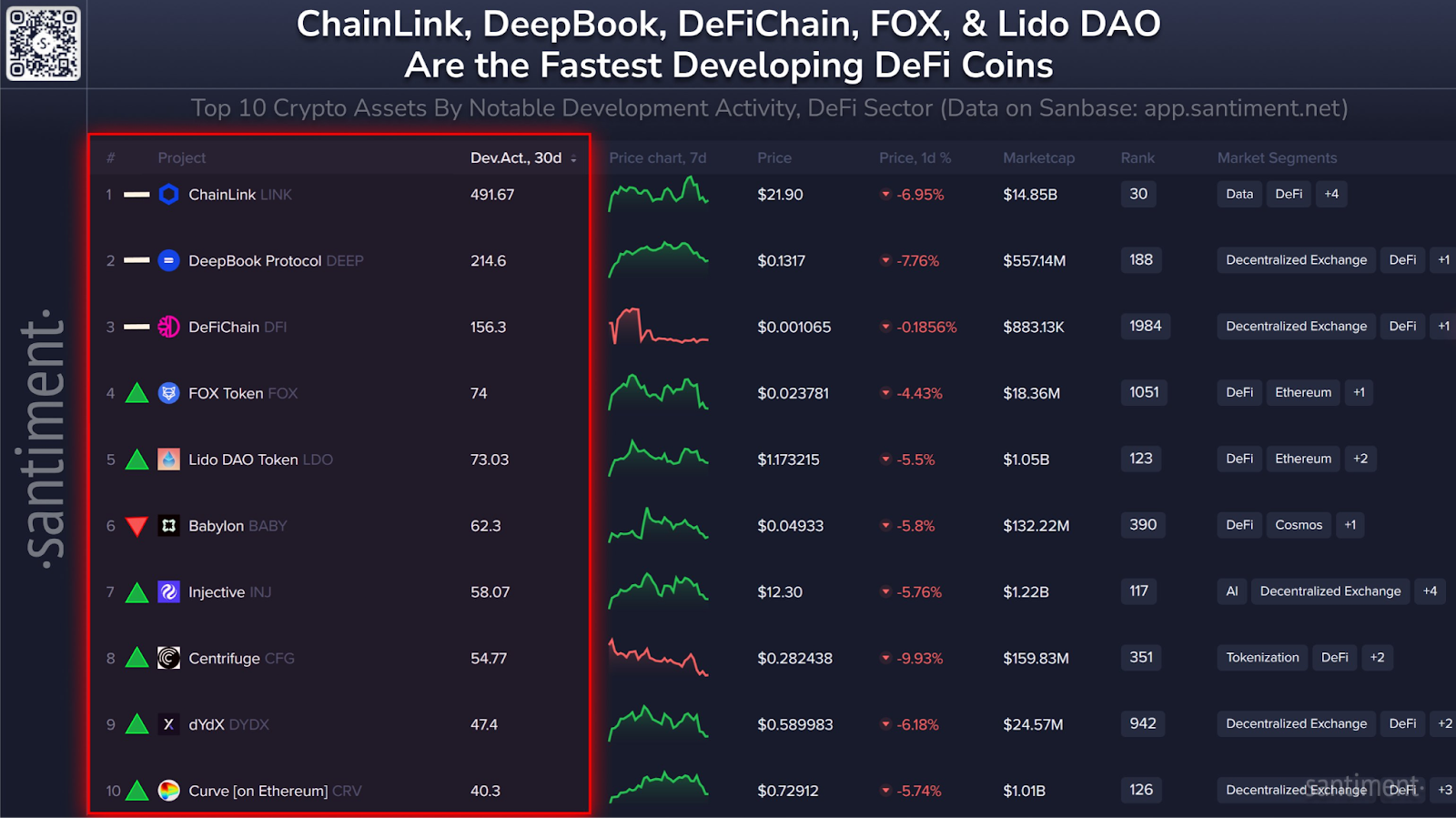

- Chainlink (LINK) ranks #1 in Santiment’s October DeFi developer activity list with a score of 491.67.

- DeepBook and DeFiChain follow as competition rises across mid-tier DeFi protocols.

- LINK price trades in a descending channel near $23 as traders watch for a breakout above resistance.

Chainlink (LINK) continues to dominate DeFi development metrics, according to Santiment’s latest October ranking.

According to recent data from Santiment, ChainLink remains the top DeFi project in terms of development activity over the past 30 days, boasting an impressive score of 491.67.

LINK First, DEPP Second

Following ChainLink, DeepBook Protocol (DEEP) holds second place with a score of 214.6, demonstrating strong developer momentum, while DeFiChain (DFI) takes third with a score of 156.3.

The rankings also reveal increased competitiveness in the middle tier with FOX Token (FOX) and Lido DAO (LDO) claiming fourth and fifth positions respectively.

Babylon (BABY) ranks sixth with a solid score of 62.3 but has slipped slightly from the previous month. Meanwhile, Injective (INJ), Centrifuge (CFG), dYdX (DYDX), and Curve (CRV) have entered into the top ten.

LINK Price Analysis: Watching $23 to $30 Range

LINK’s price action has turned volatile as the token dropped 7% in the past 24 hours, even as trading volume surged by 5%. On the daily chart, LINK is consolidating within a descending channel pattern after a sharp rally earlier this quarter.

The upper boundary near $23.7 acts as the key resistance level, while the lower boundary around $20.3 offers critical support. A breakout above the descending channel could reignite bullish momentum, targeting the $26 and $30 zones as potential upside levels.

On the other hand, if LINK breaks below the $20 support, it may trigger further correction toward the $17.5 level. Bollinger Bands indicate tightening volatility, hinting that a significant move may be imminent.

The MACD remains slightly bearish but shows signs of convergence, suggesting that buying momentum could return if the broader market also turns bullish. The Chaikin Money Flow (CMF) remains slightly negative, confirming modest capital outflows.

Once BTC recovers from its crash to $120K, LINK may stand among the first DeFi assets to rebound sharply, backed by its expanding ecosystem and crucial role in data-driven blockchain infrastructure.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.