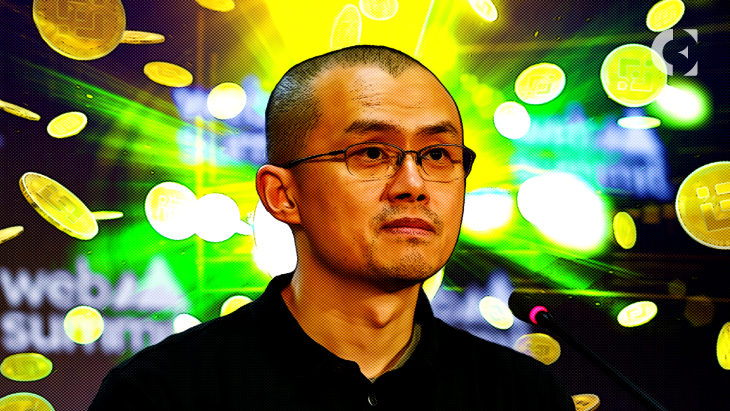

- Binance CEO Changpeng Zhao has welcomed the European Union’s decision to implement MiCA.

- Zhao has stated that his firm will be in full compliance with the new crypto regulatory regime within 18 months.

- MiCA was approved with an overwhelming majority in the European Parliament earlier today.

Changpeng Zhao, the man at the helm of the world’s largest crypto exchange, has welcomed the European Union’s decision to implement the Markets in Crypto Assets Regulation (MiCA). The European Parliament voted 517-38 in favor of MiCA earlier today, approving the new crypto regulatory regime with an overwhelming majority.

Zhao took to Twitter to laud the move by lawmakers in the European Union to introduce tailored regulations for its crypto industry in the interest of consumer protection and innovation. The implementation of MiCA will bring much needed regulatory clarity and help businesses in this industry to operate in compliance with the law.

Changpeng Zhao believes that the adoption of MiCA is a pragmatic solution to the challenges that the crypto industry collectively faces. He added that his firm will be making adjustments to its business over the next 18 months to be “in a position of full compliance” with the new EU regulatory regime.

With the implementation of MiCA, the European Union has become the first major jurisdiction in the world to introduce a comprehensive regulatory and licensing regime for crypto. According to Mairead McGuinness, the commissioner for Financial Services, the regulations will come into effect next year. The Commissioner stated that MiCA will help protect consumers and safeguard financial stability and market integrity.

Speaking on the latest development, EU lawmaker Stefan Berger stated, “This puts the EU at the forefront of the token economy with 10 000 different crypto assets. Consumers will be protected against deception and fraud, and the sector that was damaged by the FTX collapse can regain trust.”

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.