- Chainlink price today trades near $17.70, breaking below key EMAs as sellers target $17–$16.50 support.

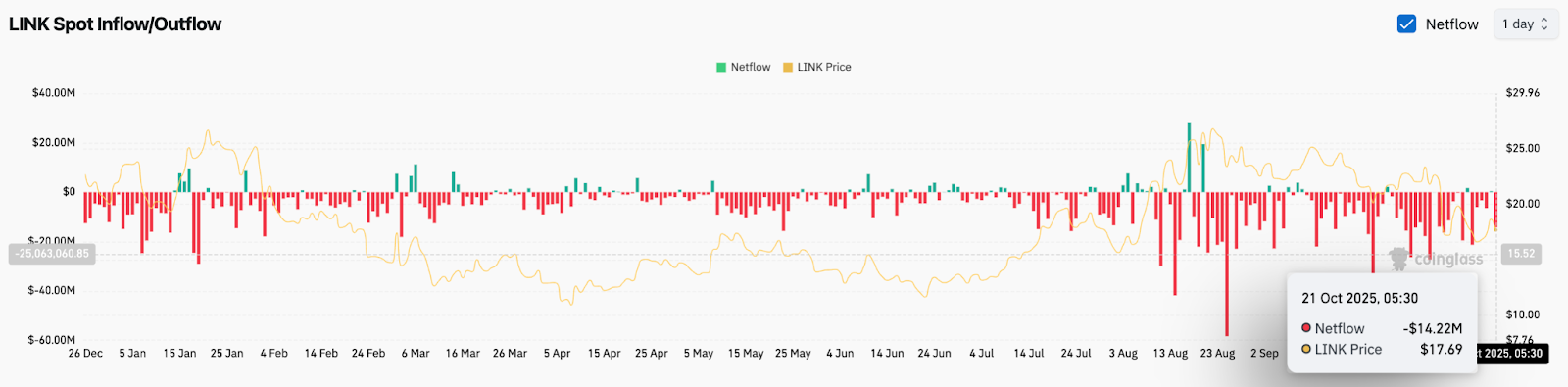

- Net outflows of $14M highlight weak demand, with persistent selling pressure keeping LINK price volatility elevated.

- Analysts warn that failure to hold $17 could expose $15, while upside recovery hinges on reclaiming $19–$20.

Chainlink price today trades near $17.70, sliding more than 5% as selling pressure continues across the market. The drop has forced traders to focus on the $17–$16.50 support band, a level that aligns with both Fibonacci retracement and prior demand zones.

LINK Price Action Loses Momentum Below Key Levels

The LINK price action shows a decisive rejection from the 50-day EMA near $20.20. After failing to sustain above the 0.382 Fibonacci retracement level at $18.62, sellers drove the token back toward the $17 handle.

The 20- and 200-day moving averages, clustered between $18.90 and $19.20, have also flipped into resistance. With price stuck below all major EMAs, momentum favors further downside unless buyers reclaim the $19 zone quickly.

The relative strength index sits around 41, pointing to weak momentum but not yet oversold, which leaves room for additional declines before a relief bounce materializes.

Outflows Highlight Bearish Sentiment

On-chain data confirms the weakness. Chainlink recorded over $14 million in net outflows on October 21, extending a broader streak of consistent red prints since mid-September. The persistent exchange outflows, while normally seen as accumulation, are coinciding with falling price, signaling that buyers have yet to absorb the selling pressure.

This disconnect reinforces why LINK price volatility has spiked, with the market struggling to find stable ground above $18. For now, the Chainlink price prediction remains tilted lower unless exchange flows begin to stabilize.

Fed Conference Brings Attention To Chainlink

Adding to the narrative, Chainlink gained visibility at the Federal Reserve’s payments innovation conference on October 21. Co-founder Sergey Nazarov joined leaders from Paxos, Circle, Coinbase, and major banks on panels discussing bridging traditional finance with digital asset infrastructure.

While the event underscores Chainlink’s growing role in institutional discussions, the immediate market impact has been muted. The Chainlink price today reflects short-term technical weakness rather than the long-term value narrative that such recognition builds.

Chainlink Reliability Amid Cloud Outage

Chainlink also emphasized its infrastructure strength after a widespread cloud outage disrupted parts of the internet. The project announced its oracle services remained fully operational throughout, securing billions in DeFi markets and maintaining uptime while centralized competitors experienced downtime.

This statement highlights why Chainlink continues to be viewed as the backbone of the decentralized oracle economy. Despite the positive reliability update, price action shows that broader market flows and technical levels remain the key drivers for near-term direction.

Technical Outlook For LINK Price

On the downside, $17.00 is the critical line in the sand. A breakdown below this level would expose the next support near $15.00, which aligns with the 0.236 Fibonacci retracement and prior consolidation from early summer. A deeper slide could target $13.50 if bearish momentum extends.

On the upside, bulls must first reclaim $18.62 to neutralize the immediate pressure. Beyond that, a breakout above $20.50 is required to retest the September peak near $23.00. Only a clean close above this range would restore confidence in a bullish Chainlink price prediction.

Outlook: Will Chainlink Go Up?

For now, the Chainlink price update shows sellers maintaining control. Outflows and failed EMA retests are weighing heavily on sentiment. If buyers can defend $17.00 and spark a quick rebound above $19.00, the setup could stabilize.

Without such a move, LINK remains vulnerable to further losses toward $15.00 before any meaningful recovery attempt. The balance tilts bearish in the short term, but long-term fundamentals such as Fed recognition and proven infrastructure resilience provide a floor for confidence beyond this correction.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.