- LINK rebounds near $18.34, signaling renewed bullish sentiment among traders.

- Rising open interest above $692M suggests strengthening momentum and leverage activity.

- Whale accumulation of 9.94M LINK points to growing long-term investor confidence.

Chainlink (LINK) is regaining traction after a steep mid-October correction, showing signs of renewed bullish sentiment among traders. The token is trading near $18.34, recovering steadily from the month’s lows. Analysts note that this rebound coincides with rising open interest and a shift in whale behavior, both pointing toward strengthening market confidence. Consequently, LINK’s technical structure now hints at a possible continuation phase if current support levels hold firm.

Key Levels Show Strengthening Recovery

The token currently trades near a confluence of short-term moving averages, with the 20-, 50-, and 100-EMAs clustering between $18.09 and $18.46. Holding above this pivot zone could signal a short-term bullish breakout.

The next resistance sits around the 0.618 Fibonacci retracement level at $18.55, followed by the $19.45 to $20.84 range, aligning with the 200-EMA. A close above $19.50 could confirm sustained recovery momentum, opening the path toward the $23.70 swing high.

Related: Hedera Price Prediction: HBAR Gains Investor Momentum as ETF Launch Nears

On the downside, immediate support lies near $16.98, with secondary levels at $15.39 and $13.42. A breakdown below these levels may expose LINK to further losses, potentially retesting the $10.24 cycle low. Hence, maintaining the current range remains critical for bulls aiming to reestablish a long-term uptrend.

Rising Open Interest and Market Confidence

According to data as of October 28, open interest has climbed to $692.91 million, while LINK trades near $18.21. This represents a strong rebound from mid-year levels when open interest dipped below $400 million.

Moreover, the increase signals renewed leverage participation as traders bet on price continuation. Historically, rising open interest paired with upward price movement has validated bullish setups, suggesting momentum could persist if price holds above $18 and open interest approaches $800 million.

Whales Signal Accumulation, Analysts Note Long-Term Optimism

Data from Bitcoinsensus indicates that large investors are once again accumulating Chainlink. Since October 10, thirty-nine new wallets have withdrawn 9.94 million LINK, worth approximately $188 million, from Binance. This significant outflow underscores confidence among institutional and high-net-worth holders positioning for a potential rally.

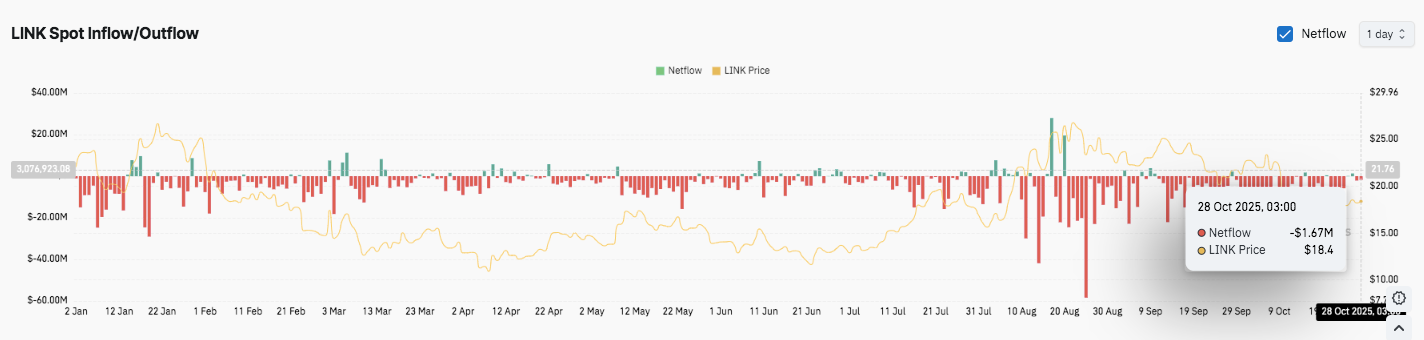

Besides, on-chain data shows consistent net outflows since early 2025, implying investors are moving tokens into private storage. Large outflow spikes in late July and September matched key correction phases, while recent mild netflow at $1.67 million suggests reduced selling pressure.

Related: Bitcoin Price Prediction: Fed QT Pause And Trump–Xi Summit Put $118K In Play

Technical Outlook for Chainlink Price

Key levels for Chainlink (LINK) remain well-defined heading into November. Upside targets are positioned at $18.55, $19.45, and $20.84 as immediate hurdles. A confirmed breakout above $20.84 could extend toward $23.70, marking a potential retest of the previous cycle high.

On the downside, initial support sits at $16.98 (0.5 Fibonacci), followed by $15.39 and $13.42. The 200-day EMA near $19.45 acts as a crucial resistance ceiling that must flip to confirm a medium-term bullish reversal.

Technically, LINK is forming a tightening range between the 100- and 200-day EMAs, suggesting an impending volatility expansion. Historical behavior during such compression phases has often preceded significant directional moves.

Will Chainlink Sustain Its Recovery?

Chainlink’s price outlook depends on whether buyers can maintain strength above $18. Holding this zone could allow a challenge of the $19.45–$20.84 cluster, where a decisive close might trigger an upside extension toward $23.70. However, losing the $16.98 support could shift momentum back to sellers, exposing the $15.39–$13.42 range.

For now, LINK remains in a pivotal consolidation zone, but rising open interest, whale accumulation, and sustained exchange outflows indicate strengthening conviction for a continued recovery in the coming sessions.

Related: Dogecoin Price Prediction: Market Braces For Breakout With $812M Options Spike

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.